Most Read: Aussie Dollar Technical Analysis – AUD/USD, AUD/NZD, AUD/JPY Price Setups

The U.S. dollar (DXY) sank at the start of the week, giving back a portion of Friday’s gains, with the pullback likely attributed to a moderate drop in U.S. Treasury yields ahead of two hot-impact market events later in the week: the Federal Reserve’s monetary policy announcement and the release of April’s U.S. jobs data.

Want to know where the U.S. dollar may be headed over the coming months? Explore key insights in our second-quarter forecast. Request your free trading guide now!

Recommended by Diego Colman

Get Your Free USD Forecast

FOMC Decision: A Potential Hawkish Tilt

At its previous meeting, the Fed hinted that the probable course ahead entailed delivering 75 basis points of easing in 2024, followed by three quarter-point rate cuts in 2025. While the central bank won’t revisit these projections until June, the institution led by Jerome Powell could embrace more hawkish guidance, signaling less willingness to begin dialing back on policy restraint in the face of uncomfortably high inflation and ongoing economic strength.

Any indication that borrowing costs will remain higher for longer should put upward pressure on U.S. Treasury yields. In this scenario, the US dollar is likely to gain ground in the near term, especially against low-yielding counterparts such as the Japanese yen.

When: Wednesday, May 1

April Jobs Report: Impact on the Dollar

The U.S. economy is expected to have added roughly 243,000 jobs in April, potentially keeping the unemployment rate steady at 3.8%. However, Wall Street has repeatedly underestimated labor market resilience, so a stronger-than-anticipated NFP survey remains a possibility. That said, a particularly robust jobs report would likely propel U.S. dollar upwards, as it could reinforce expectations of a cautious Fed on rate cuts.

When: Friday, May 3

For an extensive analysis of the euro’s medium-term prospects, download our complimentary Q2 forecast

