October 2024 marks one year since I purchased the most expensive house I could afford. Leading up to the purchase, I wrestled with uncertainty about whether buying such a home was the right move. For most, a home is the largest purchase they will ever make, bringing with it a mix of excitement and worry.

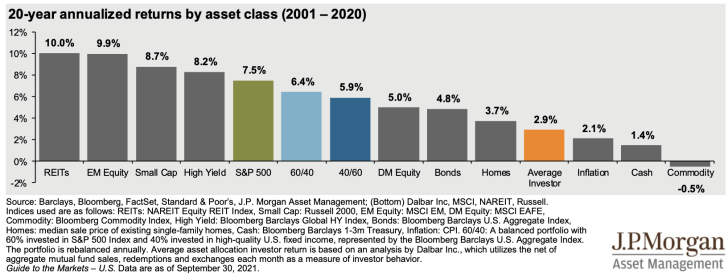

Some people are so anxious about making the wrong financial choice that they end up renting forever. It’s similar to those who, paralyzed by fear of stock market risk, hold too much cash for years. Decades later, they look back and wish they had bought more. If only they had consulted with a trusted advisor.

The reality is that no individual or couple needs more than a studio apartment and no family of up to four needs more than a two-bedroom apartment or home. Yet, driven by our desire for more, we often buy much more than we need. And that is when we can get into huge financial trouble.

In this post, I aim to assess whether buying a house I didn’t truly need was a wise decision. I want to help you decide if buying a nicer house might be the right or wrong choice for you, too.

Why I Bought A New House I Didn’t Need

We bought our current home because I believe the best time to own the nicest house you can afford is when you have children. With more people living under one roof, the home’s value increases as more family members benefit from it. The home’s cost is also spread out among more people too. Once the kids leave, the likelihood of upgrading to an even nicer home diminishes. If anything, you may want to downsize.

Another reason for the purchase was my decision to focus more on decumulating wealth after age 45. After 23 years of saving and investing over 50% of my income, I wanted to start spending more intentionally. Buying a nicer home was a way to spend down wealth while still retaining the potential for appreciation.

Here are my candid reflections of the purchase, divided into financial and lifestyle aspects. If you’re contemplating buying a home you don’t need, these reflections might help you make an optimal decision.

Financial Repercussions Of Purchasing A House You Don’t Need

Let’s first review the financial repercussions of buying a home you don’t need.

1. Missing out on tremendous stock market gains

The problem with selling any of your investments to buy something is that there’s a high likelihood you’ll miss out on further gains. Stocks, real estate, and other alternative assets tend to keep increasing in value over time. It’s similar to inflation: if you don’t buy your pair of shoes today, they will likely cost more in the future.

In the second half of 2024, we decided to sell a significant amount of stocks and Treasury bonds to pay cash for our home. About sixty-five percent of the cash purchase came from stocks, while thirty-five percent came from Treasury bonds. Since closing in October 2023, the S&P 500 and tech stocks have performed incredibly well.

I started thinking about all the things I could buy now if I had just held on: a new car to replace my nine-year-old one, many family vacations to Honolulu, and both of my children’s college tuition for four years! Oh my, stop thinking! The opportunity cost was becoming painful.

But then I realized not all is lost because I plan to keep my car for at least another year, which gives me time to save for a new one. Our family vacations can be funded with cash flow. Finally, e’ve already saved aggressively in two 529 plans that should keep up with inflation.

Always consider the potential opportunity of buying a new house. Be prepared to miss out on future gains.

2. Potential appreciation of the house

I bought the house when mortgage rates were near their peak and during a slow buying season. Since then, mortgage rates have decreased, and household wealth has risen due to a strong economy and stock market gains.

Based on the bidding wars I saw in Spring 2024, I suspect the house has appreciated between 8% and 15%, helping offset the gains I missed in the stock market. About one-third of the home purchase came from shorter-duration Treasury bonds, which would have only yielded around 5% after one year.

