Oil (Brent Crude, WTI) Analysis

- Topside surprise in US employment costs stoke USD and ‘higher for longer’ narrative ahead of FOMC meeting

- EIA revision sees US oil demand rise in February

- Brent crude, WTI turn lower with key support levels in sight

- Get your hands on the Oil Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free Oil Forecast

Topside Surprise in US Employment Costs Stoke USD and the ‘Higher for Longer’ Narrative Ahead of FOMC

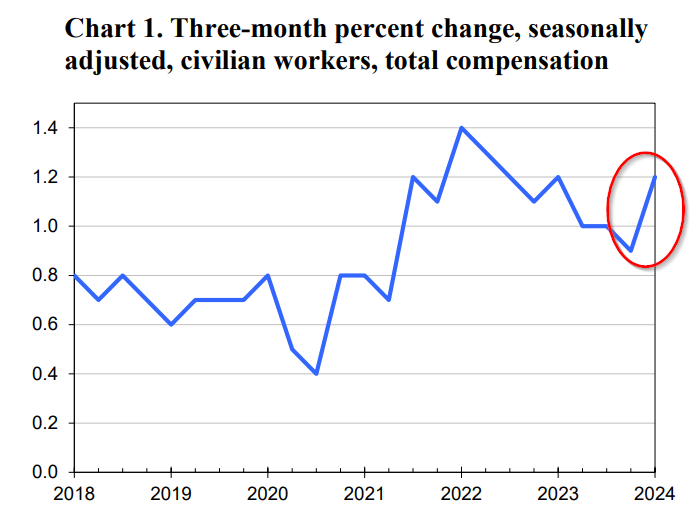

The Employment Cost Index rose by more than even the most optimistic of analyst predictions, sending the US dollar higher towards the end of the European session. Compensation costs for civilian workers reported by the US Bureau of Labor Statistics rose in the three-month period ending March 2024 by 1.2%, up from 0.9% for the three months ending in December 2023. The data appears in a week full of jobs data before non-farm payrolls takes center stage on Friday.

Customize and filter live economic data via our DailyFX economic calendar

Source: BLS

The increase in labour costs exacerbate concerns around a reacceleration in price pressures in the US after CPI and PCE measures of inflation revealed hot month-on-month figures. The FOMC is due to release its statement tomorrow evening where is widely anticipated that further acknowledgement of the stubborn prices will emerge. Markets propped up the greenback on the even of the FOMC announcement.

In addition, the Energy Information Agency (EIA) revised total US oil consumption in February to 19.95m barrels per day (bpd), up 425,000 bpd from estimates based on weekly data. This has done little to counter the daily decline at the time of writing.

