In a recent series of investor meetings in the US, Infosys’ CFO and Financial Controller shared optimistic updates on the company’s progress and future outlook. According to BofA, Infosys (NS:) is tracking well for the first quarter of FY24, thanks to the ramp-up of several major deals initiated in March.

Despite recent underwhelming performances from other software and digital firms, Infosys management believes their cautious assumptions regarding discretionary spending will shield them from additional pressures. However, the broader demand environment remains conservative, with a focus on cost-reduction projects.

Offer: Click here and discover the power of InvestingPro! Effortlessly access precise intrinsic stock values and detailed financial health scores using over 100 parameters. Grab our limited-time 10% discount now and make informed investment decisions with ease!

Infosys is establishing itself as a leader in AI and generative AI services, earning top rankings from seven industry analysts. It is one of the first IT services companies globally to receive certification for its AI management systems, which promote responsible AI practices and regulatory compliance.

These credentials are expected to position Infosys as a significant player in the expanding AI services market. Interestingly, Infosys has not observed a decline in deal prices due to anticipated AI-driven productivity gains, and vendor pricing aggression remains low despite wage inflation and foreign exchange trends.

BofA has set a price objective (PO) for Infosys at INR 1,785 (ADR: US$21.5), based on a target price-to-earnings (P/E) ratio of 25x for the 12 months ending March 2026. This target is about 10% lower than the sector leader’s multiple, aligning with the average trading discount over the past three years. Compared to its historical performance, this target multiple represents a 10% premium over Infosys’ five-year average forward P/E multiple.

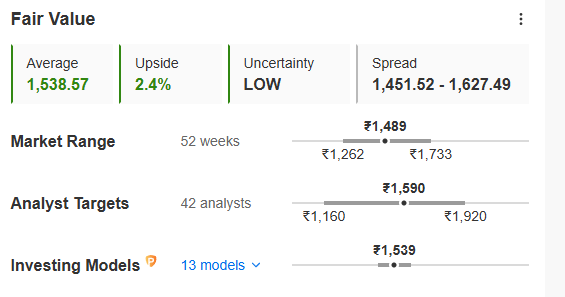

Image Source: InvestingPro+

There is no doubt that it is an investment-grade stock as its financial health score in InvestingPro is 4 out of 5, which is commendable. Not much stocks are able score this high. This score is given after analyzing over 100 parameters on the fundamental front, making it a piece of cake for investors to know the financial strength of the company without even having to dive deep into the financial staementes.

Image Description: InvestignPro+

On the valuation front, the fair value feature is estimating an appropriate price of INR 1,538, depicting an upside potential of INR 2.4% from the CMP of INR 1,488.9. This is lower than what BofA is estimating, but the key takeaway is that bot are bullish on the counter.

In fact, the average analysts’ target is also higher than the CMP, at INR 1,590. So clearly, the stock is loved by many but the valuation gap is not sufficient to take risks. Therefore, waiting for a dip to make an entry might be a better idea.

Infosys aims to maintain its robust free cash flow (FCF) growth, which stood at a strong 14% year-over-year in FY24, through FY25. The company expects its FCF growth to continue outpacing revenue and profit growth, although it acknowledges a 4%-5% lower FCF/sales ratio compared to peers. This is due to Infosys’ accounting treatment for financial income from long-term investments.

Looking ahead, BofA anticipates a revenue growth rebound for Infosys in FY26, driven by increased spending on regulatory technology by banks to meet Basel III requirements and postponed SAP upgrades. Given the stock’s underperformance over the past two years, its valuation is highly sensitive to these growth prospects. The earnings outlook for FY25 is nearing a floor, but Infosys is expected to benefit from the rising AI-led demand.

You can check the financial health score of any stock along with other features such as fair value, ProTips, etc., all in InvestingPro. Click here and get InvestingPro now at a steeply discounted rate, all thanks to the limited-time sale of 10% off! Hurry up and grab your offer today!

Read More: Unlocking Investment Potential via Fair Value

X (formerly, Twitter) – Aayush Khanna

Read the full article here