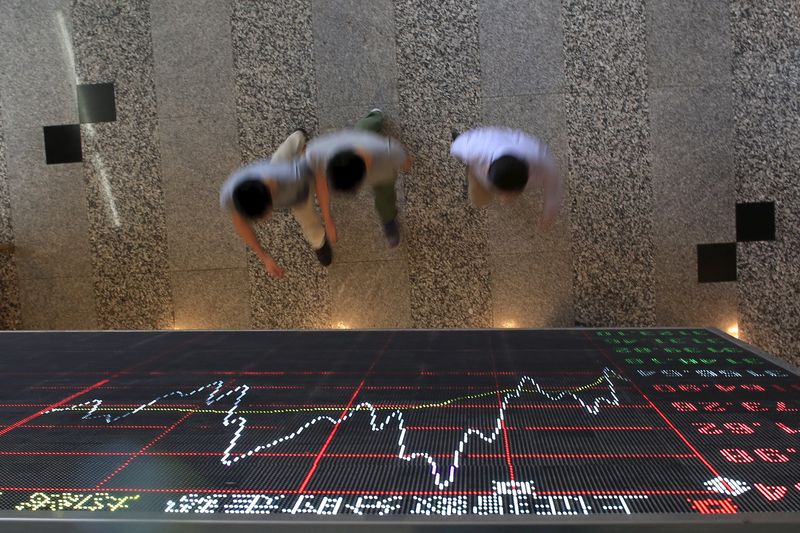

Investing.com– Most Asian stocks rose on Tuesday tracking record highs on Wall Street as the third-quarter earnings season approached, while Chinese stocks fell amid waning optimism over new fiscal stimulus.

Regional markets took positive cues from Wall Street, with the and the hitting new peaks on gains in financial and technology stocks. U.S. stock index futures were mildly positive in Asian trade, with focus turning to a string of key Q3 earnings due this week.

Chinese markets lagged their peers following weak inflation and trade data released over the past two days. The announcement of new fiscal stimulus measures from Beijing also provided only fleeting support, given that the government left investors wanting of several key details.

Nikkei crosses 40k, ASX 200 hits record high

Japanese shares were the best performers in Asia as they clocked strong gains after a long weekend.

The surged 1.7% and crossed 40,000 points for the first time since mid-July, while the added 1%. Gains were largely biased towards technology stocks, especially chipmakers, which tracked overnight gains in their U.S. peers.

Sentiment towards Japanese markets was also buoyed by reports that Tokyo Metro raised $2.3 billion in the country’s biggest initial public offering in six years.

Australia’s surged 0.9% to a record high of 8,327.60 points, with major miners BHP Group Ltd (ASX:) and Rio Tinto Ltd (ASX:) rising more than 1% each before their quarterly production reports, which are due later in the week.

Australian markets benefited from a global push into economically sensitive sectors, which are expected to benefit as interest rates fall.

Among broader Asian markets, South Korea’s added 0.2%, while futures for India’s index pointed to a mildly negative open, as Indian inflation read higher than expected for September. Still, the Nifty managed to close above 25,000 points on Monday.

Chinese stocks lag as stimulus rally fizzles

China’s and indexes moved in a flat-to-low range on Tuesday, while Hong Kong’s index shed 0.5%.

Chinese markets clocked strong gains on Monday as investors cheered the prospect of more stimulus in the country, especially after the Ministry of Finance outlined plans for fiscal stimulus in a recent briefing.

But the MoF still left out key details on its plans, specifically the scope and timing of the planned fiscal measures. A lack of direct support for private consumption also disappointed investors.

Weak economic readings from China also dented sentiment towards the country. Data on Monday showed the country’s grew less than expected as growth slowed sharply. Earlier data showed Chinese disinflation remained squarely in play.

Read the full article here