Jamie Dimon aired a laundry list of concerns during JPMorgan’s investor day on Monday, ranging from sticky inflation and government largesse to overseas clashes and a burgeoning cash crunch.

“I’m cautiously pessimistic,” Dimon said, according to a transcript provided by AlphaSense. Between the conflicts raging in Ukraine and Gaza, and rising tensions between countries like the US, Russia, and China, he bemoaned the “most complicated geopolitical situation” since World War II.

“I look at the world situation and I’m quite cautious,” the JPMorgan CEO said before echoing Warren Buffett: “I like having a lot of extra capital right now to tell you the truth.”

Dimon warned against dismissing inflation and elevated interest rates as temporary headwinds. Annualized price growth has slowed from a 40-year high of over 9% to below 4% within the past two years, but still remains above the Federal Reserve’s 2% target. The central bank raised rates from nearly zero to north of 5% to tackle the problem, and hasn’t yet made its first cut.

“It’s possible that inflation is embedded in the system at 4% for the next year, and there’s not a damn thing anyone can do about it,” he said.

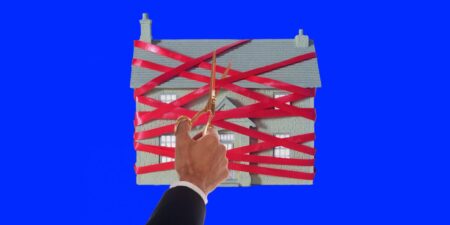

The billionaire banker also underlined that if rates climb higher, it could change the calculus for investing in many types of assets. Higher rates tend to erode the appeal of risk assets like stocks and housing by boosting the guaranteed returns from savings accounts and Treasurys.

“That’s a different world for real estate. It’s a different world for assets. It’s a different world for private credit. It’s a world that a lot of the people in the world have not seen,” Dimon said.

The Wall Street heavyweight also emphasized that people are feeling the pinch from historic inflation — which has made basics like food, energy, and housing more costly — and steeper rates that have raised the monthly payments due on their car loans, credit cards, and mortgages.

“We do know the consumers are running out of excess money. Small businesses are running out of excess money. We don’t know when it’s going to end, but it looks like sometime early next year.”

Dimon rang the alarm on the budget deficit and national debt too, warning that both are set to worsen over the next decade and beyond.

“Somewhere along that journey, and I don’t know if it’s six months, six years, or 16 years, it will be a problem,” he said.

The bank chief has voiced similar concerns in recent weeks. In October, he warned of the “most dangerous time” for the world in decades. In his shareholder letter this year, he called out market complacency toward the threats of inflation, interest rates, and recession.

Read the full article here