Brent Crude, WIT Turn Lower with Key Support Levels in Sight

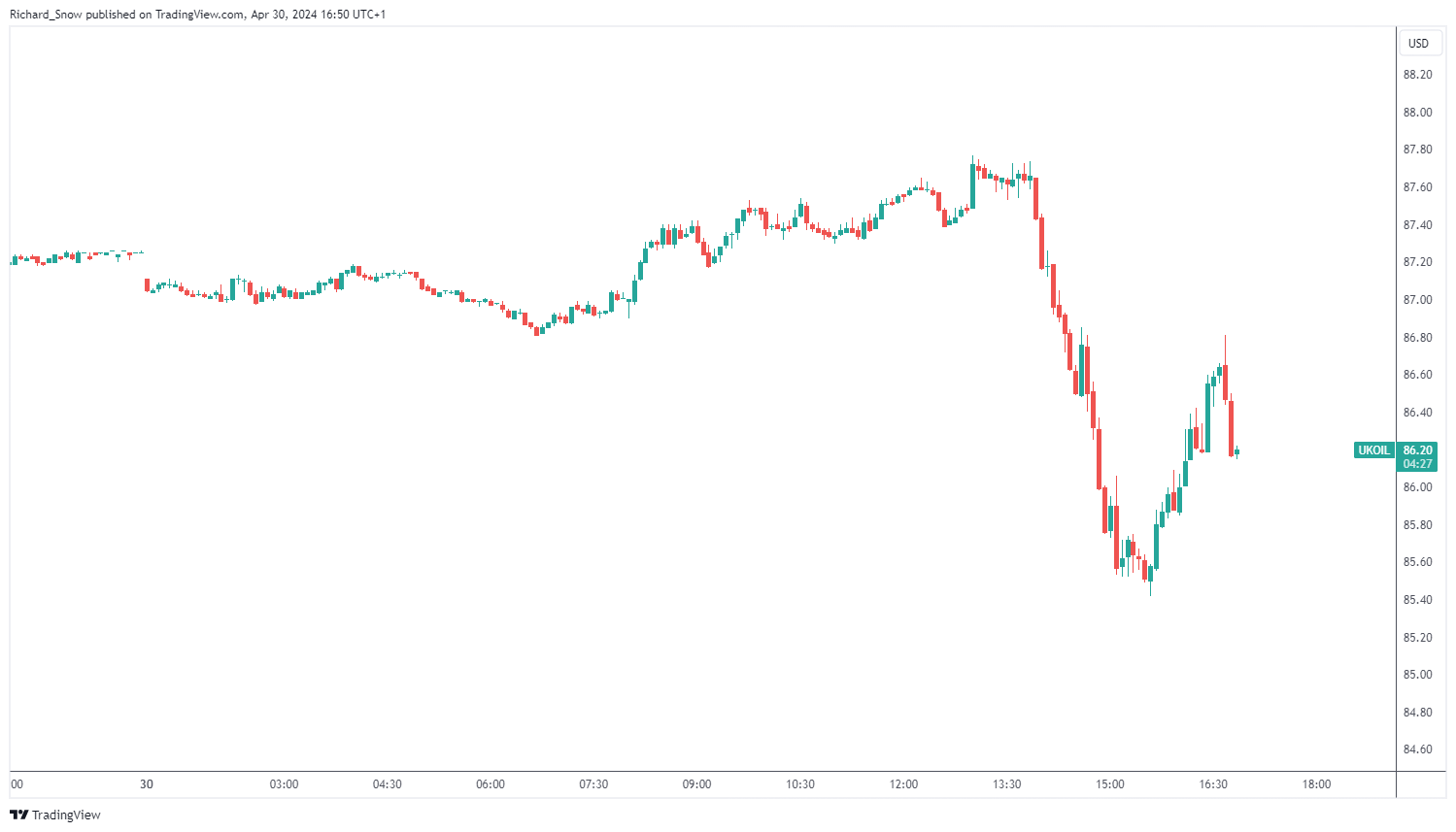

Brent prices dropped notably on Tuesday afternoon in the European session sometime after the dollar pushed higher.

