Q1 was great for markets. April was…not. So naturally, investors are wondering if this is just a “pause that refreshes” or a worrisome sign of more trouble to come. See what top MoneyShow contributors have to say about stocks – and gold – given the big rallies they experienced earlier in 2024 AND their more-recent pullbacks.

Lucas Downey Mapsignals.com

Plenty of growth stocks are feeling the pain. That’s what happens when institutional demand grinds to a halt. Don’t fret. One rare setup just fired, indicating a major ultra-bullish signal is approaching.

The rips and dips keep coming for equities. The Fed presser from Wednesday offered little confidence for investors. We’ll let other research shops recap that narrative. At MAPsignals, we’re going to focus on what we do best: Money Flows.

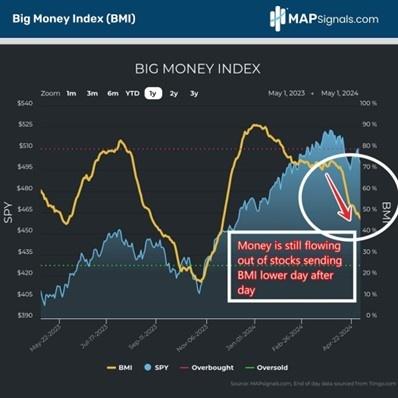

Our market North Star, the Big Money Index (BMI), has been in free-fall for weeks…even dropping further after Wednesday’s intraday pump and slump. But there’s good news. A monster bullish setup is forming in our data. If history is any guide, we are looking at a crowd-stunning rally coming later this year. Now is not the time to get fearful. It’s time to get cheerful.

The all-clear signal is not here yet. That’s evidenced by the Big Money Index sinking day after day. Seasonal volatility is causing overall weakness and rotational action. Inflows are seen in more cyclical areas like Energy, Financials, and Industrials as money is fleeing Big Tech.

Given Tech’s huge market weight in the S&P 500, those outflows are why major large-cap indices are anchored. Below shows how the BMI continues to spiral, last hitting a YTD low of 47.2%:

But while I’ve been pointing to overall weakness in our data since February, today’s data-driven environment is actually quite rare. Our BMI has been trending lower since December 29. That’s a long period…one that suggests a major ultra-bullish signal is approaching.

Last week we took a deep dive in our data and found something interesting. When the BMI falls 40+ points in 16 weeks, it’s extraordinary. In fact, over the past 30 years, it’s occurred 303 times.

While that may not seem exceptional on the surface, in reality most of those instances cluster around 17 discrete episodes throughout the three-decade period including back-tested data. But history proves these prolonged money flow dips are quite bullish over the medium- to long-term.

When we single out similar BMI pullbacks to now, we find six instances ranging from 1998, 2019, and 2020. What we find is stocks struggle near term, with the S&P 500 falling 4.1% a month later and 1.2% three months later. But the underlying message that you need to heed is stocks zoom six and 12 months later, with average gains of 14% and 20.3% respectively.

Here’s the bottom line: Investors are looking for clarity in this turbulent market. Data has more answers than the news ever will. We are currently witnessing a rare 40+ point drop in the Big Money Index (BMI). History says a little more pain will lead to monster gains in the coming months.

Brien Lundin Gold Newsletter

Even when you know it’s coming at some point, the shock of a market sell-off like what we saw recently in gold is still unsettling. After seven weeks of dizzying gains with few interruptions, gold had gotten tremendously overbought. The good news as I write is that this medicine, while harsh going down, was just what the doctor ordered for this gold market.

Silver and mining stocks had begun to significantly outperform gold, which served as important confirmation that a secular bull was charging. Western investors, while still not buying gold ETFs, had jumped into the futures markets head-first.

“Managed Money” positions on the disaggregated Comex commitments of traders report (i.e. hedge funds) had soared. Even the geopolitical situation was joining in to turbocharge the action. Alas, those last two factors proved to be the trip wire for gold.

After Israel’s restrained retaliatory action against Iran, and Iran’s failure to counter over the weekend, trigger-happy hedges decided to take their gold profits and run as overseas gold trading opened on a Sunday evening. The resulting price decline continued with more selling in New York.

By the end of it all, gold had dropped about 2.5% (around $60), while silver had fallen about 5%. The long-awaited and dreaded smash had come. That waterfall drop on Monday tested the mettle of gold bulls.

But as you can see from our opening chart, the big drop loses much of its significance when you consider how far gold has come over the last three months. Although it seemed pretty severe at the time, the selling brought the price back down to the lows of only the previous week. After a seven-week rally that had taken the price of gold nearly $400 higher since the end of February, a $60 setback doesn’t seem like much.

