The Consumer Financial Protection Bureau (CFPB) is a federal regulatory agency established in 2010 as a response to the 2007-2008 financial crisis. The CFPB implements and enforces Federal consumer financial law in an effort to ensure that “markets for consumer financial products are fair, transparent, and competitive,” according to the agency’s website.

Among other things, the CFPB supervises banks and credit unions with assets over $10 billion, fining these institutions when the agency finds legal violations. Notably, the CFPB takes action against financial institutions for charging illegal junk fees and opening accounts without consumer consent.

As a recent example, the CFPB fined fintech company Chime more than $4.5 million for illegally delaying consumer refunds past the promised 14-day timeframe.

What can you do before filing a CFPB complaint?

Consumers need not reach out to the company they’re having trouble with prior to submitting a complaint, but it can be a helpful first step, according to Darian Dorsey, the CFPB deputy associate director of Consumer Response and Education.

“Sometimes companies can answer questions unique to your situation and the products and services they offer,” Dorsey said. “They may be able to provide you with answers or resolutions, saving you the extra step of submitting a complaint.”

But if you find the company to be unresponsive or uncooperative, then you can move on with filing a CFPB complaint.

Which products and services can consumers complain about?

In an effort to find violations, the CFPB allows consumers to file complaints for harm caused by unfair, deceptive or abusive practices, including against a bank or credit union. Products and services consumer can complain about include:

- Checking and savings accounts

- Credit cards

- Debt collection

- Mortgages

- Student loans

If you believe you’ve been subject to unfair, deceptive or abusive practices by a financial company, here’s how you can file a CFPB complaint.

Where do you file a CFPB complaint?

The CFPB’s website includes a dedicated filing page where you can find the portal to submit a new complaint, in addition to resources detailing what should be included in the filing.

You’ll first need to create an account with the CFPB before you can proceed with filing. You’ll need to submit your name, email address, phone number and create a password. After verifying your email, you can start the filing process.

A step-by-step guide to filing a CFPB complaint

Step 1

The first part of the filing is guided. You’ll have several options to choose from to indicate what your complaint is about. In step one, you’ll choose which product or service best matches your complaint.

This could be, for example, about a deposit account such as checking, savings or certificates of deposit. Or you could choose mortgages, which would include such products as conventional home loans or home equity loans or line of credit (HELOC).

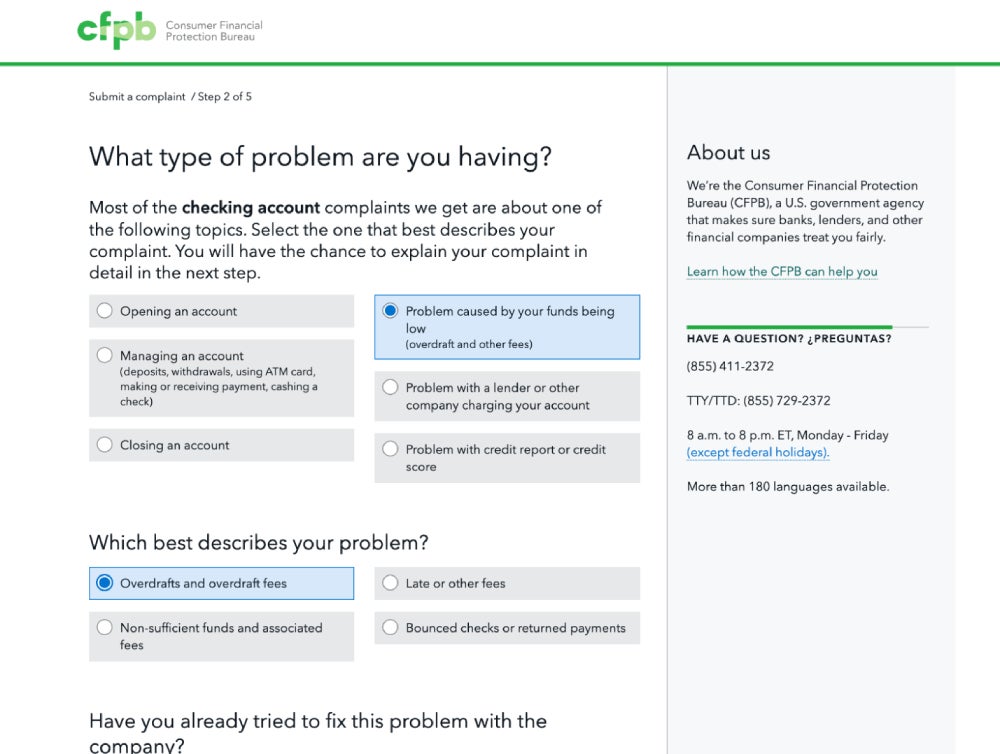

Step 2

In step two, you’ll indicate which problem you’re having. For example, if you’re having trouble with overdraft fees, you’d first select “problem caused by your funds being low” and then select “overdrafts and overdraft fees.”

At this stage, you can also indicate whether you’ve reached out to the respective company about the issue you’re having. If you’ve already reached out to the company, you can indicate what information you requested from them in the complaint.

Step 3

In step three, you’ll be able to write directly into a text box to describe what happened. You’ll also be able to indicate what you believe would be a fair resolution to the issue you’re having. You can also attach any documents that would support your claim (the limit is 50 pages).

“If a consumer is looking for an apology, they can add that into the complaint,” Dorsey said. “Or maybe they want a refund of a late fee. This section enables companies to tailor their response with what a consumer is actually asking for.”

Be sure to include the most important dates, dollar amounts and communications you’ve had with the company you’re complaining about.

Because you can’t file about the same complaint more than once, filers are encouraged to “organize their thoughts and the issues they’re having so that the company is responding to the most thorough description of the issue and the impact to the consumer,” Dorsey said. “This way, consumers get the best chance at a response from the company that answers their issues.”

At this step, you’ll also be able to indicate whether you’re OK with the CFPB publishing the description of your complaint to its website. (The CFPB will take steps to remove your personal information, so that you can’t be identified.)

Steps 4 and 5

And lastly, in steps four and five, you’ll indicate which company you’re having a problem with and indicate who you’re submitting this complaint for (yourself or for someone else). You’ll then be able to add your personal information.

If you’re complaining about a bank, you’ll have the option to include specific information about your account, including your billing address and account number.

What happens after submitting a CFPB complaint?

After receiving your filing, the CFPB will send your complaint to the relevant company, which will review the issues raised.

Companies typically respond within 15 days, though some companies take up to 60 days to provide their final response. In the latter case, the company will typically acknowledge your complaint is in progress before providing you with a final response.

After the company responds, you’ll have 60 days to provide feedback through a post-complaint survey, which will be forwarded to the company. Unfortunately at this stage, that’s the end of the road for filers — whether or not you are satisfied with the resolution.

“Companies make their own business decisions about what’s required of them: what’s within their legal and compliance requirements and what fits with their business practices,” Dorsey said. “But consumer complaints come together to inform the CFPB’s broader work, especially when it comes to enforcement.”

Bottom line

If you’re having issues with a financial service provider – be it with overdraft fees, a HELOC or student loans – filing a complaint with the CFPB can help you get to a resolution. It may be worth attempting to work the problem out with the company first, but that isn’t a requirement to submit a CFPB complaint. And if the resolution isn’t satisfactory, you can indicate so in the post-complaint survey, which the CFPB provides directly to the institution in question.

Read the full article here