Gold (XAU/USD) Weekly Forecast: Bullish

- Gold volatility subsides ahead of high importance US data

- Gold nudges higher despite lack of major bullish drivers

- Risk events ahead: US quarterly refunding announcement, FOMC, NFP

- Elevate your trading skills and gain a competitive edge. Get your hands on the Gold Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free Gold Forecast

Gold Volatility Subsides Ahead of High Importance US Data

Gold volatility has subsided drastically now that the risk of a broader conflict between Israel and Iran have been greatly reduced. Riskier assets like the S&P 500 and high-beta currencies like the Aussie dollar and British pound managed to claw back prior losses as risk sentiment improved. As a result, gold’s former safe haven bid has had the wind taken out of its sails.

In the coming week, the US Treasury is set to update the public on details of its funding needs and will provide specifics around whether bond issuance is likely to favour shorter or longer duration – which is likely to affect the shorter and longer dated yields and potentially, gold.

Gold Volatility Index (GVZ)

Source: TradingView, prepared by Richard Snow

Gold Nudges Higher Despite Lack of Major Bullish Drivers

The precious metal may soon have to face the reality of the Fed funds rate remaining higher for longer after inflation data proved worrisome on Friday. A string of hotter-than-expected price data culminated in Friday’s PCE print where both headline and core inflation beat expectations.

Increasing attention has been placed on shorter-term measures of price trends like the month-on-month comparisons, which has been rising – which hasn’t gone unnoticed at the Fed. Jerome Powell acknowledged the undesirable uptick in inflation but reiterated that policy is poised to react to any outcome and the Vice Chairman of the Fed, John Williams even made mention of another hike is needed.

The prospect of higher inflation has forced markets to backtrack on ambitious rate cuts initially eyed for 2024, extending the dollars longer-term strength. A stronger dollar and rising yields have had little effect on the precious metal when geopolitical uncertainty was at its peak, but with the recent de-escalation and in the absence of any further catalysts, gold bulls may soon run out of momentum.

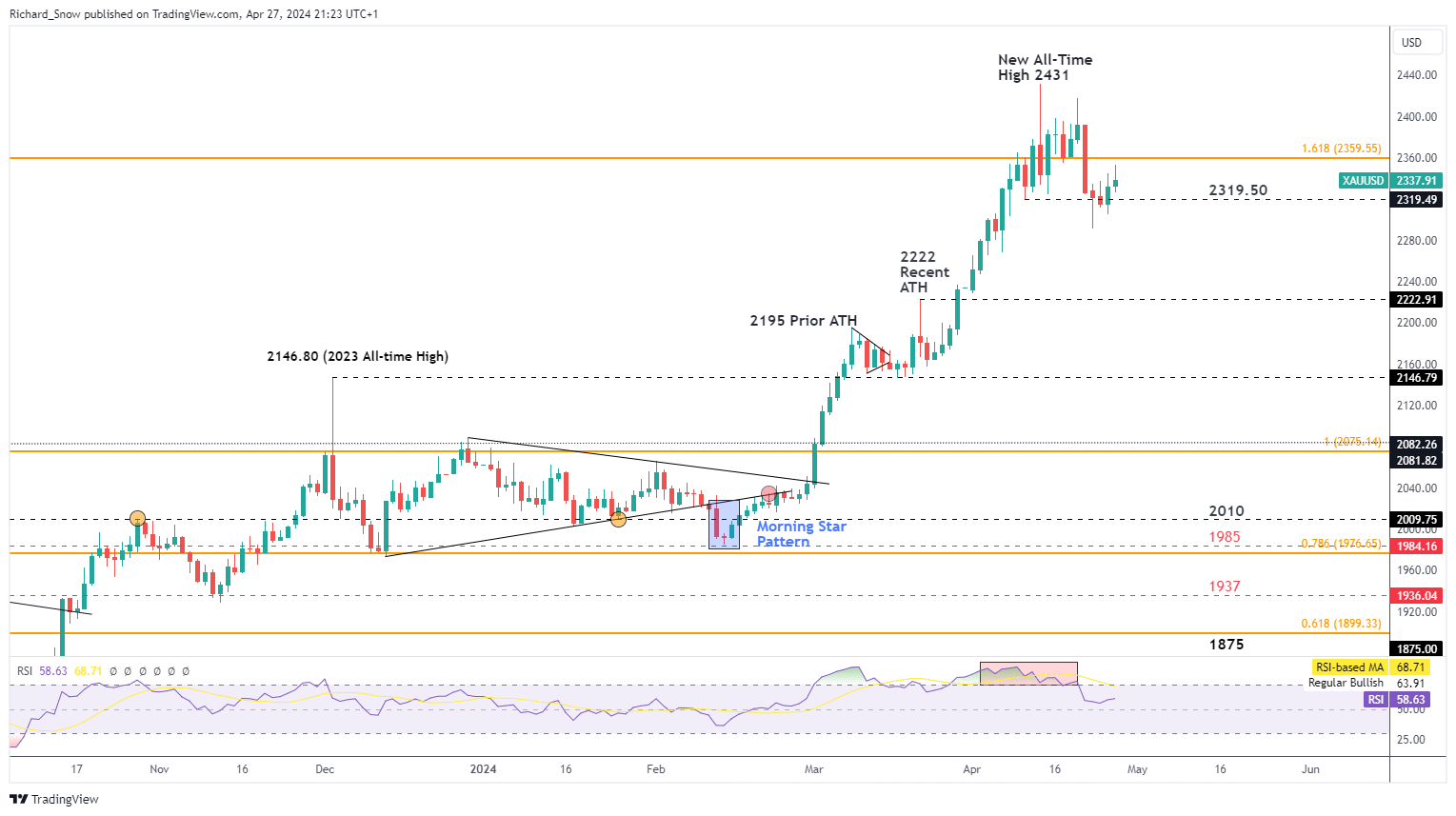

Gold bounced off of support at $2320 – a prior swing low. If prices remain above this level, the bullish continuation remains constructive. However, in the absence of a catalyst, the upside potential may be greatly reduced.

Gold Daily Chart

Source: TradingView, prepared by Richard Snow

Gold market trading involves a thorough understanding of the fundamental factors that determine gold prices like demand and supply, as well as the effect of geopolitical tensions and war. Find out how to trade the safe haven metal by reading our comprehensive guide:

Recommended by Richard Snow

How to Trade Gold

Major Risk Events in the Week Ahead

Risk events next week include both scheduled and geopolitical events to be aware of. On the geopolitical front, despite the Israel-Iran tensions subsiding, news of Russia striking power facilities on Ukraine could slow the risk on sentiment that transpired in the trading week gone by.

Scheduled risk events include the FOMC meeting where there is no realistic expectation of a change to interest rates but markets will be focused on how concerned officials are regarding the re-acceleration of inflation that has emerged since the start of the year.

Thereafter, non-farm payroll data is likely to inject more volatility – even if this is short-lived – into dollar denominated markets like gold. The labour market continues to show resilience, further delaying the first rate cut from the Fed. Another point to note is that US ISM manufacturing data will draw more attention than usual after Q1 GDP disappointed massively on Thursday, showing early signs of vulnerability for the world’s largest economy.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Read the full article here