In fact, the big effect of the selling wasn’t the damage to the price chart, but a more positive one: Convincing investors that this gold market wasn’t a runaway train heading for a crack-up, but rather a normal bull market driven by conventional factors. That simple fact was in doubt as gold took off with seeming disregard for any bearish influence.

Many investors were also waiting for a pause in the relentless rally to get in. They certainly got that, although it doesn’t seem to have lasted long, with both gold and silver rebounding well as I write.

Longer term, it is the powerful monetary argument that will drive gold far higher. Gold is the insurance, and investment, that you’ll want to own as this process plays out.

Recommended Action: Buy gold.

Matthew Carr Tipping Point Profits

The streak is broken. Five consecutive months of gains came crashing to an end in April. But that was to be expected…at least from our perspective. Now May is at the door. My work suggests “Sell in May and Go Away” is just another of a growing list of debunked market myths.

In May, the paddock on my farm becomes a field of yellow, conquered by buttercups on the march. The temperature is rising. All around, the countryside is dressed in a spring coat of lush green. And we find ourselves confronted with the most infamous month of the year for stocks…May. For those in dire need of an excuse to be bearish the month has long been an investor favorite to avoid.

But is there truth to this idea? Or is it one of the market’s most misunderstood myths and pearls of wisdom?

The “Sell in May” concept originated in England, when aristocrats, bankers, and other wealthy elites would flee the suffocating heat of London to summer in the countryside. And they wouldn’t return until after the St. Leger Stakes – the final race in the British Triple Crown – on September 15.

The expression carried over to the US where most people take vacations between May and September. The idea was investors pared their exposure to the markets in these months by having their money take a vacation as well. That meant a summer lull as volume sputtered to a trickle. And it wouldn’t normalize again until after the summer ended and children went back to school, around Labor Day.

For decades, the theory seemed efficient enough. From 1950 to 2022, the Dow Jones Industrial Average averaged a meager 0.8% return from May to October. Meanwhile, the blue chips went on a charge from November to April, gaining an average of 7.3%.

And when we look at the stretch of average monthly gains for the SPDR S&P 500 ETF (SPY) since 1993, the period from May through September doesn’t look very promising. Three of the four worst months of the year for large-cap international stocks occur in that five-month span.

But by no means does that mean to completely buy into the “Sell in May” philosophy…because if you do you could be missing out on gains. In fact, since 2014, the success rate for a gain on the SPY from May through October is 80%. That’s actually better than the 70% success rate of November through April during the same span.

And since 1993, the average gain on the SPY from November through April is 6.49%…only slightly better than the average gain of 5.38% from May through October.

One possible reason? Everyone is now connected to the markets 24/7, 365. Even on vacation – whether it’s in May or in November – investors can place trades.

Bottom line: It’s not the greatest month of the year for stocks. But it’s far from the worst. And in election years, we see it holds steady instead of crumbling under the weight of anxiety and fear.

Recommended Action: Buy SPY.

Danielle Shay Fivestartrader.com

Danielle Shay is VP of Options at Simpler Trading, as well as chief commentator on the trader education website www.fivestartrader.com. In this MoneyShow MoneyMasters Podcast episode, which you can watch here, she joins me for a deep dive discussion on options trading tactics and stock market trends.

Danielle first covers the loss of momentum in sectors like technology and financials over the last few weeks. She notes how high expectations were heading into Q1 earnings…but how company executives like JPMorgan Chase & Co. (JPM) CEO Jamie Dimon have shared more muted outlooks on their operations.

In tech, she says: “We knew the crazy train wasn’t going to go on forever” in stocks like Super Micro Computer Inc. (SMCI) and Nvidia Corp. (NVDA). But as long as one key sector – and an ETF that tracks it – holds up, she thinks there’s still a shot we go higher over the longer term. We also discuss energy, gold, and profit opportunities in commodity stocks.

The rest of the conversation focuses on Danielle’s specialty: Options trading tactics and techniques. She explains how and why she focuses on pattern recognition in general and “the squeeze” in particular. She covers how to profit from sentiment extremes, using a recent series of real-life Tesla Inc. (TSLA) trades as examples. Plus, she discusses options spread trading – and why options butterflies are particularly useful to her.

Finally, Danielle shares a sneak peek of what she’ll teach attendees at the MoneyShow Masters Symposium Las Vegas, set for Aug. 1-3, 2024 at the Paris Las Vegas.

Read the full article here