Shares of athletic footwear and apparel specialist Nike (NYSE: NKE) have gone over a cliff lately. Its recent quarterly results have raised concerns that the company’s growth has evaporated, at least for the foreseeable future. And as the business isn’t known for having low-priced products, investors may be worried about what may happen down the road, particularly if the economy falls into a recession.

But with shares of Nike now down more than 30% since the start of the year, has the stock become too cheap to pass up?

Historically, Nike has averaged a much higher earnings multiple

Nike’s shares, like many of its products, have often commanded a premium. Investors have been willing to pay more for the consumer stock due to its strong brand and impressive growth over the years. Currently, however, it’s trading at a price-to-earnings (P/E) multiple of just under 20. This is far lower than it has averaged over the past decade.

Generally, it has been rare for the stock to trade below a P/E of 20. When investors are no longer willing to pay a premium for a stock, it can be a sign that expectations have changed and that they are bracing for greater headwinds in the future. And in the case of Nike, those fears aren’t unwarranted.

Nike’s growth rate has slowed significantly

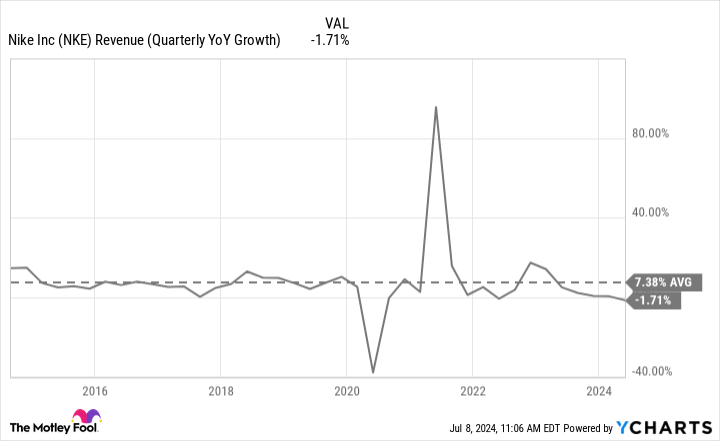

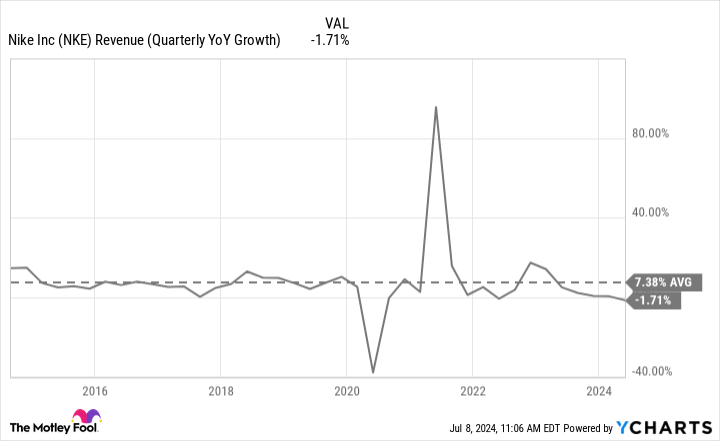

Nike recently wrapped up its 2024 fiscal year, and it was an underwhelming one for the business. Revenue of $51.4 billion for the year ended May 31 was up by just 1%. That’s not the kind of growth that investors are going to be expecting from the business, especially if the stock is commanding a high earnings multiple. And the quarterly growth rate has been declining as well.

Historically, there have been dips in Nike’s growth rate, especially due to COVID-19, but for the most part, the company has been able to average solid mid-single-digit gains of around 7% or better. But this time around, the footwear titan isn’t expecting a quick rebound. Instead, management said on its recent earnings call that it expects sales to decline for the current fiscal year by mid-single digits.

As a result, investors haven’t been feeling bullish on the stock, and it has been in a tailspin after the release of the earnings report.

Should you buy Nike’s stock?

Nike’s stock is trading at a discount compared to what investors have paid for it in the past. But there’s good reason. The company is facing some headwinds and generating growth could be a challenge in the near future.

In the long run, however, I still see Nike as potentially being a good buy. There’s some solid value here for investors given that it’s one of the top consumer brands in the world. And although it may be a tough year ahead, as economic conditions improve, those trends could change.

Spending money on shoes and athletic wear may not be a top priority for consumers right now, but that doesn’t mean demand won’t come back. And when it does, a brand like Nike, which is synonymous with athletic wear, will be sure to benefit from that resurgence.

As long as you’re willing to be patient with the stock, Nike could be a good buy-and-hold investment.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $805,042!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 8, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

Has Nike Stock Become Too Cheap to Pass Up? was originally published by The Motley Fool

Read the full article here