The quandary of buying a home lies in hoping the economy fares well afterward. If the economy slows, other assets might fall more than your home’s value, as lower mortgage rates could help support home prices. In a growing economy, however, other investments may outpace your home’s appreciation.

Ultimately, if you have a job and other investments, you want the economy to perform well after purchasing a home, despite the potential for higher rates.

3. Retirement portfolios continue to perform well

Although I missed out on some gains in taxable investments, our retirement accounts—like the rollover IRA, SEP IRA, Solo 401(k), and Roth IRAs—have performed well. We didn’t tap into these accounts to buy the house, allowing them to continue compounding as intended.

The experience reinforces the importance of building a taxable investment portfolio alongside retirement accounts. It’s the taxable portfolio that enables you to buy homes or generate passive income for early retirement.

When it comes to investing, compartmentalize your investments based on specific goals. Avoid the temptation to borrow from your 401(k) to buy a house. Let your investments grow and compound for their intended purposes.

4. Finally used up my remaining capital losses

I’ve been investing in stocks since 1995, experiencing significant booms and busts along the way. Although stocks have delivered substantial gains over the years, I’ve also faced considerable losses.

In my teens and 20s, I was an undisciplined investor who day traded excessively and used margin to try to boost returns. My frequent trading was largely driven by witnessing so many fortunes lost—from the Dotcom bust in 2000 to the lost decade and the global financial crisis that began in 2007. These events made me wary of long-term investing.

It wasn’t until around age 32, in 2009 after the global financial crisis, that I slowly shifted my focus to long-term investing. By then, I felt defeated and lacked the energy to keep trying to outsmart the market. Instead of trading, I launched Financial Samurai in July 2009, channeling my energy into writing.

After enduring another tumultuous 20% market decline in 2022, I saw an opportunity in the second half of 2023 to reduce risk and finally purchase something I had wanted since early 2022. The house was first listed for sale at a much higher price in March 2023, then it disappeared for 14 months before resurfacing.

Keep a record of your stock investment losses. These losses are valuable “credits” for offsetting future capital gains when you sell stocks. If you don’t have any capital gains in a given year, you can use up to $3,000 of losses annually to reduce your taxable income.

5. The stress was intense for the first three months after purchase

I almost forgot to include this point, probably because we tend to have selective memories when it comes to recalling difficulties. For the first three months after buying our house, I was incredibly stressed. This stress led to unhappiness and more arguments with my wife.

I was constantly worried about what might break in the house and how much it would cost to fix. I also worried about potential leaks during the winter rainy season, since most home damage is caused by water.

My stress pushed me to take on a part-time consulting job starting in late November 2023 to boost cash flow and increase our savings. While working for the seed-stage startup was a good experience overall, there were frustrating moments as well.

If you push your house-buying limits to the max, you’ll likely experience significant stress during the first 3-6 months as well—especially if your spouse doesn’t have a traditional day job. When all the financial pressure falls on you, it can feel crushing.

To avoid feeling overwhelmed, you must follow all three parts of my 30/30/3 home-buying rule. I used to believe that following two out of three would suffice, but it isn’t enough if you’re pushing the limits to afford a house under this rule.

6. A nicer home is a meaningful way to decumulate wealth

If you’re a personal finance enthusiast, you’re likely an aggressive saver who loves to invest. However, at some point, you’ll realize that continuing to save and invest so aggressively can be counterproductive, leading you to die with too much. You’ll be jolted awake once you crunch the numbers in a retirement calculator.

At the same time, you’ll come to understand that buying expensive things doesn’t bring lasting happiness. Sure, purchasing a Porsche 911 Turbo might thrill you for 6 to 12 months, but after that, it’s just another fast car that you fear getting dinged. The same goes for buying a Birkin handbag or a Patek Philippe watch—acquiring material possessions rarely brings long-term satisfaction.

In contrast, buying a nice primary residence can provide tremendous satisfaction for many people while also forcing you to spend down your wealth. Not only do you need to come up with a down payment for the house, but you also have to pay for home insurance, maintenance, gardening, utilities, and property taxes. Each of these payments means money that isn’t going toward saving and investing for the future.

