Pfizer (PFE) beat on earnings in the first quarter of 2024, giving its stock a much-needed 7% boost Wednesday.

The company reported $14.9 billion in revenue, down 19% compared to last year. That beat Wall Street estimates of $13.9 billion by 6.9%. Without its COVID products, the company is up 11% with $12.5 billion in revenues.

Despite the win, investors have cooled their enthusiasm for Pfizer in recent months. In addition to waning COVID product revenues, the company lacks a near-term potential blockbuster — making it a safe but unexciting bet.

Pfizer’s stock is trading near its 52-week low of $25 and is down 30% in the past year, much lower than its pandemic high of $58 per share at the end of 2021.

CEO Albert Bourla has made several moves to bolster the pipeline, including the $43 billion Seagen acquisition, and continues to announce new product launches — all of which will take time to bear fruit.

It’s why investors, despite the boost to the stock, are wary.

“We continue to see PFE shares as range bound in the near-term … [and] we do not believe that COVID upside alone … is enough to drive shares higher in the near-term. Rather, we believe stronger new launch performance and/or further progress on the pipeline will be necessary to change the current narrative on the stock,” wrote JPMorgan analyst Chris Schott in a note to clients Wednesday.

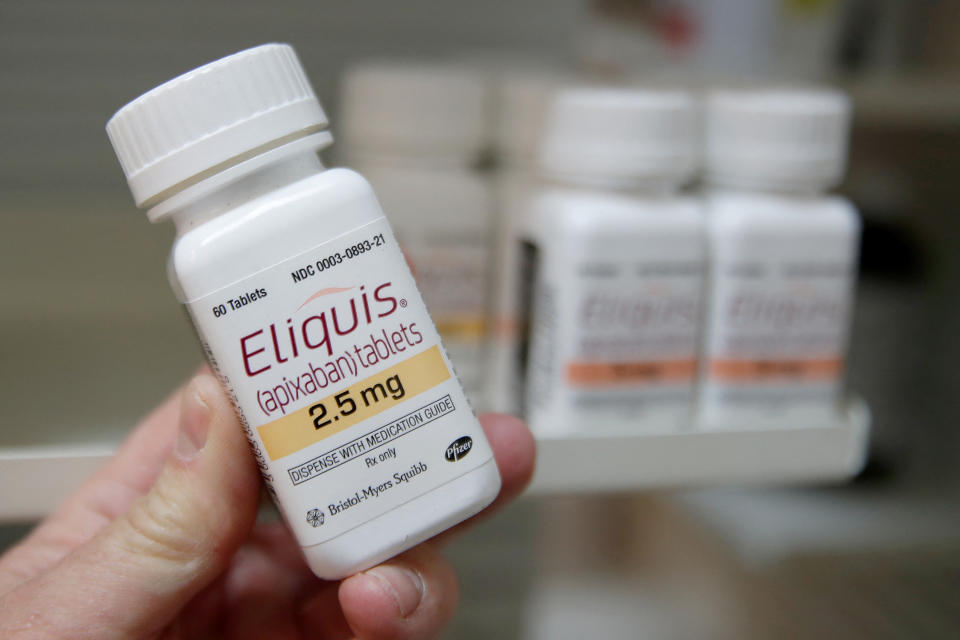

Pfizer also faces the expiration of patents on some of its biggest drugs, including breast cancer drug Ibrance in 2027 and its Prevnar 13 vaccine in 2026, and has one drug, Eliquis, facing pressure from Medicare drug pricing negotiations.

Lee Brown, global sector lead for healthcare at research firm Third Bridge, said in a statement that the Medicare negotiations, a part of the Inflation Reduction Act, are a concern.

“Our focus remains on Eliquis with sales increasing 9% (year over year) to just over $2.0 billion and topping consensus by 4.5%. Eliquis represents nearly 14% of Pfizer’s Q1 revenue, and we recognize the uncertainty tied to the Inflation Reduction Act’s Medicare Part D price negotiations,” Brown said.

“The maximum fair price will be published September 1 and could materially impact Eliquis’ outlook. We also note that Eliquis faces generic competition in several international markets, as well as faces loss of exclusivity in the U.S in April 2028,” he said.

But beyond the product pipeline, the company’s value to shareholders has remained a question in the past year.

‘The dividend is a sacred cow for us’

In addition to the pipeline concerns, investors had been waiting for their share of the pandemic windfall — either through increased dividends or the company’s share repurchases. But that hasn’t panned out.

The company said it will maintain its dividend and has no plans to cut it, which had been a concern for some investors prior to the call with profits waning post-pandemic.

Bank of America managing director and senior healthcare analyst Geoff Meacham told Yahoo Finance that most businesses would cut their dividend if they were in the same position as Pfizer with muted growth prospects.

“It is a diversified, big business, so it’s not going to be the end of the world. But the growth is just going to look kind of nasty,” he said.

Pfizer has paid a dividend for 340 consecutive quarters and is focused on enhancing shareholder value, executives said on its earnings call Wednesday.

CFO David Denton told investors the company is prioritizing maintaining and growing the dividend and has returned $2.4 billion to shareholders in the first quarter. In addition, Pfizer plans to de-lever from its acquisitions and other debt and reinvest $2.5 billion in internal R&D.

“Our No. 1 priority from a capital allocation perspective is both supporting and growing our dividend over time — and that is not at risk,” Denton said.

While the yield from Pfizer is not considered low, at more than 6% annually, its quarterly dividend is just $0.42. And investors have worried the company will have to cut the dividend as its revenues right-size in coming months both from the pandemic impact as well as patent cliffs.

But CEO Bourla emphasized that is not the case.

“The dividend is a sacred cow for us. The dividend — it is secure, and we will continue our policy on [the] dividend as we have promised repeatedly,” he said on the earnings call.

Bourla has also made bold personal moves to back the company’s outlook, including putting all of his pension into Pfizer’s stock earlier this year.

The company has no plans to repurchase shares in the year, adding to the reasons investors are no longer excited.

Anjalee Khemlani is the senior health reporter at Yahoo Finance, covering all things pharma, insurance, care services, digital health, PBMs, and health policy and politics. Follow Anjalee on all social media platforms @AnjKhem.

Click here for in-depth analysis of the latest health industry news and events impacting stock prices

Read the latest financial and business news from Yahoo Finance

Read the full article here