(Bloomberg) — Asian stocks tumbled as sentiment was hit by a triple whammy of a Japan selloff, a global tech rout and signs of weakness in the US economy.

Most Read from Bloomberg

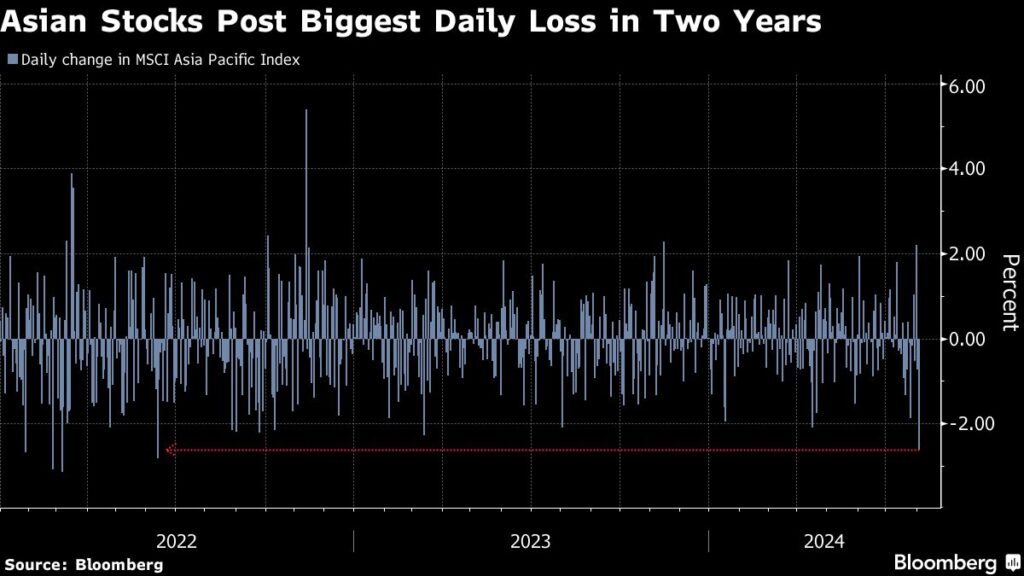

The MSCI Asia Pacific Index dropped as much as 3%, the most since June 2022, with Taiwan Semiconductor Manufacturing Co. and Tokyo Electron Ltd. among the biggest drags. Japan’s Topix Index headed for a technical correction, while benchmarks in the tech-heavy markets of South Korea and Taiwan fell more than 3%.

Traders are taking risk off the table as the investment landscape shifts. Japanese stocks are falling out of favor as the prospect of further interest-rate hikes by the country’s central bank supports the yen, hitting the shares of exporters. Meanwhile, disappointing earnings from US tech behemoths has cooled optimism over artificial intelligence, triggering a rout that has ensnared Asian chip giants.

“The recent strengthening of the Japanese yen coupled with tech sector weakness is poised to significantly impact the Asian stock market,” Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore. “Given the substantial weight of tech stocks in Asian indices, disappointing results from tech giants could trigger a broader market downturn in Asian markets.”

Regional declines also came after concerns over the health of the US economy emerged. Thursday data showed unemployment claims hit an almost one-year high while manufacturing shrank. Investors will be monitoring payrolls data due later Friday for further clues on the state of the economy and the Federal Reserve’s rate path.

“The narrative is changing quickly after a confirmation of the FOMC’s September rate cut path. As manufacturing and job data are pointing toward recession levels, investors are now questioning whether the Fed is cutting too late,” said Billy Leung, an investment strategist at Global X Management. “A US recession would also hurt Asia.”

MSCI’s Asia benchmark is on track for its third-straight week of declines. Weakness in Chinese shares also weighed on the region as traders awaited further stimulus measures from Beijing to shore up its flagging economy.

–With assistance from Abhishek Vishnoi.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here