In the U.S., property burglary occurs every 28 seconds. Home insurance can help you after the fact, but knowing the most commonly stolen items can give you a better sense of what to keep under lock and key. Bankrate’s insurance editorial team looked at multiple crime databases to highlight what burglars steal the most to help you better safeguard your home.

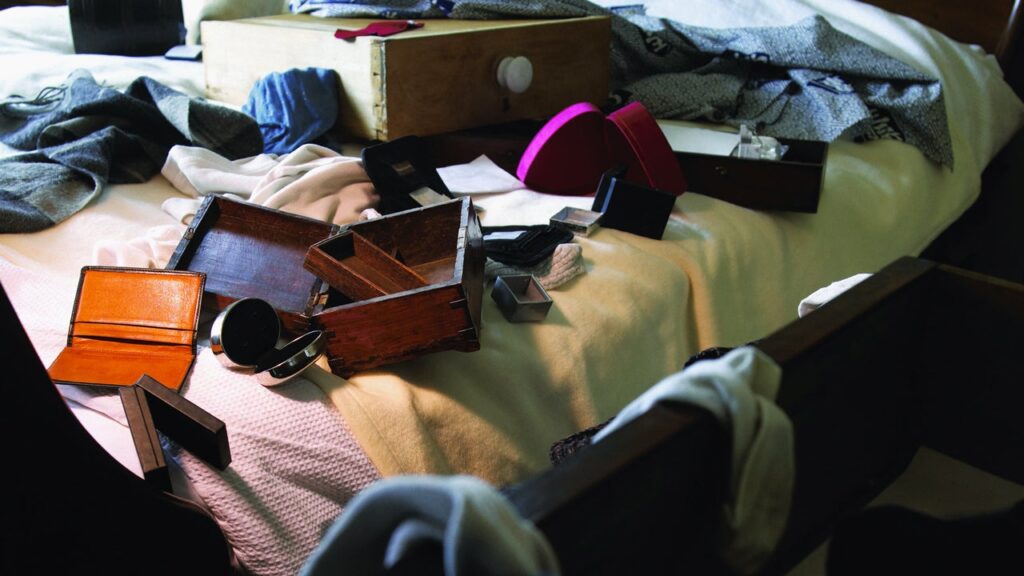

Top 10 items stolen in home invasions

From October 2023 to October 2024, the FBI reported around $76.7 million worth of stolen property — but less than 10 percent ($6 million) of that property was recovered. Other data from the FBI shows that the average amount of dollar loss per burglary event is $2,661. Thieves aren’t only after your television, new laptop or gaming system. If a thief breaks into your home while you’re away or unsuspecting, what they take could surprise you. Prescription drugs, for instance, also make the list as some of the most stolen items.

1. Wallets and cash

The amount of cash stolen in home burglaries far outweighs the value of other stolen goods, according to the FBI’s findings. From October 2023 to October 2024, $27.9 million in cash was stolen in burglaries nationwide. Your home insurance policy does offer some protection for stolen cash, but not much. Most home policies only include around $200 for cash coverage, which is significantly lower than most home insurance deductibles. Remember, with home insurance, it’s usually only worth it to file a claim if the loss is more than your deductible amount.

-

The best way to prevent cash theft from your home is to avoid keeping it there in the first place. But, if you are someone who keeps significant amounts of cash at home, be sure to store it in a safe or other secure location. If you do get a safe, make sure it is mounted to a wall or otherwise unable to be lifted by a thief.

2. Clothing and furs

You might not think that your wardrobe is particularly valuable to a thief, but if you have designer clothes in your closet, it’s a potential gold mine to a burglar. Thieves might be looking for designer labels, including shoes, handbags and accessories, that can be resold. Other high-quality items, like leather jackets and furs, are also a target for home burglars.

-

In addition to having a home security system in place, you may want to consider extra measures for valuable handbags and other high-ticket items. You could install a special lock on your closet door, or consider a safe. The personal property part of your home insurance policy likely has sub-limits that apply to furs and other expensive clothing items. To insure them at their full value, you may need scheduled personal property endorsements.

3. Prescription drugs

Stealing prescription drugs can be extremely profitable for home burglars. Medications are easily resold on the streets, which is why many home burglars target the medicine cabinet in your bathroom during a break-in. Some over-the-counter medications might also get stolen in the process. A burglar probably won’t stop to read the label, so if you keep things like painkillers, allergy medicine and even vitamins on hand, a burglar might decide to take it.

-

It could help to keep your prescriptions somewhere hidden or out of the ordinary, like on a high shelf in the back of your pantry. But, be sure they remain out of reach of children or pets. Before you go on vacation, you may want to lock up your prescriptions in a safe.

4. Cars and parts

Burglars may see your car as an easier target than your home. Additionally, the stealing car itself may not even be the goal. A band of burglars could be interested in swiping your catalytic converter. In the first six months of 2023, nearly 27,000 catalytic converters were reported stolen nationwide. A burglar could also smash your windshield in order to access items in your glove box.

-

If your car gets stolen or damaged by burglars, you’d rely on your car insurance policy to cover those losses. Vehicle theft and damage, like a smashed gas tank, are only usually covered by comprehensive coverage. Without it, you’d likely be on the hook for the cost of repairing or even replacing your vehicle. If possible, keeping your car in a locked garage or off the street can help deter thieves.

6. Electronics

Electronics, like televisions, computer sets and gaming systems are common targets for burglars. Nonetheless, your phone may also be a targeted item. The Federal Communications Commission reports that ore than 40 percent of thefts in major U.S. cities involve cell phones. In fact, the same report found that 1 in 10 U.S. smartphone owners are the victims of phone theft and the vast majority (68 percent) of theft victims were unable to recover their phones.

