With just a few weeks left until the 60th U.S. presidential election, many investors are bracing for a change in administration either way.

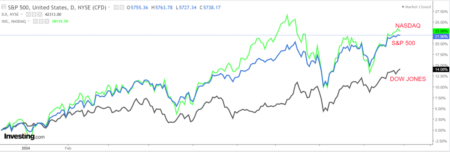

The S&P 500 has delivered an annualized return of 11.8% since President Joe Biden took office in 2021, according to Forbes. However, since the incumbent isn’t running for re-election, Wall Street has been focused on the economic policies of Vice President Kamala Harris and former-President Donald Trump.

Don’t miss

-

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

-

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here’s how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

-

These 5 magic money moves will boost you up America’s net worth ladder in 2024 — and you can complete each step within minutes. Here’s how

Which of these contenders is better for the stock market? According to professional investors, that question is irrelevant. Here’s why.

Forget politics

Paul Hickey, the co-founder of Bespoke Investment Group, assembled stock market data over the past 70 years to figure out how changes in the executive branch impacted stocks.

Based on his analysis, an investor who placed $1,000 in the stock market in 1953 and held it only under Republican presidents would have managed to accumulate $27,400 by 2023. Meanwhile, an investor who placed $1,000 in the market and held it only under Democratic presidents would have managed to accumulate $61,800 over the same period.

Does this mean investors do better under Democratic regimes and investors should sell their stocks if Trump wins? Not exactly. Hickey attributes this result to there being more Democratic presidents during this time period, and thus allowing for more time in the market.

Going one step further, he analyzed the returns of an investor who placed $1,000 in the stock market in 1953 and held it throughout the 70-year period, regardless of who was in the White House during that time. This investor managed to accumulate a whopping $1,690,000.

Simply put, investors who couldn’t set aside their politics managed to miss out on over $1.6 million in total wealth accumulation.

Read more: Rich, young Americans are ditching the stormy stock market — here are the alternative assets they’re banking on instead

Other experts agree

Financial services giant BNY Mellon conducted a similar but broader study recently. Its analysis of the S&P 500’s average returns from 1933 to 2023 found that investors can enjoy steady returns regardless of which combination of Democrats and Republicans held the presidency, congress and senate.

“We advise investors not to mix politics with investing,” says the report. This view is also echoed by legendary investor Warren Buffett.

“All my life I’ve been hearing half the country say that if the person favored by the other half wins things are going to go to hell,” he told CNBC’s Becky Quick in 2019. “I’ve lived under 15 presidents, 14 of them I’ve invested under. I didn’t invest under Hoover, I was a little young then. But seven were Republicans, seven were Democrats.”

Buffett’s exceptional track record highlights the fact that time in the market is more important than timing the market, even when it comes to political events.

A 2023 study by Wealthfront found that investors could reduce their risk of losing money in the stock market from 25.2% down to just 4.8% by extending their time horizon from one year to eight years. In other words, your performance is likely to be better if you simply ignore the next two elections and stay committed regardless of who wins the White House in November.

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Read the full article here