If you use an IRA to save for retirement, IRS Form 8606 might be an important part of tax season. Specifically, this is the form on which you report nondeductible contributions to an IRA. It is also used to track distributions for households that have made nondeductible contributions, early distributions from Roth IRAs, and conversions between pre-tax and post-tax IRAs. Here’s what you need to know.

A financial advisor can help optimize your retirement portfolio to lower your tax liability.

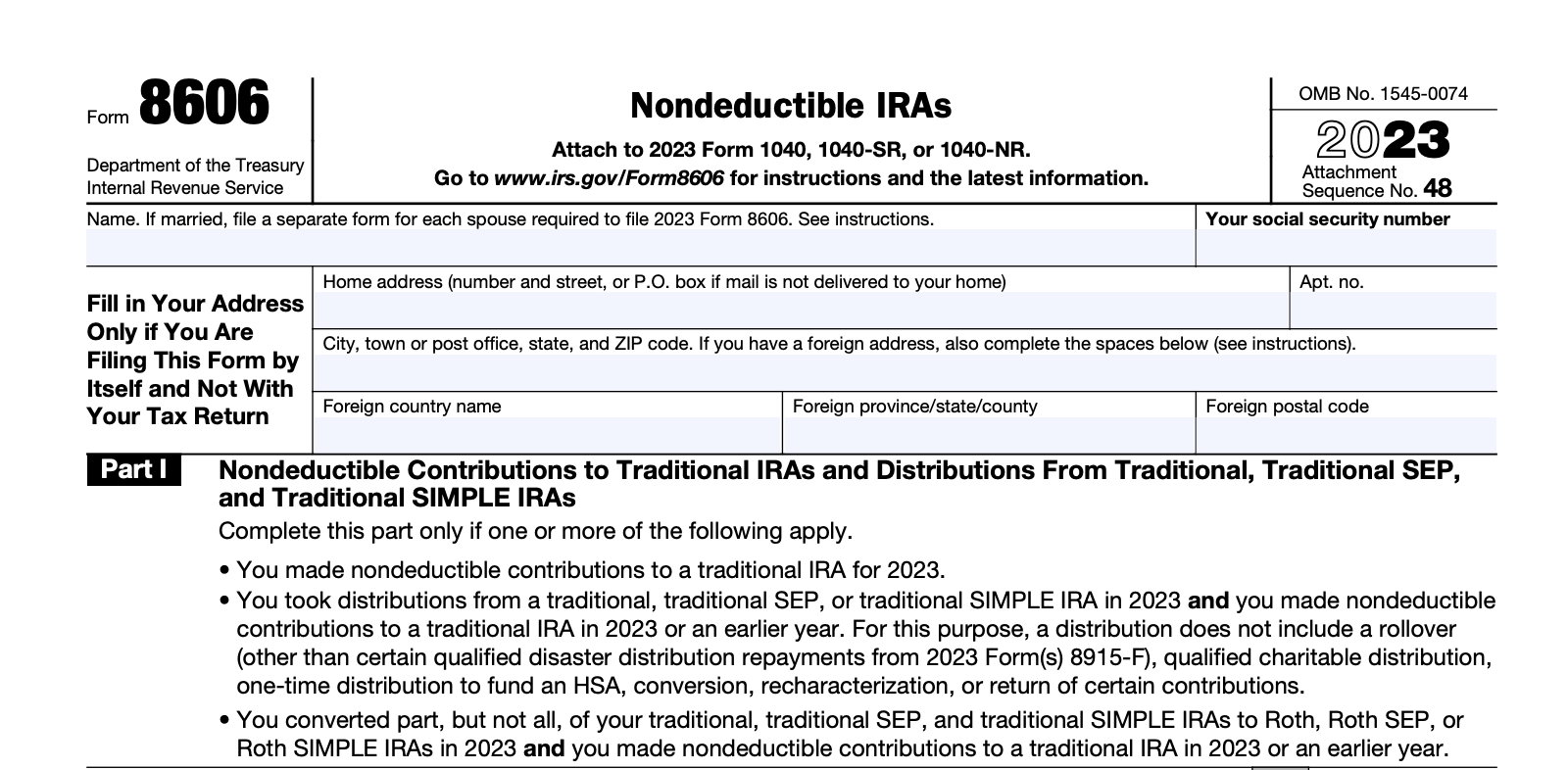

What Is Form 8606 and How to Complete It?