Example of Missing Out On A Promising Investment

Because I now have a large primary residence property tax bill, I’m forced to be more careful with my cash flow. I’ve had to accumulate significantly more cash in my taxable investment account, which would have otherwise been fully invested in stocks, private real estate, and venture capital. In a bull market, this means I’m missing out on potential gains.

Specifically, I wanted to invest $100,000 in Anthropic’s Q1 2024 funding round, which valued the company at around $10 billion. Based on OpenAI’s latest funding round, which valued the company at over $150 billion—up from just $85 billion eight months earlier—I expect Anthropic to raise its next round at a valuation of over $15 billion.

However, I didn’t invest because I didn’t feel comfortable having such a concentrated investment in one company after purchasing my house. As an alternative, I decided to invest in an open-ended venture fund that participated in its $10 billion valuation round, with an amount I felt more comfortable with.

I realized I had a timing arbitrage opportunity where I could invest in Anthropic months later at the same valuation, but before the fund’s NAV potentially revalues upward in the fund if Anthropic announces a new funding round.

7. You will get motivated to make and save more money

There are three main times in life when your motivation to earn will shoot through the roof. The first is after you graduate from high school or college and need to become an independent adult. Due to pride and honor, no longer will you rely The Bank Of Mom & Dad. The second is when you have kids—there is no greater motivation to earn. The third is when you buy a home, especially one that stretches your finances to the limit.

Before the house purchase, my previous jolt of motivation to earn came in December 2019 when our daughter was born. But just like everything over time, my motivation slowly faded. Once I got into escrow, my motivation to make more money surged back to its most intense level.

I sought consulting work, explored more business opportunities online, and took greater risks with my investments. My riskier investments might not pay off, but my desire to replenish our liquidity pushed me to earn, save, and invest more. This type of motivation felt almost like a wonder drug! It was exhilarating to feel so alive again.

When your back is against the financial wall, you’ll do whatever it takes to survive. As long as you buy your house responsibly, you’ll eventually rebuild your liquidity and regain a sense of financial stability.

Lifestyle Repercussions Of Purchasing a House You Don’t Need

Now that we’ve gone through the financial implications of buying a house you don’t need, let’s review the lifestyle benefits.

1. Feels good to provide during a small window

When I bought our house, our kids were three and six. One of my concerns as a father was the risk of them running out onto the street and getting hit by a car. At that age, kids are often bursting with energy and can be unpredictable. So when I found a cozy home with an enclosed front yard, my protective instincts went into overdrive.

I had never seen a house with so much usable outdoor space and a view for less than $25 million in San Francisco. My kids needed a safe space to run around outside. If you have a hyperactive child or one with ADHD, you’ll further appreciate the value of having a lot of enclosed outdoor space.

The window for kids to truly enjoy a home’s outdoor space is smaller than I thought. By the time they reach age eight, they may be involved in various activities—like soccer, swimming, gymnastics, or tennis—that keep them busy after school and on weekends. By the time they get home, they may be too exhausted to play outside.

Instead of assuming your home’s outdoor space will be a huge benefit from ages 0 to 18, think of it as a great advantage for ages 0 to 8. Anything beyond that is a bonus.

As a father, I’m not sure anything feels more rewarding that providing for your family.

2. Easy to reminisce about how easy things used to be.

The danger with real estate is that the desire for more never ends until you make it stop. There’s always a nicer house you can buy, and these days, people are regularly purchasing $100 to $200 million mansions in LA and Florida. Because of my love for real estate, I’ve climbed the property ladder at every opportunity. However, that’s not always ideal for your family or your finances.

Our previous home, although much smaller, would have been perfectly adequate for a family of four. It had decks on three levels facing the ocean and two office areas for my wife and me. If our kids had never seen our current house, they wouldn’t know what they were missing.

