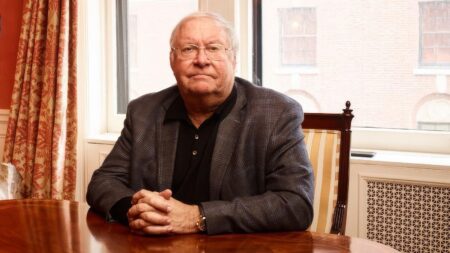

Wall Street scion Christopher Davis hung tough for 14 years as risk-free borrowing pinched value stocks. Now that money costs money again, he’s taking advantage of what he calls “a return to normalcy.

By Bob Ivry, Forbes Staff

There’s a Mistake Wall in Christopher Davis’ office on Fifth Avenue in Manhattan—23 framed stock certificates in four horizontal rows. They represent the biggest investing blunders committed by Davis Advisors, the family business he took over in 1998, which includes 17 mutual funds and ETFs, with total assets of $23 billion. Each certificate is accompanied by two or three sentences in small type describing what Davis calls “transferable lessons,” which mean, if heeded, that the errors won’t happen again. Google

GOOG

“We have a humble culture,” he says.

That doesn’t mean Davis, 58, has nothing to brag about. His flagship $6.2 billion New York Venture Fund returned 30% last year, compared with 26% for the S&P 500 Index. The fund has delivered an 11.4% average annualized return since it began in 1969. The S&P: 10.2%.

But near-zero interest rates from 2008 to 2022 proved humbling to value investors and those not falling hard for large tech stocks. Davis’ undervalued stocks stayed undervalued. Clients bailed. Venture Fund assets fell by 88%. Davis questioned his approach.

“We rarely think we know more than the market, and in those few cases when we think we do, the vast majority of people will think we’re wrong,” he says. “The difference between conviction and stubbornness is a delicate line.”

Few Wall Street pedigrees are as sterling as Davis’. His grandfather, Shelby Cullom Davis, started trading in 1947 with $50,000 and turned it into $900 million, landing him on The Forbes 400 for eight years before his death in 1994. Under the stewardship of Davis’ father, Shelby M.C. Davis, 86, the New York Venture Fund beat the market 16 times in 20 years and firm assets climbed to $3 billion by 1998.

With his unruly graying blonde hair, pullover sweater–and-tie ensemble and an office decorated with what looks like a detonation of paper, a bust of Charlie Munger and a doggie bed for Knick, his 4-year-old Kooiker—a Dutch breed, hence the name, short for Knickerbocker—Davis radiates the vibe of a philosophy professor more than that of a Wall Street power player. Davis Advisors is employee-owned; Davis’ share is 30%, valued at around $100 million, and he has a significant stake in the firm’s funds. But his grandfather and father dedicated most of their money to philanthropy, and Davis insists he is not a billionaire.

Still, he formed his investment strategy the old-fashioned way. He inherited it. His firm’s approach is similar to Warren Buffett’s: Pay reasonable prices for irreplaceable companies that have disciplined leadership and let them ride.

Buying decisions are based on two determinations. First, Davis and his team calculate what he calls owner-earnings yield—the cash a business generates after reinvesting enough to maintain its current competitive position divided by the price paid to buy the business. Drilling into financial statements, his team pays close attention to debt and its duration, refinancing possibilities and capitalized leases, as well as to items that may flatter a company’s net income, such as surprisingly low tax rates, aggressive depreciation schedules and stock-based compensation. Second, they focus on the opportunities that a company has to reinvest in itself. A company that has attractive reinvestment prospects may be worth a lot more than one that doesn’t, Davis says.

“We act as if we are buying the entire business,” he says, noting that stock ownership by management is a must. Each year he adds only a few new names to the 40 or so in his mutual funds.

For more than five years, the Venture Fund has been heavily weighted in financial companies, including Berkshire Hathaway

BRK.B

COF

BK

He can identify the moment he felt he could breathe again: March 16, 2022. That was the day the Federal Reserve started raising rates. Davis calls it a return to normalcy. “This is our great opportunity,” he says.

Meta became Davis’ biggest position, currently at 8.5% of the Venture Fund. Davis Advisors already owned some of the stock, but by November 2022, shares had plummeted 76% from their peak. Revenue was wilting. Young people were avoiding Facebook while TikTok was eating Instagram’s lunch. CEO Mark Zuckerberg was losing billions investing in the metaverse.

Davis held a different view. “Here’s a company trading at 14 times earnings, which seems shockingly low with the market at 18 times with companies that barely grow at all,” he says. Not only that, but Zuckerberg recognized that with borrowing costs climbing, Meta needed discipline. Even if his bet on the metaverse failed to pay off, it was the kind of long-range thinking Davis admires. “I’ve known Mark since 2000,” he says. “He’s hyper-rational. He’s not a lunatic.”

Between the beginning of September and November 3, 2022, Davis says, he bought nearly 125 million shares of Meta at an average price per share of about $113. The stock now hovers in the vicinity of $500. Davis’ 2023 return on Meta: 194%.

Financials also buoyed Davis’ 2023 returns. Last year, Capital One was up 44%, JPMorgan Chase

JPM

WFC

AMZN

AMAT

Is Davis worried that the return to normalcy his firm is counting on will evaporate with lower interest rates? “Our bet is that over the next 15 years, interest rates are on average higher than the last 15, and that’s normal,” he says. “The free-money era is over.”

MORE FROM FORBES

Read the full article here