Tax Form 8606 is used to report four main transactions:

- Nondeductible contributions to a traditional IRA

- Distributions from a traditional, SEP or SIMPLE IRA when you have made nondeductible contributions to a traditional IRA in that tax year

- Conversions from a traditional, SEP or SIMPLE IRA to a Roth IRA

- Distributions from a Roth IRA when taken before age 59 1/2 or before the account has been open for five years

If you have made any of the four transactions above during the tax year, you will fill out Form 8606 and include it with your annual 1040.

Nondeductible Contributions

The first section of this form deals with nondeductible contributions to a traditional IRA.

While uncommon, individuals can contribute money to a traditional IRA without taking a tax deduction. This happens most often if you have access to an employer-based retirement plan and your income exceeds the cap for deductible contributions. If you or your spouse participate in an employer-sponsored retirement account, your deductible contributions to a traditional IRA phase out at a maximum level of income.

If you do not participate in an employer-sponsored retirement plan, there is no income cap for participating in a traditional IRA.

In 2024, the IRA deduction phases out for individual filers who earn between $77,000 and $87,000. For joint filers, if you are the spouse who has access to an employer-sponsored retirement plan your traditional IRA deduction phases out between $123,000 and $143,000. If you have access to an employer-sponsored retirement plan but your spouse does, your traditional IRA deduction phases out between $230,000 and $240,000.

Nondeductible IRA contributions give access to the same tax-deferred growth of a traditional IRA account. This means that returns, dividends and interest payment can grow freely. However they give no income tax benefits either when you contribute funds (pre-tax benefits) or withdraw them (post-tax benefits).

When you make a nondeductible contribution to a traditional IRA, you report it using Form 8606. When you have made nondeductible contributions to a traditional IRA and take distributions in the same year from a traditional, SEP or SIMPLE IRA, you report these distributions using Form 8606.

Roth Conversions

A Roth conversion is when you move money from a pre-tax (traditional) account into a Roth IRA account. You can make a Roth conversion with most, if not all, pre-tax retirement portfolios even if you have made nondeductible contributions.

If you have converted funds from a traditional, SEP or SIMPLE IRA to a Roth IRA, you report this transaction using Form 8606. You use this form whether you converted all or just part of this portfolio.

Early Roth Distributions

Finally, you use Form 8606 to report any distributions taken from a traditional, SEP or SIMPLE Roth IRA before the age 59 1/2 or before the account has been open for five years. This includes distributions taken for disallowed reasons. It also includes distributions taken for portfolio exceptions such as the first-time homebuyer allowance and qualified disaster allowances.

You do not use Form 8606 to report distributions taken from a Roth IRA after the age of 59 1/2 unless the account has not been open for five years.

General Instructions for Completing Form 8606

To complete the form, you’ll need to report the amount of nondeductible contributions made to your traditional IRA for the tax year in Part I. The total will be used to calculate the updated basis in your IRA.

The basis of an IRA refers to the portion of contributions that have already been taxed, typically representing nondeductible contributions made to a traditional IRA or contributions to a Roth IRA, which are withdrawn tax-free.

For any conversions to a Roth account for the tax year, you will need to indicate that amount in Part II. So, if you have any basis carried over from nondeductible contributions that were made to a traditional IRA in previous years and later converted to a Roth IRA, you may need to enter this amount in the appropriate section.

And, if you have any distributions from Roth accounts for the tax year, you will need to indicate that amount in Part III.

Bottom Line

Form 8606 is a tax form used mainly to report nondeductible contributions to an IRA. You also use this form to report non-qualified distributions taken from a Roth IRA (such as those taken before the age 59 1/2), as well as distributions taken from an IRA in years when you made nondeductible contributions.

Tax Planning Tips

- Smart tax filing means smart tax planning, and that’s not a small project. Here are nine common tax mistakes that could cost you more money and how to avoid them.

- A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock/Kemal Yildirim, ©irs.gov, ©irs.gov

Read the full article here