Key takeaways

- Resort fees, also called destination or urban fees, are charges for amenities.

- Researching the resort in advance can help you avoid these charges, as well as using free sites that check for resort fees.

- Booking with points at certain properties or reaching certain elite statuses can help you avoid paying resort fees.

Making a hotel reservation used to be straightforward. You found a hotel you liked, chose a reasonable nightly rate and paid for it after reviewing all the taxes and fees. Now it’s a bit more complicated, with properties adding resort fees that get charged separately.

Resort fees are just one of the many annoying travel fees that jack up the cost of your vacation, with some travelers arguing that they’re unnecessary and poorly disclosed. These fees are supposed to cover run-of-the-mill amenities like hotel gym access and Wi-Fi at some properties as well as the use of beach umbrellas, pool towels, a welcome drink and more at other properties. Some would argue these amenities should be included in the cost of the room, but they’re not — and more hotels are adding them as a means to increase revenue without raising room rates.

Over a multi-night stay, resort fees can add up to hundreds of dollars in addition to your room rate and other expenses. But you don’t have to be at the mercy of hotels when it comes to resort fees. There are ways you can get around these pesky fees and keep your travel budget intact. Below, we’ll go over everything you need to know about resort fees and how to avoid them.

What are resort fees?

Resort fees typically range from $25 to $60 per night and are imposed by hotels and resorts for amenities like pools, tennis courts, gyms and internet access. Sometimes they’re disguised under alternate names like “destination” or “urban” fees.

EXPAND

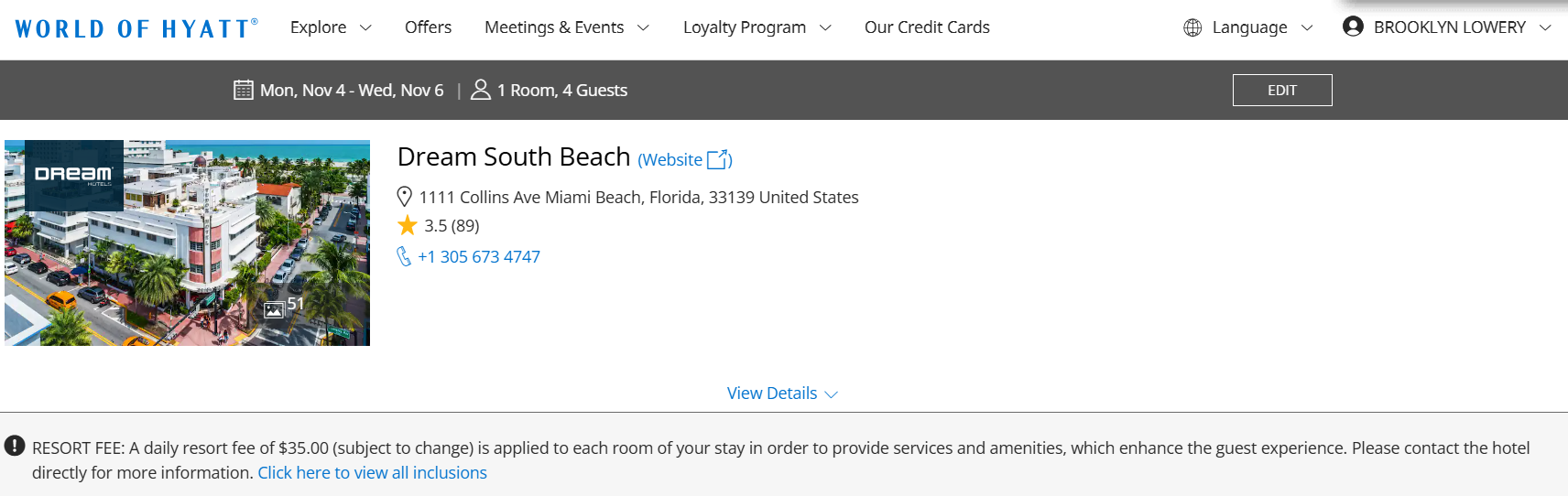

Resort fees are usually listed alongside taxes and fees on the hotel booking page. Some properties prominently display these fees on the room selection page so guests are aware of what they’re paying for in advance. However, some resort fees aren’t disclosed until later in the reservation process or even after checkout.

EXPAND

In particular, many large Vegas hotels are known for charging resort fees. While Vegas hotel rooms are often cheap or even comped, mandatory resort fees of $30 to $60 per night allow hotels to generate room revenue from all guests. Some Vegas hotels that charge resort fees include:

- Caesar’s Palace

- Delano

- Encore

- Excalibur

- Mandalay Bay

In some cases, resort fees do get you additional perks. For example, the Wynn Las Vegas includes complimentary valet parking in the daily resort fee for eligible purchased rooms. That’s pretty close to what most Vegas hotels charge for valet parking, so the resort fee might be justified if you valet park your car.

In most cases, however, resort fees don’t bring much, if any, value. As you can imagine, these fees are controversial among travelers. There’s been a rise in resort fees at both city hotels and beach resorts, and the reasoning isn’t always solid. For example, the amenities they’re supposed to cover should be included in the nightly room rate. Hotel gyms and internet access are standard amenities that guests shouldn’t be paying extra for.

