- The Education Department extended the student-loan payment pause by at least 6 more months for borrowers on the SAVE plan.

- The SAVE plan has been blocked since July following legal challenges from GOP states.

- The department said it would reopen other repayment plans because SAVE remains blocked.

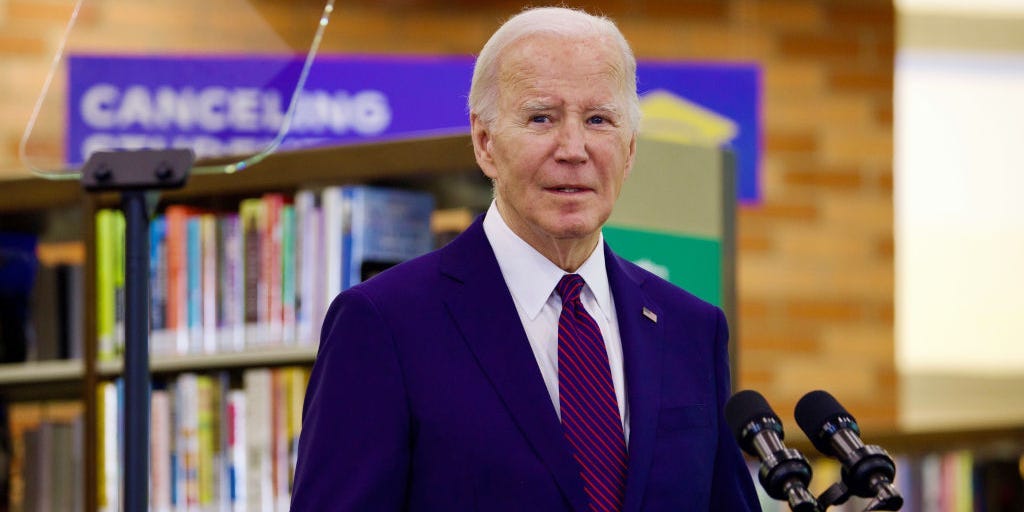

Millions of student-loan borrowers on President Joe Biden’s new repayment plan got updates on their payments due to ongoing legal challenges.

The SAVE income-driven repayment plan, intended to give borrowers cheaper monthly payments and a shorter timeline for loan forgiveness, has been blocked since July following lawsuits from GOP state attorneys general.

Since then, the Education Department placed 8 million enrolled borrowers on forbearance, during which interest would not accrue, to give them financial relief while the fate of the SAVE plan remains in limbo. A department spokesperson said on Monday that because the plan remains blocked, the already enrolled borrowers — along with anyone who applied for SAVE since the lawsuits — will not have to make payments for at least six more months. In the meantime, the Education Department “re-programs its systems” to comply with the preliminary injunction on the plan.

While the department is working to support borrowers impacted by the legal challenges, the spokesperson said, the lawsuits require the department to change complex computer systems that manage repayment, and it can be a lengthy and burdensome process. Further legal challenges could also arise in the meantime, the spokesperson said.

Given the time it will take for servicers to update their systems, the department will work to reopen the PAYE and income-contingent repayment plans for borrowers. These plans were previously closed because the SAVE plan offered the same benefits as the other income-driven repayment plans. Since borrowers on forbearance cannot earn credit toward forgiveness through Public Service Loan Forgiveness, the spokesperson said the PAYE plan would be the fastest path for PSLF borrowers to achieve forgiveness.

The department will share more information on enrollment changes to other repayment plans in the coming weeks while it continues to defend the SAVE plan in court.

Student-loan borrowers are now waiting for the 8th Circuit Court of Appeals to issue its final decision on the plan, and they are soon getting closer to an answer — the 8th Circuit is hearing oral arguments on the case on Thursday.

Along with challenges to the SAVE plan, Biden’s second attempt at broader student-loan forgiveness, expected to benefit over 30 million borrowers, is also blocked following a separate challenge from GOP state attorneys general. The Education Department has said it would continue fighting for the relief in court, and in the meantime, it has continued its targeted debt relief efforts, most recently canceling $4.5 billion in student debt for 60,000 borrowers in public service.

Read the full article here