Now I have to spend time managing our old property, which is now a rental. The tenants have already broken the kitchen faucet, and the walls are all dinged up after I spent a month meticulously painting them. They also neglect the front yard.

If you buy a nicer home you don’t need, be prepared to deal with the hassle of owning or selling your old home. As long as there is love in the household, young kids don’t really care where they live.

Be honest with yourself about whether you’re buying a house for your family or for yourself. You might justify the purchase by saying it’s the best way to provide for your family, but the reality might be that it’s more about fulfilling your own ego.

3. Once you buy a nice house, your vacations won’t feel as nice

You’ll quickly get used to living in a nicer house—probably within a year. You might even wonder how you ever managed in a smaller place. This is the risk of hedonic adaptation.

The downside is that once you get accustomed to more space and comfort, your vacation accommodations may no longer feel adequate unless you upgrade them. For example, if you’re used to living in an 1,800-square-foot, three-bedroom, two-bathroom home with a family of four, staying in a 360-square-foot hotel room with a pull-out couch on vacation will feel cramped. To maintain a similar level of comfort, you may need to pay double for a one-bedroom or two-bedroom suite.

Our two bedroom, two bathroom vacation condo in Lake Tahoe used to feel huge. But with every subsequent primary home upgrade, it feels more and more cramped. As a result, my desire for going up to Lake Tahoe has partially declined. No Toto bidets are a bummer too!

In short, upgrading your home can create pressure to spend more on family vacations to maintain the lifestyle you’ve grown accustomed to

4. You’ll gain satisfaction from not wasting time

Ever since becoming a parent, the speed of time has accelerated as little ones transform so quickly during their first 16 years of life. Seeing my kids every day serves as a reminder not to waste time doing things I don’t enjoy. They also make me question why people strive to retire rich when they could just retire early.

All parents want the best for their kids, which creates a push and pull between spending time making money and spending time raising them. One reason we often prioritize making money over spending time with our kids is to afford a nicer home to shelter them, among other things.

I could have easily waited until 2030, or 10 years after owning our previous home, to buy a forever home. That was my intention when we purchased our last house in mid-2020. However, after living through the pandemic with a newborn, I experienced a “screw it, let’s YOLO” mentality switch in my mind.

If you wait too long, you might never make the move. Don’t waste time. Once your kids turn 12, they’ll start valuing time with friends over you. Buying a house you don’t need when they’re older may feel less rewarding, leaving you with a nice home but no one to share it with.

Poorer Financially, But Richer In Satisfaction

Ultimately, deciding whether to buy a house you don’t need comes down to your priorities. When I review my decision, I see that the financial considerations outweigh the lifestyle factors by a ratio of 1.75:1. However, I believe the lifestyle benefits hold more weight.

If you prioritize money above all else, keep saving and investing aggressively. But if you value experiences and quality of life, stretching for a nicer home could be worthwhile.

While I am financially poorer for not keeping all my investments in the stock market, I’m richer in terms of satisfaction. I took the chance to provide the best lifestyle for my family, and so far, the pros outweigh the cons.

Readers, have you ever purchased a house you didn’t need? If so, what reflections and realizations have you had since then? Are there any other considerations I should include in this post?

Invest in Real Estate Without the Hassle

Real estate is my favorite asset class for building wealth. If you want to invest in real estate without dealing with tenants, maintenance issues, or insurance agents, check out Fundrise.

Founded in 2012, Fundrise manages over $3.3 billion for nearly 400,000 investors. The firm focuses on single-family and multi-family properties in the Sunbelt, where property valuations are lower and cap rates are higher. With the Federal Reserve likely to enter a multi-year rate cut cycle, the potential for lower mortgage rates could boost demand.

I’ve been investing in private real estate since 2016 to diversify my portfolio and generate more passive income. Fundrise has been a long-time sponsor of Financial Samurai, and I’ve personally invested over $270,000 in Fundrise to date.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Purchasing A House You Don’t Need is a Financial Samurai original post. All rights reserved.

Read the full article here