Investing.com– Most Asian stocks rose on Thursday tracking overnight record highs on Wall Street after some soft consumer inflation readings ramped up bets on interest rate cuts in 2024.

The strong overnight lead-in from Wall Street helped Asian markets somewhat look past headwinds from China and Japan, especially as the Japanese economy shrank and as the Biden administration increased some trade tariffs against Beijing.

Wall Street indexes finished at record highs on Wednesday, as some softer-than-expected data saw traders increase expectations for a rate cut in September. U.S. stock index futures also extended gains into Asian trade.

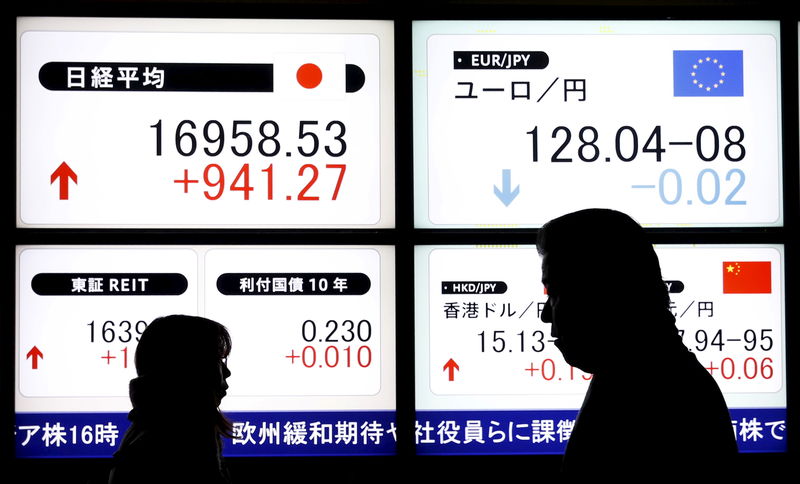

Japan’s Nikkei 225 rises, but soft GDP limits gains

Japan’s index rose 0.6%, buoyed chiefly by technology stocks as they tracked gains in their U.S. peers.

But other more economically-sensitive sectors retreated, as did the broader , which has relatively less tech weightage than the Nikkei.

data showed Japan’s economy contracted much more than expected in the first quarter of 2024, as sticky inflation and laggard wages saw weaken sharply.

– which had helped buoy growth in the past two quarters- also slowed drastically, as uncertainty over Japan’s economy kept businesses wary of investing.

The weak data raised more doubts over just how much the Bank of Japan will be able to tighten policy this year. While loose policy bodes well for stock markets, a weakening economy presents more headwinds.

Chinese shares lag amid trade, economic caution

China’s and indexes lagged their regional peers on Thursday, rising about 0.3% each. Hong Kong’s index also rose 0.6%, relatively lesser than its Asian peers.

Sentiment towards China was battered by the Biden administration imposing higher trade tariffs on several key Chinese sectors, namely electric vehicles, medicine and solar energy.

While the immediate economic impact of the tariffs was unclear, they drew ire from Beijing, which threatened retaliatory measures. Such a move could reignite a trade war between the world’s biggest economies.

Anticipation of more economic cues also factored into caution over China. and data is due on Friday.

Other Asian markets also advanced. Australia’s was the best performer among its peers, rallying 1.8% and coming close to record highs. Data on Thursday also showed an unexpected increase in Australia’s , which pushed up hopes that the labor market was cooling.

Gains in technology stocks saw South Korea’s jump 0.8%.

Futures for India’s index pointed to a positive open, with tech stocks set to track their global peers. But gains are expected to be held back by caution over the 2024 Indian general elections.

Read the full article here