Euro (EUR/USD, EUR/GBP) Analysis

- EU inflation steadies and growth may have turned the corner

- EUR/USD recovers after EU GDP and inflation data

- EUR/GBP attempts to halt the decline

- Get your hands on the Euro Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free EUR Forecast

EU Inflation Steadies and Growth May have Turned the Corner

Euro area annual inflation is expected to be 2.4% in April 2024, stable when compared to March according to a flash estimate from Eurostat. While services inflation is expected to cool a tad compared to March, energy prices declined by less then before – somewhat offsetting the price declines seen elsewhere.

Breaking down the main components of euro area inflation, services is expected to have the highest annual rate in April (3.7%, compared with 4.0% in March), followed by food, alcohol & tobacco (2.8%, compared with 2.6% in March). Then, non-energy industrial goods (0.9%, compared with 1.1% in March) and energy (-0.6%, compared with -1.8% in March).

Additionally, EU GDP rose 0.3% in the first quarter which is promising seeing that all of 2023 oscillated around 0.1% and -0.1%. Year on year growth also surprised to the upside at 0.4% compared to the expectation of a minor 0.2% expansion.

Customize and filter live economic data via our DailyFX economic calendar

EUR/USD Recovers after EU GDP and Inflation Data

EUR/USD dropped in the moments after Germany’s economy avoided a technical recession. Q1 grew by 0.2% after Q4 last year registered a contraction of 0.3%. However, the single currency recovered after the broader EU growth and inflation numbers revealed a slight cool down in services inflation and an uptick in growth. EU sentiment and confidence indicators have improved in the lead up to the ECB’s first rate cut which is expected to arrive in June.

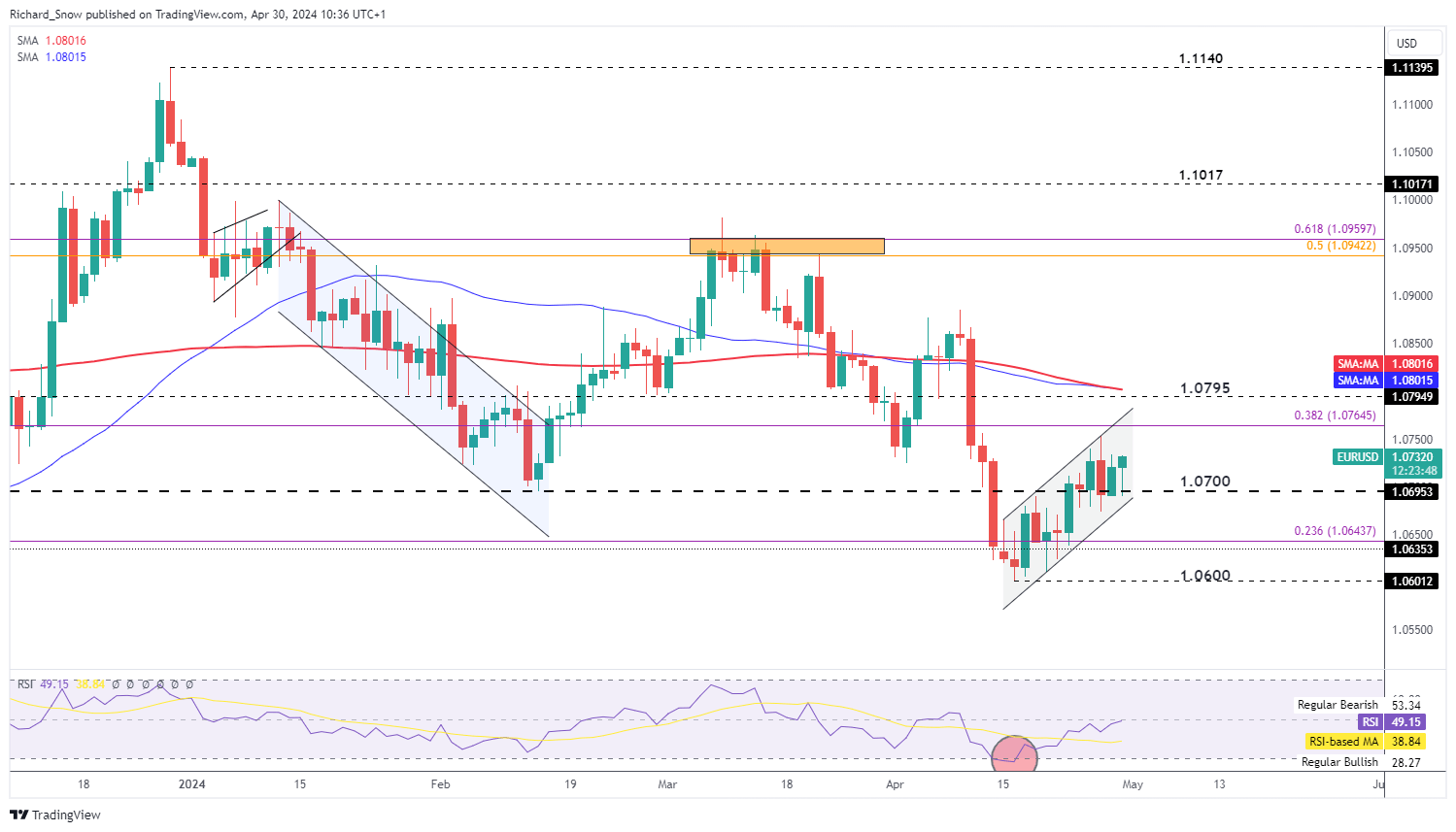

EUR/USD trades within an ascending channel, which developed during the current risk on sentiment that has emerged since tensions between Israel and Iran died down. Positive US earnings, for the most part, have also helped buoy sentiment in riskier FX currencies with AUD, EUR and GBP managing to claw back prior losses against the greenback.

EUR/USD appears to have tested the psychological level of 1.0700 on an intra-day level, with channel resistance in focus for bulls around 1.0765 and potentially the confluence zone above 1.0795 where the 50 and 200-day simple moving averages reside.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the second quarter!

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

EUR/GBP Attempts to Halt the Decline

EUR/GBP has produced a massive reversal since rising out of the prior horizontal channel which has encased the majority of price action in 2024. The move found resistance at the 0.8635 level, turning sharply lower since.

The Bank of England is expecting inflation to drop sharply into the middle of the year but sterling still boasts a superior interest rate differential to the euro, meaning the bullish EUR/GBP move was always at risk of a pullback/reversal.

After trading below 0.8560, the pair appears supported after the positive data dump this morning and heads back towards 0.8560.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Read the full article here