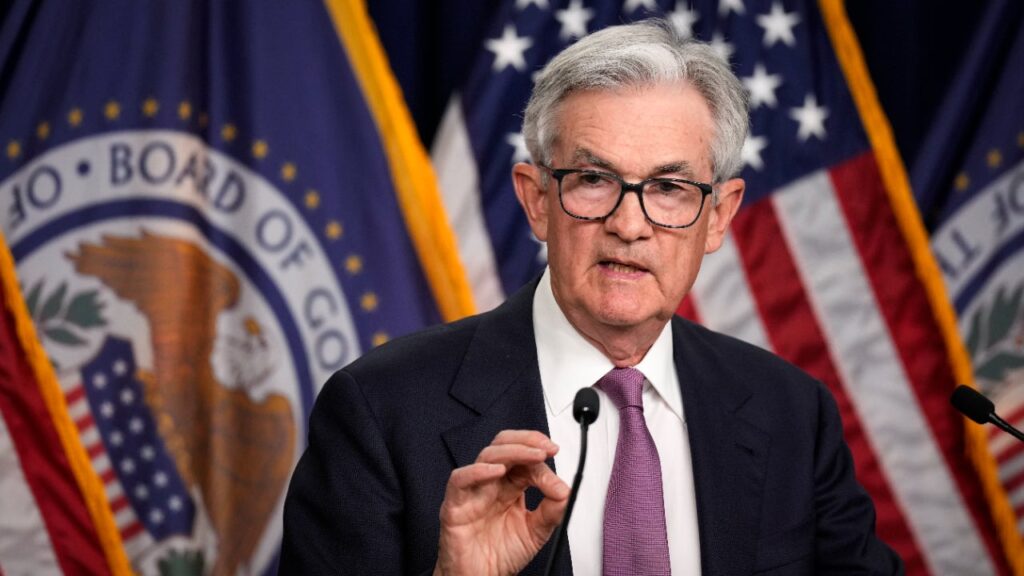

Drew Angerer/Getty Images

The Federal Reserve cut interest rates for the second consecutive meeting on Thursday but this time by a smaller quarter of a percentage point, as inflation continues cooling and a slowdown in the job market stabilizes.

The Federal Open Market Committee (FOMC)’s decision means its key benchmark borrowing rate will now hold in a target range of 4.5-4.75 percent, the lowest since the spring of 2023.

Many borrowing costs across the market — which have already been on the descent since the Fed first cut interest rates by half a percentage point in September — will continue edging lower. The smaller rate cut, meanwhile, means returns on saving accounts and certificates of deposit (CDs) are poised to fall, just less sharply.

Consumers, however, are likely still going to feel the pinch of historically pricey financing rates. Before the Fed’s rapid post-pandemic inflation fight, borrowing costs hadn’t hit a level this high since 2006.

The U.S. economy looks like it’s on much better footing than it did when officials preferred to cut interest rates by a larger half a percentage point. Unemployment has edged back down to 4.1 percent, job growth has picked up and the U.S. financial system grew 2.8 percent in the third quarter of this year — higher than what officials currently consider “trend” growth.

Yet, the Fed’s next moves are beginning to look even more uncertain. Officials previously projected that they’d cut borrowing costs by another quarter of a percentage point in December, but that was before the U.S. economy’s recent upside surprises.

President-elect Donald Trump’s policies are posing another wrinkle, with the higher tariffs and lower taxes that he proposed on the campaign trail likely contributing to higher inflation, according to economists. Fed officials penciled in four more quarter-point rate cuts for 2025, moves that could be taken off the table if price pressures reaccelerate.

The Fed’s interest rate decision: What it means for you

Savers

The Fed may be cutting interest rates, but the highest yields in over a decade are still hanging around.

Bankrate’s picks for the best high-yield savings accounts for November 2024 currently offer an average annual percentage yield (APY) of 4.8 percent, almost nine times the national average and nearly 500 times greater than offers at Chase and Bank of America. They’re as high as 5.25 percent and as low as 4.57 percent.

All of those yields beat the current annual inflation rate of 2.4 percent, according to the latest data from the Bureau of Labor Statistics’ consumer price index (CPI). That means the cash Americans store on the sidelines can grow faster than inflation — while still being protected with Federal Deposit Insurance Corp. (FDIC) coverage.The Americans who already have at least six months’ worth of expenses stashed away in an emergency fund can also lock in a CD with a yield that’s likely to beat inflation throughout its entire term. The top-yielding 5-year CD is offering a 4 percent APY, while the 2-year and 1-year CD is offering a 4.29 percent and 4.59 percent yield, respectively.

Borrowers

It’s not one or two rate cuts that matter most to borrowers — but the cumulative total that the Fed cuts interest rates.

Credit card borrowers have had it hardest. The average credit card annual percentage rate (APR) is hovering at 20.5 percent, up from 16 percent when rates were at rock-bottom levels during the pandemic, according to Bankrate’s data.

Individuals grappling with high-interest debt should prioritize eliminating those balances. Bankrate’s choices for the best balance-transfer cards currently give Americans an introductory 0 percent APR for as long as 21 months. You’ll have to craft a debt payment plan, but if you’re able to chip away at your balance before you transition back to the standard APR, you could speed up your debt repayment and save massively in interest. Just remember to consider the costs associated with transferring that balance, usually a one-time charge of 3 or 5 percent of the total debt that you transfer.

A lower-rate environment also underscores the importance of comparison shopping, comparing multiple offers and reevaluating any big-ticket purchases that require financing.

Homeowners and homebuyers

The Fed’s half-point interest rate cut has provided would-be homebuyers with no relief. In fact, the 30-year fixed-rate mortgage has risen every week since that Sept. 18 reduction, jumping from 6.2 percent to 7 percent in the week that ended on Nov. 7, according to Bankrate data.

That’s largely because those key financing rates track the 10-year Treasury yield — which has been surging again as economic growth holds up, recession fears abate and fears about inflation reaccelerating swirl in a so-called “Trump trade” that’s been impacting financial markets.

For the homeowners who locked in a mortgage when rates were at their peak of 8.01 percent, the refinance window could still be open. Borrowers are typically advised to figure out how quickly they could recoup the cost of refinancing if they can get an interest rate that’s at least half a percentage point lower than what they’re currently paying. Just be sure to weigh other factors, including how long you plan to stay in your home, McBride says.

Investors

The prospects of a “soft” landing of the U.S. economy and a Trump administration have been like candy for investors. The S&P 500 topped a record high on Wednesday on the news of Trump’s reelection and hit another record high on Thursday before the Fed announced its interest rate decision.

Still, there’s always a chance that their parade could get rained on. For the long-term investor, that shouldn’t matter. Maintain a diversified portfolio and stay the course with your investments.

— Note: This is a breaking news story. Please check back for updates.

Read the full article here