Recommended by Diego Colman

Get Your Free EUR Forecast

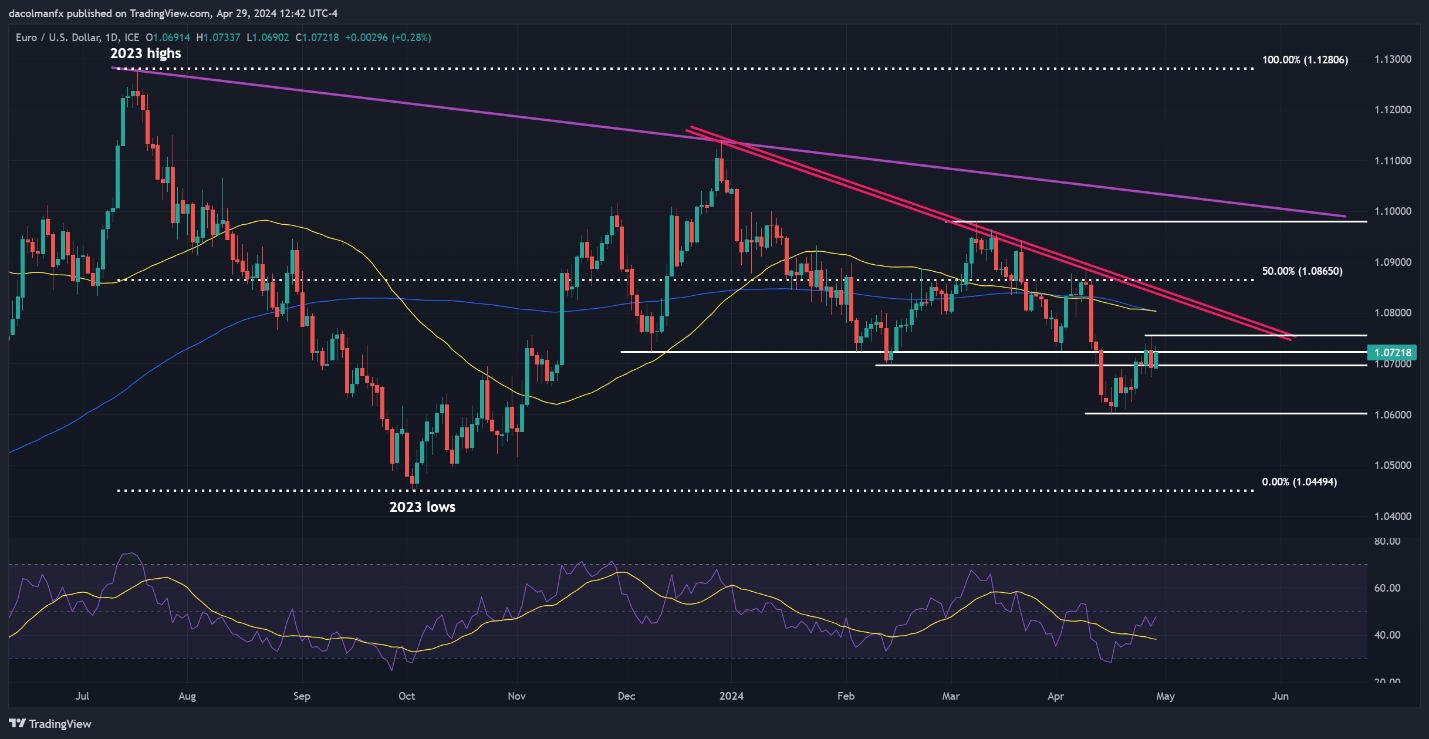

EUR/USD FORECAST – TECHNICAL ANALYSIS

After a subdued performance late last week, the EUR/USD bounced back on Monday, challenging overhead resistance at 1.0725. A successful clearance of this technical barrier could pave the way for a move towards 1.0755. Further strength from this point onwards would shift focus to the 1.0800 handle, where the 50-day and 200-day simple moving averages converge.

In the event of a market retracement, support is expected near the psychological level of 1.0700, followed by April’s swing lows around 1.0600. Prices are likely to establish a base in this region during a pullback ahead of a possible turnaround. However, if a breakdown occurs, the possibility of a rebound diminishes, as this move could lead to a drop towards the 2023 trough at 1.0450.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Using TradingView

Wondering about GBP/USD’s medium-term prospects? Gain clarity with our latest forecast. Download it now!

Recommended by Diego Colman

Get Your Free GBP Forecast

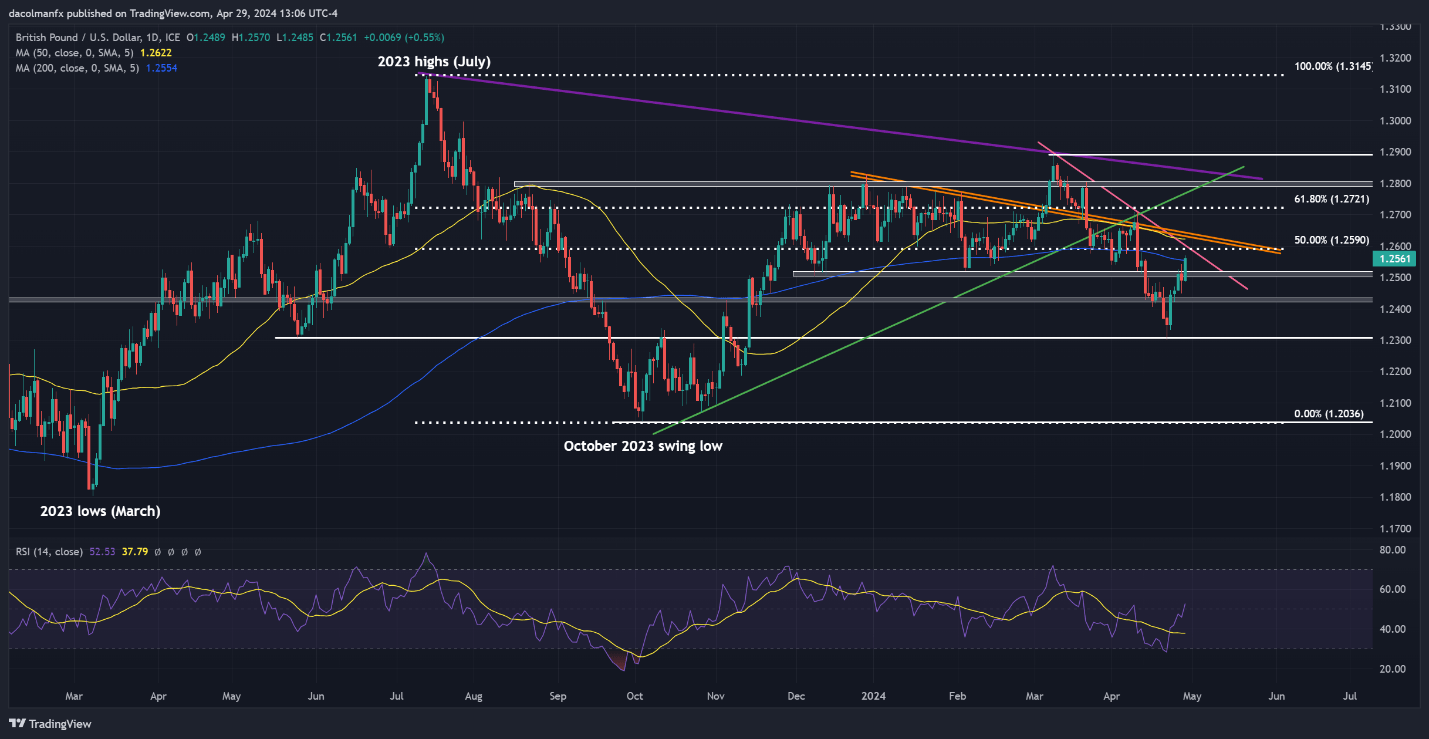

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD rallied on Monday, blasting past the 200-day simple moving average at 1.2550. If this bullish breakout is sustained, buyers could feel emboldened to attack trendline resistance at 1.2590 in the near term. Further upward pressure could place the spotlight on 1.2635, followed by 1.2720, which coincides with the 61.8% Fibonacci retracement of the July-October 2023 pullback.