President Joe Biden agrees with this sentiment. In his 2023 State of the Union address, Biden called for eliminating (or limiting) “junk” fees, which include hidden or unnecessary fees that are imposed on consumers — like telecom cancellation fees, processing fees for concert tickets and resort or destination fees. In response, Sens. Richard Blumenthal and Sheldon Whitehouse have introduced the Junk Fee Prevention Act. In cases where these types of fees cannot be eliminated, the act intends to make the fees more transparent so that consumers know what they’re paying for upfront.

Still, resort fees are here to stay — at least for now. Luckily, there are ways you can get around paying them.

How can you avoid resort fees?

You can avoid paying resort fees in many ways. Sometimes, it’s as simple as picking up the phone, and other times it can involve a bit of research and advanced planning. No matter which method you use, it’s worth a try since resort fees can add up substantially over a multi-night stay. After all, wouldn’t you rather put that $25 to $60 per night fee toward a nice dinner or spa treatment instead?

Stay at hotels that don’t charge resort fees

The simplest way to avoid resort fees is to stay at hotels that don’t charge them. Easier said than done, right? Sites like ResortFeeChecker.com take the hassle out of this process. Simply head over to the site, enter your hotel name and you’ll get a list of fees the property charges. This includes deposits, breakfast, parking, extra bedding and more.

If you search by city, you’ll get a list of properties along with their daily resort fees. This can help you quickly determine which hotels to avoid if you don’t want to pay resort fees.

Credit cards that waive resort fees

What if you prefer a hotel with a resort fee? You don’t necessarily have to compromise on accommodations. Use one of the best hotel credit cards that waive resort fees for the hotel you want to stay at. Often that means you’ll need to reach a certain status or meet an earned rewards threshold. These are two of the cards you can use to get your resort fees waived:

Hilton Honors American Express Card: The Hilton Honors American Express Card grants cardholders complimentary Silver Status which waives resort fees on award stays. That’s also true for other Hilton Honors credit cards which grant complimentary Gold and Diamond status with higher annual fees.

World of Hyatt Credit Card: The World of Hyatt Credit Card* waives resort fees and destination fees when redeeming Free Night Awards. Plus, if you reach Globalist status by staying 60 nights or earning 100,000 base points in a year, you’ll get resort fees waived on eligible rates as well as on Free Night Awards.

Book your hotel with points

If you’re staying at Hilton, Hyatt or Wyndham, you’ll be pleased to know they typically waive resort fees on eligible award bookings (however, resort fees may occasionally apply and they cannot be paid for with points). Simply use your points to book an eligible room and the resort fee will be waived. This is a great way to save money on a vacation because you’ll not only get a free room, but you’ll also save around $40 to $60 per night in fees.

Saving money on resort fees is great, but you’ll also want to make sure you’re getting maximum value from your hard-earned hotel points. Before booking a hotel with points, be sure to check paid rates first. Reviewing points valuations against nightly rates (including resort fees) helps you ensure you’re getting the most bang for your buck (or hotel points).

While valuations aren’t everything, you should expect (and aim) to get the following values out of your hotel points, according to our latest points and miles valuations:

Leverage elite status

Hotel elite status can get you a lot of perks, like complimentary breakfast, room upgrades, bonus points and — you guessed it — waived resort fees. For instance, Hyatt waives resort fees on eligible bookings (in addition to free night awards) for Globalist members. Plus, the nice thing about World of Hyatt elite status is that you can match your status with MGM Rewards. So on your next trip to Vegas, you’ll get resort fees waived at resorts like the Aria, Bellagio, Delano, MGM Grand and more.

Earning elite status doesn’t have to be an uphill climb, either. For example, Hyatt offers mid-tier Discoverist status with the World of Hyatt Credit Card, and you can even spend your way to top-tier Globalist status with the card. You can also earn five qualifying night credits toward your next tier status every calendar year plus two additional qualifying night credits toward your next tier status for every $5,000 spent on your card.

Of course, you’ll want to weigh the card’s $95 annual fee against the resort fee savings, as well as consider the numerous perks offered by the card, to make sure you’ll be able to recoup the cost of card membership through card perks. You’ll also want to weigh any spending requirements and figure out whether it makes sense for you to put that much spending on this specific card in order to earn Globalist status.

Ask for a waiver

If all other avenues fail, you can always reach out to the hotel and see if it’ll waive the resort fees. The motto “It never hurts to ask” applies to virtually any scenario, including getting resort fees waived.

You may be able to make a good case for why the hotel shouldn’t charge resort fees. For example, if the hotel pool is closed or the gym is not operating, it doesn’t make sense for guests to be paying for those services. Or, if you’re staying for a brief period and not making use of the hotel’s amenities, that could also be worth pointing out as grounds for a resort fee waiver.

You can also point out competitor hotels that aren’t charging resort fees (using the handy Resort Fee Checker website), which may convince some properties to waive the fees for you. It’s always best to reach out to a manager as they are typically more empowered to accommodate requests like this than reservation agents.

The bottom line

Resort fees should be listed on the checkout page whenever you make a reservation. Confirming the charges means you’ve agreed to pay those fees and you can’t renege unless you cancel the reservation. You can try asking the hotel manager for a waiver, but they may not grant it since these fees generate substantial revenue. If hotels make a habit of waiving them, they’ll lose out on that revenue.

Justified or not, resort fees are an unfortunate cost most of us will encounter during our travels. But they don’t have to get in the way of a great vacation. You can work these pesky fees into your travel budget or use a top travel card. Do your best to avoid them altogether by reserving a hotel that doesn’t charge resort fees or booking with a chain that waives fees for elite members or award bookings.

*The information about The World of Hyatt Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Read the full article here