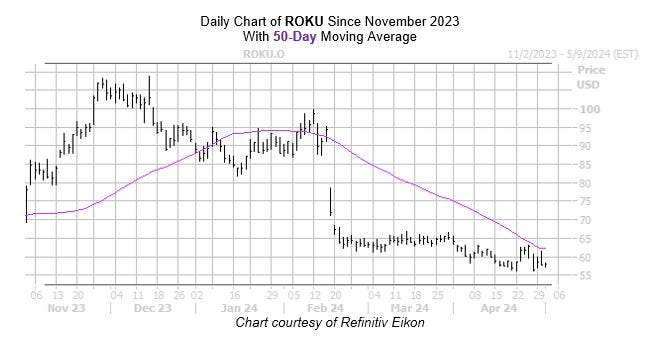

It’s been a tough run for Roku (ROKU) stock, which is already down 36.8% in 2024. The security is sticking close to six-month lows, though a floor has formed at the $56 level in recent weeks. Those looking to buy the dip on ROKU should hold off for now, as things could get bumpier in the coming month.

The security just came within one standard deviation of its 50-day moving average, after a lengthy period below the trendline. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, Roku stock saw seven similar occurrences over the past three years. The equity was lower one month later in 43% of those instances, averaging a 7.9% drop. A similar fall from its current perch of $58.07 would put ROKU right around the $53.50 mark – levels not seen in roughly 12 months.

A broader look paints a bullish picture, and an unwinding of this optimism could weigh on the security. According to data at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), ROKU’s 50-day call/put volume ratio of 2.24 ranks higher than 98% of readings from the past year. Echoing this, the equity’s Schaeffer’s put/call open interest ratio (SOIR) of 0.65 that sits lower than 88% of annual readings implies a call-bias amongst short-term premium traders.

For those looking to speculate on Roku stock’s next move, options could be the way to go. The security’s Schaeffer’s Volatility Index (SVI) of 52% sits higher than just 9% of readings from the past year. In other words, options traders are pricing in relatively low volatility expectations right now. What’s more, its Schaeffer’s Volatility Scorecard (SVS) of 72 (out of 100) show the stock regularly made bigger moves than options traders were pricing in during the last 12 months.

Read the full article here