(Bloomberg) — Equities in Asia were primed to broadly track US stocks higher Thursday on firming signs the Federal Reserve will soon cut interest rates. Japan was an outlier as stock futures fell to reflect a stronger yen.

Most Read from Bloomberg

Share futures for Australia and Hong Kong climbed after the S&P 500 and the Nasdaq 100 both rose, helped along by sharp gains for big tech companies that extended into late trading. Nvidia Corp. surged 13% during the main session while Meta Platforms Inc. increased around 5% in post-market trade after beating sales forecasts. Contracts for US equities advanced in early Asian trading.

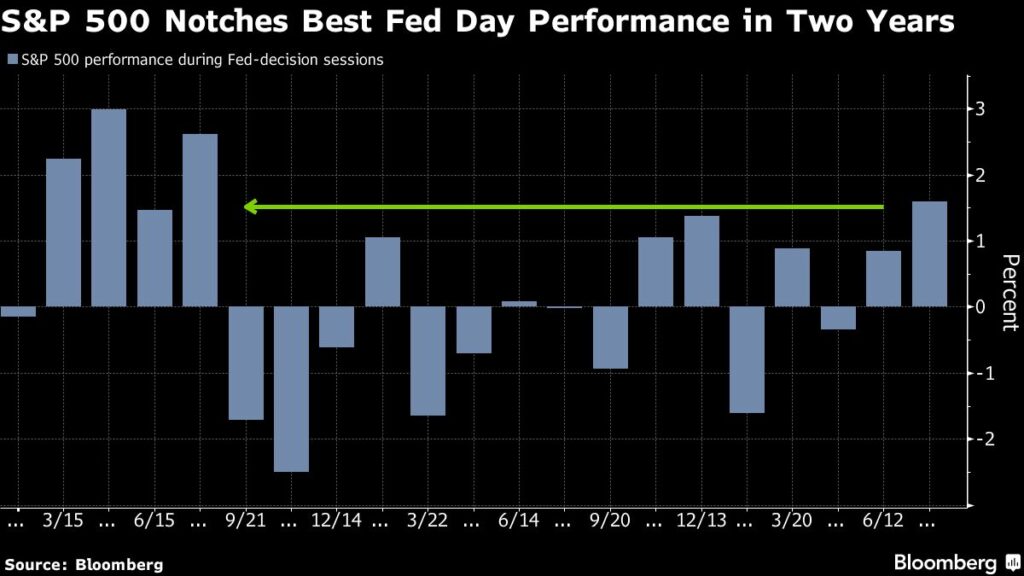

Wall Street gains were driven by signs the Fed will cut rates after leaving borrowing costs unchanged in its Wednesday meeting. Notably, the committee shifted to saying it is “attentive to the risks to both sides of its dual mandate,” rather than prior wording focused just on inflation. In a press conference, Fed Chair Jerome Powell said officials could cut rates “as soon as” September.

The Fed “has clearly telegraphed” a September rate cut, said Ronald Temple at Lazard Asset Management. Although “a July rate cut could have been justified by slowing inflation, easing labor market tightness, and moderating growth, I think the case will be even more compelling in seven weeks,” he noted.

Treasuries rallied across the curve, while an index of dollar strength had its worst day since May. The 10-year yield fell 11 basis points to 4.03%, a level not seen since February. Gains for US debt also reflected reports that Iran had ordered retaliation against Israel for the killing of a Hamas leader on its soil.

The drop in US yields added further fuel for a rally in the yen. The Japanese currency was steady in early Thursday trade after falling below 150 per dollar Wednesday, a level not seen since March, after the Bank of Japan raised rates and announced plans to cut bond purchases.

In Asia, economic data due for release Thursday includes Australian trade, Indonesia inflation and the China July Caixin manufacturing PMI.

In commodities, West Texas Intermediate rose early Thursday to compound its 4.3% advance Wednesday, the biggest daily jump in more than two years. Gold was steady after climbing Wednesday.

Federal Reserve

The changes in the Fed statement solidify a shift in tone among several policymakers, including Powell, recognizing growing risks to the labor market. They are also likely to reinforce expectations among economists and investors for a rate cut at the central bank’s Sept. 17-18 gathering.

“Powell so wants to say today ‘let’s do it’ — but at the same time, he knows he doesn’t have to commit just yet before he gets more time and data,” said Peter Boockvar at the Boock Report.

Given markets were already fully priced for a September cut, neither the Fed’s statement nor Powell’s remarks dramatically changed the rate path into the bond market, according to Tiffany Wilding at Pacific Investment Management Co.

Interest-rate swaps showed traders are still fully priced in a quarter point cut in September — and a total of almost 70 basis points worth of reductions for the year.

“The data has moved in Powell’s direction and now he’s getting ready to follow,” said David Russell at TradeStation. “Jobs data on Friday and CPI in two weeks are the next big items. If those go well, we could get clearer messaging from Powell at Jackson Hole in late August.”

Key events this week:

-

Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Thursday

-

US initial jobless claims, ISM Manufacturing, Thursday

-

Amazon, Apple earnings, Thursday

-

Bank of England rate decision, Thursday

-

US employment, factory orders, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.4% as of 7:34 a.m. Tokyo time

-

Hang Seng futures rose 0.2%

-

S&P/ASX 200 futures rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0827

-

The Japanese yen was little changed at 149.99 per dollar

-

The offshore yuan was little changed at 7.2256 per dollar

-

The Australian dollar was little changed at $0.6546

Cryptocurrencies

-

Bitcoin rose 0.4% to $64,791.37

-

Ether rose 0.3% to $3,232.03

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here