Investing.com — The European steel industry faces a unique situation. Traditional steel prices have declined due to market pressures, while “green steel” produced through environmentally friendly methods commands a premium.

This trend flags the growing importance of sustainability in industrial production and the willingness of certain market segments to pay more for environmentally responsible products.

In 2024, steel prices across Europe have seen a downward trajectory. As per analysts at BofA Securities, several factors have contributed to this decline.

Key sectors such as construction and automotive, which are major consumers of steel, have been experiencing subdued demand.

“A weak construction sector combined with lacklustre economic activity in virtually all key customer sectors for strip steel and section products kept demand at a low level,” the analysts said.

The decline in traditional steel prices in Europe during 2024 has been driven by several interrelated factors. Economic slowdowns, rising interest rates, and ongoing geopolitical uncertainties have collectively dampened overall demand for steel.

Additionally, the European market has faced an influx of steel imports from regions with lower production costs, which has intensified competition and exerted further downward pressure on prices.

Broader economic challenges, including inflation and the tightening of monetary policies by central banks, have also reduced industrial activity, further lowering steel demand.

Consequently, these factors have forced traditional steel prices to adjust, reflecting the combined effects of weakened demand and increased supply in the market.

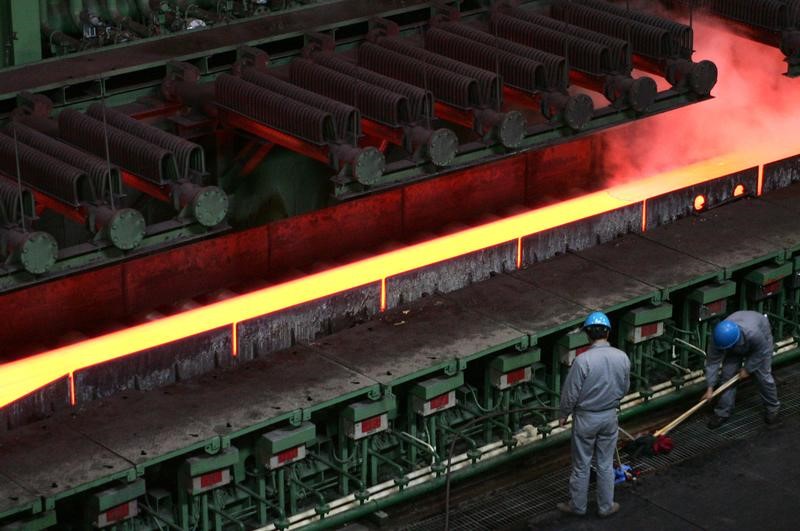

Despite the overall decline in steel prices, an exception has emerged in the form of green steel. Green steel refers to steel that is produced with lower carbon emissions, often through the use of renewable energy sources and advanced production techniques aimed at reducing the environmental impact.

BofA Securities analysts, there is a growing segment of consumers and companies that are prioritizing sustainability in their procurement practices. These entities are willing to pay a premium for green steel due to its reduced environmental footprint.

“Remarkably, while steel fundamentals have been challenged globally in recent months, a two-tier market has developed, with European consumers willing to pay a €100-300/t premium for green steel,” the analysts said.

This demand is particularly strong in Europe, where regulatory pressures and consumer preferences are increasingly aligned towards decarbonization.

The production of green steel is more expensive compared to traditional methods. This is due to the use of cleaner energy sources, the need for new technologies, and the overall shift towards more sustainable practices.

H2 Green Steel, another key player in the market, has reported selling green steel at a premium of 20-30% over traditional steel prices. This translates to an additional cost of approximately €130-200 per ton based on the average steel prices in 2024.

Overall, the premium for low-carbon hot-rolled coil (HRC) steel is averaging around €120 per ton above the standard steel prices, according to BofA Securities.

The divergent pricing trends between traditional and green steel highlight the evolving dynamics within the steel industry. The premium pricing for green steel signals a clear shift towards sustainability, driven by both regulatory requirements and market demand.

BofA Securities analysts believe that companies that can efficiently produce green steel are likely to benefit from higher margins and a growing customer base. As demand for green steel continues to rise, traditional steel producers may face increased pressure to adapt their production methods or risk losing market share to more sustainable competitors.

This could lead to investments in new technologies and a shift in business models towards greener practices. While the current premium for green steel is substantial, BofA Securities notes that as production becomes more widespread and economies of scale are achieved, the price differential may decrease.

However, in the near term, green steel is expected to remain a premium product with a distinct market position.

Read the full article here