Brent Crude 5-Minute Chart

Source: TradingView, prepared by Richard Snow

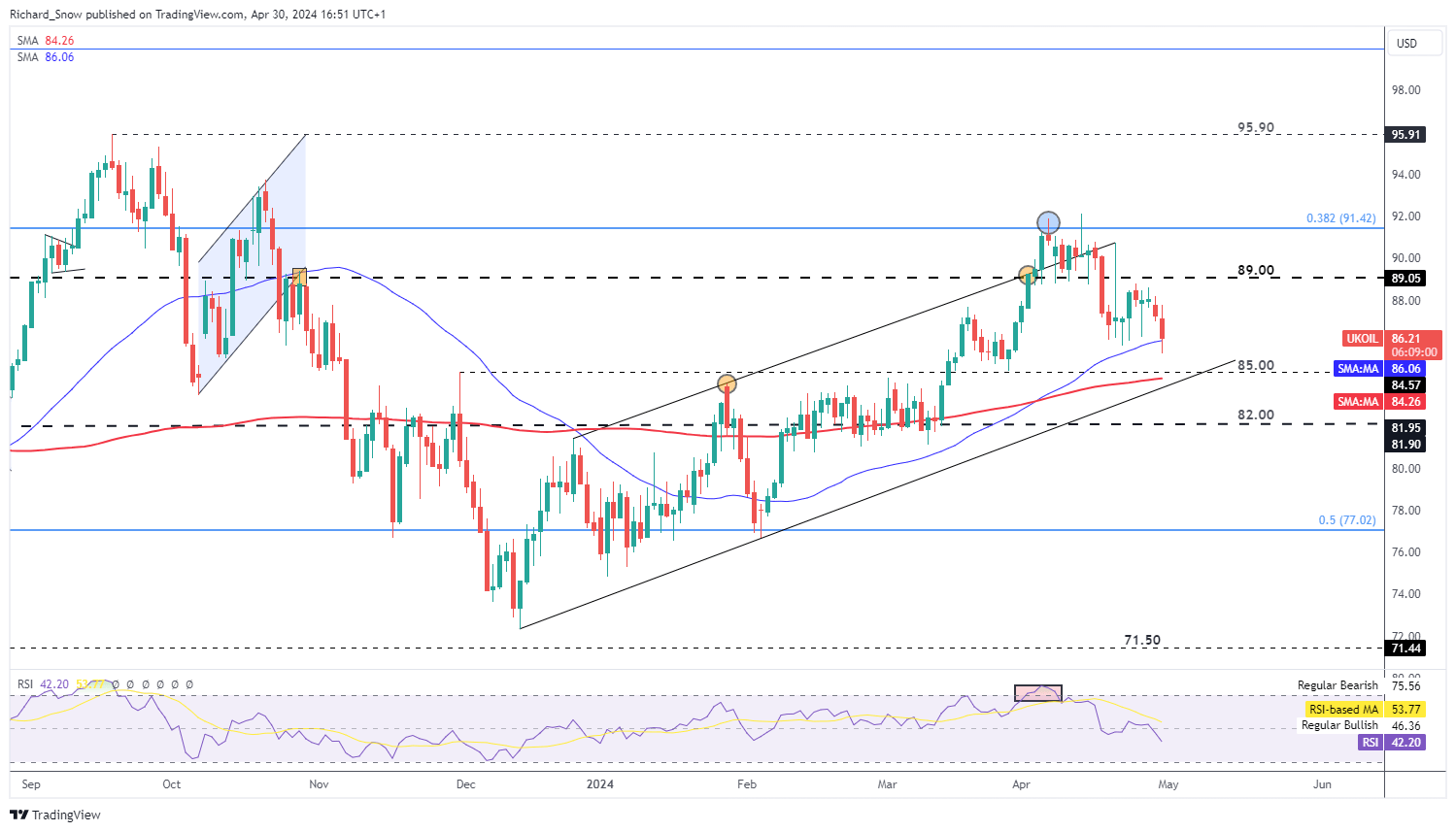

Brent has pulled back in the days following the de-escalation between Israel and Iran, building some momentum to the downside. However, a tight oil market may prevent prices from dropping too fast.

The immediate consideration for bears is the 50-day simple moving average (SMA), followed closely by the psychological $85 level, the 200 SMA and channel support. In the event the confluence zone of support holds, $89 remains as the most significant level of resistance. Markets will be closely watching the Fed and Jerome Powell at the press conference. Recent moderation in US growth stepped up a gear in Q1 as the economy grew less than anticipated – which runs the risk of filtering into the oil market. However, inflation is the Fed’s more immediate target, meaning the Fed won’t ease policy just because growth trends lower.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

There are many fundamental factors to keep in mind whenever trading oil, like demand and supply, geopolitical tensions and the state of the global economy. Read the comprehensive oil trading guide below:

