- Amazon, Google, Meta, and Microsoft are expected to churn through $300 billion in capex next year.

- The spending spree is driven by generative AI and LLM opportunities, says Morgan Stanley.

- Amazon’s capex estimate jumped the most as AI cloud demand grows.

Amazon, Google, Meta, and Microsoft are expected to invest about $300 billion in capital expenditures next year, and 2026 should be even bigger, according to new estimates by Morgan Stanley.

Most of this capex is focused on fixed assets, such as data centers and real estate. These companies, called hyperscalers due to their vast cloud networks, are in a multiyear investment cycle of epic proportions as they chase opportunities in generative AI and large language models, Morgan Stanley wrote in a note Tuesday.

“These high and rising capex numbers again speak to the importance of continued disclosure about new/incremental adoption, engagement, and revenue opportunities each of the four companies are seeing and investing in,” the bank’s analysts said.

Big Tech earnings last week showed huge demand for AI services. More data centers, GPUs, networking gear, energy, and other infrastructure are needed to deliver this technology. That’s driving eye-watering levels of spending. Earlier this year, Bernstein forecast Big Tech capex of more than $1 trillion over five years.

In Morgan Stanley’s new estimates, Amazon saw the largest increase in future spending. The bank’s analysts raised their capex estimate for Amazon by 22%, to $96.4 billion in 2025. That increase will mostly be driven by more purchases of GPUs and servers for its data centers, they explained.

In 2026, Amazon capex will climb even higher, to $105 billion, according to Morgan Stanley estimates. That leads the other tech giants, Microsoft, Google and Meta. All together, these four companies will invest $336.5 billion in capex in 2026, the bank forecast.

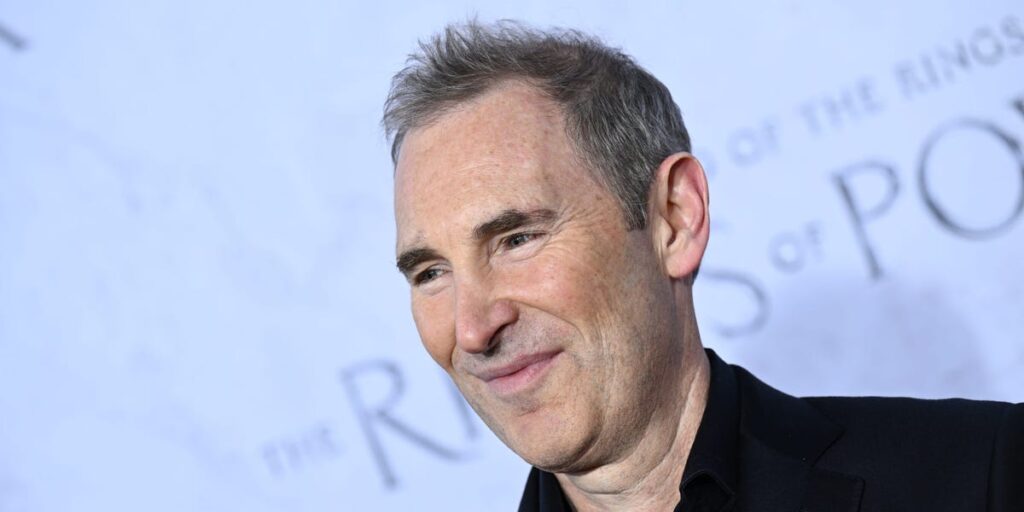

Last week, Amazon’s CEO Andy Jassy told analysts that the company will continue to “aggressively” invest in AI.

“We’ve proven over time that we can drive enough operating income and free cash flow to make this a very successful return on invested capital business,” Jassy said. “And we expect the same thing will happen here with generative AI. It is a really unusually large, maybe once in a lifetime type of opportunity.”

Do you work at Amazon? Got a tip?

Contact the reporter, Eugene Kim, via the encrypted-messaging apps Signal or Telegram (+1-650-942-3061) or email (ekim@businessinsider.com). Reach out using a nonwork device. Check out Business Insider’s source guide for other tips on sharing information securely.

Read the full article here