-

If possible, you may want to put your devices in a secure, locked cabinet when they’re not in use. If it’s too much to do every day, consider locking them up when you go out of town. Depending on your personal property coverage limits and sub-limits, you may need to insure them with a scheduled property endorsement.

7. Jewelry and precious metals

Burglars are usually on the lookout for expensive fine jewelry and watches to steal and resell to make a profit. And it’s not just diamonds they’re hoping to get — sterling silver jewelry, gold jewelry and even costume jewelry can be resold for profit. If you have jewelry or watches lying out in plain sight, it’s fair game for potential theft.

-

Consider storing valuable pieces that you won’t wear every day at a bank or other secure site away from your home. For the pieces you keep at home, store them in a secure, locked location. Your home insurance policy may not cover the full cost of some pieces of jewelry; most policies apply a $1,500 sub-limit for jewelry theft. Like with other valuables, consider a scheduled personal property endorsement.

8. Personal documents

Unfortunately, some burglars might be after your personal documents, like your Social Security card, password books and passport. If a burglar gets their hands on these items, they can use them to steal your identity or even access your financial accounts.

-

Try not to leave important documents lying about; keep important documents in a locked file cabinet and consider storing them in a place that a potential burglar would not immediately think to search. It also helps to make digital copies of any important documents, just in case.

9. Firearms

Firearms are one of the most stolen items in home invasions. According to data from the Bureau of Alcohol, Tobacco, Firearms and Explosives, (ATF), more than 95 percent of guns originate from thefts from private citizens (not specific to home invasions). Since many guns have an extremely high resale value, burglars often target them to quickly resell on the streets.

-

Firearms should always be kept in a safe or other secure location in your home. For something more discreet, you could consider furniture with a hidden compartment. Like with jewelry and furs, most home insurance policies apply a $2,500 sub-limit for firearms.

10. Power tools

Power tools aren’t just nabbed from construction sites. Burglars are also prone to grabbing power tools and landscaping tools from homes. They’re pretty easy to steal and can easily be resold.

-

Don’t stop at just locking your tools away in a shed. You may also want to consider locking them to something inside of a shed. Engraving your tools may also deter thieves.

How home insurance protects against loss from theft

Your home insurance policy provides financial protection for theft. Coverage C, the personal property insurance arm of your policy, covers you up to a certain amount for your stuff. Coverages A and B, dwelling and other structures, can help with structural damage after a break in. If burglars break down your front door, smash a window or break a lock on your shed, you can file a claim with your home insurance company for those losses.

Home insurance theft claim

“Someone stole a lawnmower, leaf blower, golf clubs, a weed whacker and other tools from my shed when my house was under construction. The electricity was turned off, so our security cameras were offline. Plus, the house was pretty obviously under construction, which made it kind of an easy target. The shed was locked, but they knocked it off with a loose brick. I filed a police report online, then I filed a claim with my home insurance company. After I met my deductible and listed all of the items that were stolen, I got the money direct deposited to my account.”

— Micheal S., Bankrate Staffer

It’s important to note that you may not be protected for the full value of some commonly-stolen items through your personal property coverage. Most insurance policies apply sub-limits to certain items for theft losses, such as:

| Item | Personal property sub-limit |

|---|---|

| Cash and other currency | $200 |

| Manuscripts and other valuable papers | $1,500 |

| Jewelry and watches | $1,500 |

| Furs | $1,500 |

| Firearms | $2,500 |

| Silverware, goldware or pewterware | $2,500 |

So, even if you have $100,000 in personal property coverage, your $10,000 necklace may only be covered for $1,500. The sub-limits listed above are approximations, and exactly what you’re covered for will depend on your policy specifics.

Tips on protecting your personal belongings

Even if you take all the right safety precautions, motivated burglars can still find ways to break into your home. However, there are plenty of ways to protect your personal items in the event of a home burglary. Here are some tips:

- Purchase property insurance: If you rent or own a home, having property insurance is a smart investment, even though it’s not required unless you have a mortgage. If someone breaks into your house, the personal property portion of your renters or home insurance policy will reimburse you for the stolen items up to your policy limits. Before you get a policy, it’s a good idea to shop around and get a few quotes to find the best policy for your situation. If you have a lot of valuables, you may want to consider scheduled personal property insurance, which could cover high-value items like expensive jewelry or art.

- Set up a security system: Home security systems could be a great line of defense against burglars. Depending on your budget, you can install a professionally-monitored system, or get a cheaper DIY-install system that you self-monitor through an app. As an added bonus, many home insurance companies offer a discount on your policy if you have a security system in your house.

- Install motion sensor flood lights: For obvious reasons, many burglars break into houses when it’s dark and they can’t be easily spotted. By installing motion sensor-activated flood lights around the perimeter of your house, you can potentially spook a burglar from going further in their attempt.

- Secure valuable items in a safe: If you keep valuable items in your home, like jewelry, art or firearms, consider storing them in a locked safe. When these items are left out, it’s very easy for a burglar to stash them in a bag or pocket and leave quickly.

- Shred sensitive documents: As a general rule of thumb, you shouldn’t keep sensitive documents that contain personal information in plain sight. Once you no longer need a document, whether it’s a bill or a credit card PIN number, it’s best to shred the document where it can’t be found. Keep in mind that burglars may try to get sensitive information by going through your trash or recycling bin, so shredding provides an added layer of protection.

- Be mindful of seasonal theft trends: If you take advantage of Black Friday for your holiday shopping, be mindful of porch piracy. If possible, get your packages delivered to a discrete location or require a signature for larger packages.

Read the full article here