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

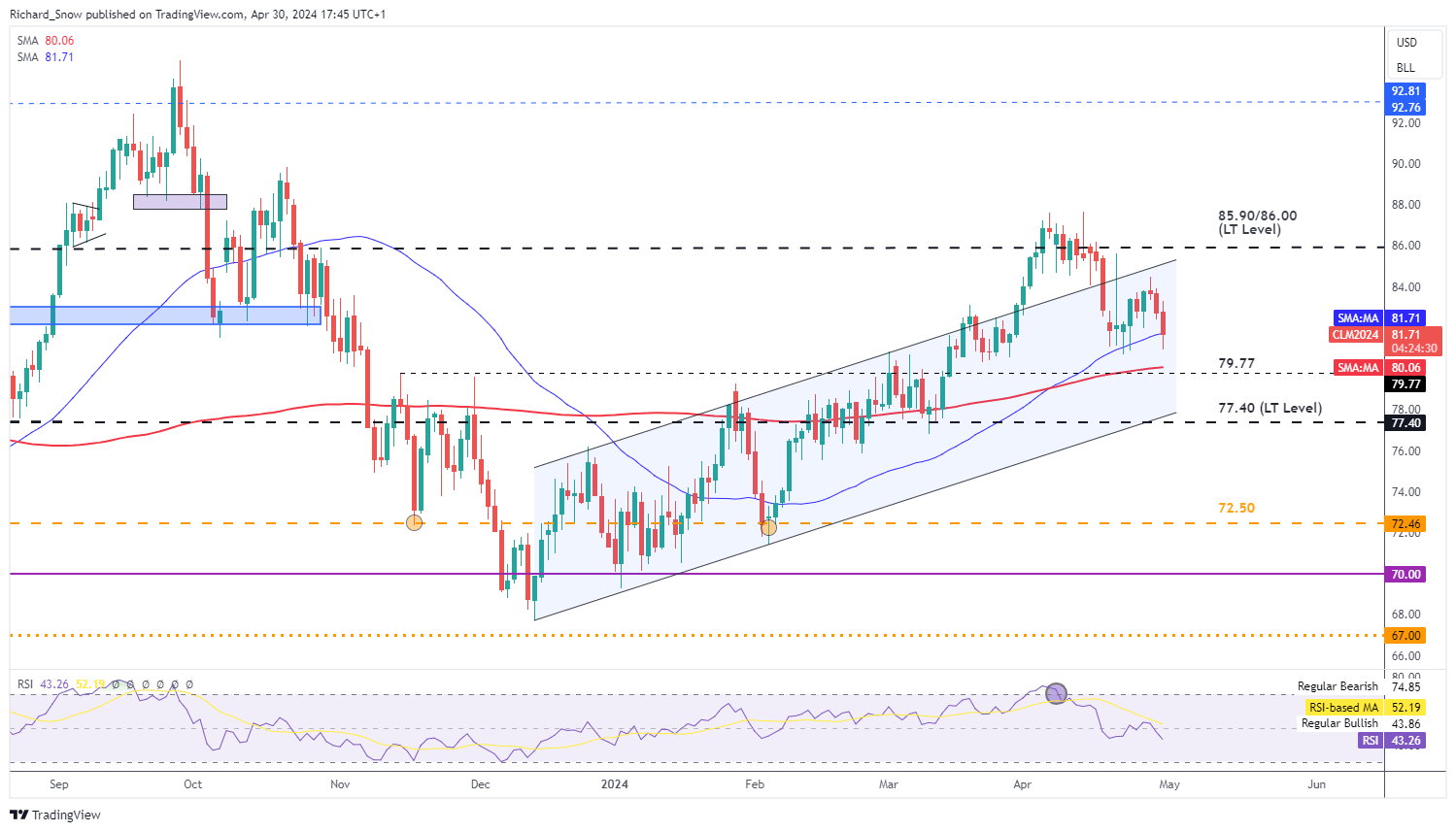

WTI trades in a similar fashion to Brent, testing the 50 SMA ahead of the $79.77 level which coincides with he 200 SMA. The next level of support emerges at the general area around $77.40 and channel support. WTI continues to trade within the broader ascending channel after the breakout attempt in early April.

WTI Oil Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Read the full article here