On the flip side, if sentiment shifts in favor of sellers and prices take a turn to the downside, breaching the 200-day simple moving average, support zones emerge around 1.2515/1.2500 and then at 1.2430. To prevent a more significant selloff, bulls must fiercely defend this technical floor; any lapse could trigger a rapid market decline towards 1.2305.

GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Using TradingView

Curious to uncover the connection between FX retail positioning and USD/CAD’s price action dynamics? Check out our sentiment guide for key findings. Download it now!

| Change in | Longs | Shorts | OI |

| Daily | -1% | 13% | 8% |

| Weekly | -10% | 13% | 5% |

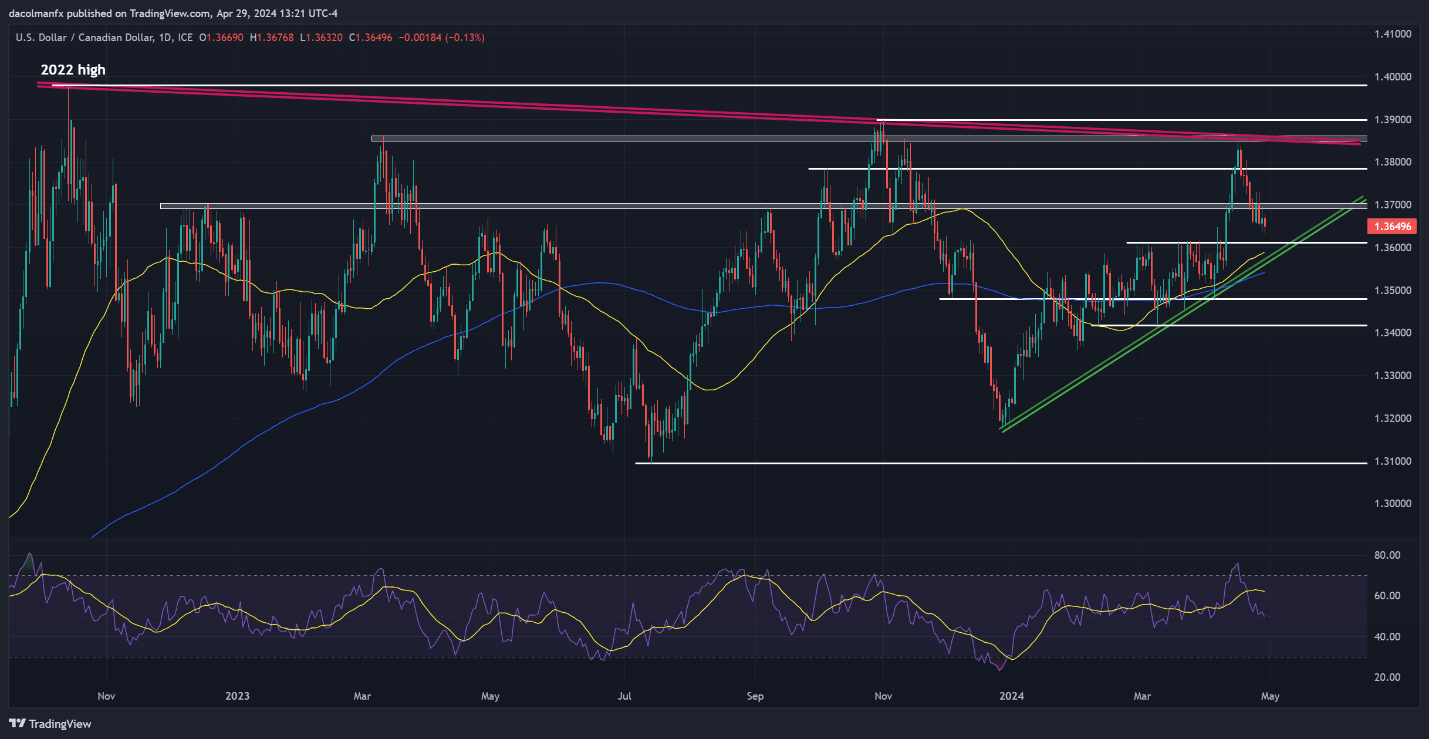

USD/CAD FORECAST – TECHNICAL ANALYSIS

USD/CAD fell modestly on Monday, extending its recent decline that began about two weeks ago, with price currently approaching a key floor near 1.3610. It’s crucial for this technical region to hold; a break below could lead to a drop towards trendline support at 1.3580/1.3570. Further losses would then expose the 200-day simple moving average around 1.3540.

Conversely, if bulls regain control and drive the exchange rate higher over the coming days, initial resistance awaits at 1.3785, followed by 1.3860. Buyers may face difficulty pushing the market beyond this point. However, in the event of a bullish breakout, we can’t rule out a retest of the psychological 1.3900 mark in the near term.

USD/CAD PRICE ACTION CHART

USD/CAD Chart Created Using TradingView

Read the full article here