Recent news coverage of corporate sustainability and environmental, social and governance (ESG) initiatives has focused on a handful of sweeping reforms that will have a truly global impact. These include instruments such as the Corporate Sustainability Reporting Directive and the Corporate Sustainability Due Diligence Directive (CSDDD) in Europe, the U.S. Securities Exchange Commission’s (SEC) Climate Related Disclosure Standards and the new, global sustainability reporting standards introduced by the International Sustainability Standards Board. While these are indeed the heavy hitters of sustainability rulemaking, they just scratch the surface when it comes to the sweeping scale, and rapid-fire pace of global and local regulatory developments.

The bigger picture perspective, however, is the key to understanding the significance of the risk businesses face as regulatory pressures grow and – importantly – how much it will cost them to get compliant in the various jurisdictions in which they operate. It also happens to be the type of guidance I routinely offer to chief compliance, risk and sustainability officers in my day job analyzing the potential impacts of these new and pending sustainability and ESG regulations.

Sustainability Regulation By-The-Numbers

To help put those risks in perspective, my team and I recently conducted an analysis tracking the total number of sustainability-related regulatory developments in key jurisdictions globally, including North America, the EU, the Asia-Pacific region, Africa and the Middle East. These regulatory developments include new regulations, regulatory proposals and amendments to existing rules across different categories, including corporate sustainability reporting, ESG topics such as climate change, stakeholder engagement, responsible investment, biodiversity and more.

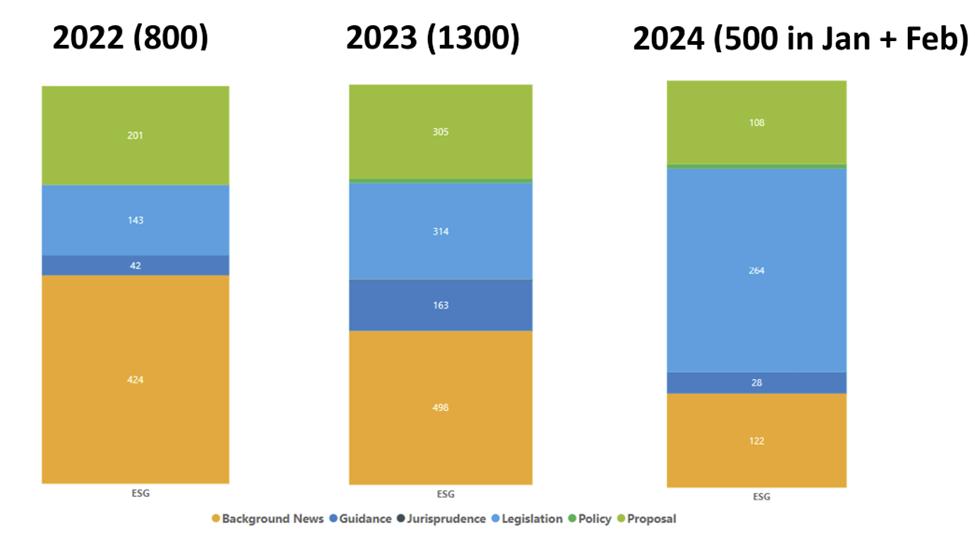

The sheer volume of activity should be enough to give even the most diligent corporate sustainability team pause. For the first two months of 2024 alone, we calculated that there had been 522 new regulatory developments focused on corporate sustainability, globally. That includes the mix of big, global regulations, like the aforementioned CSRD and CSDDD, and more targeted guidance, such as the guidelines recently issued by the Sustainable Stock Exchanges Initiative (SSE) on how to report ESG information to investors. These all come on top of some 1,300 regulatory developments reported in 2023 and 800 regulatory developments in 2022.

Think Global, Act Local

In practical terms, what this means for the businesses at the center of this phenomenon is sustainability regulation is starting to develop a cumulative effect. The guidance and proposals that were introduced in 2022 and 2023 are moving along the maturity curve and becoming laws that are steadily being updated, amended, tweaked and refined as they are implemented in each different jurisdiction around the world. As any multinational sustainability chief will tell you, they are contending with several hundred new sustainability and ESG-related regulatory updates in various states of finalization in almost every single country (and in some cases individual states) in which they operate, at any given moment in time.

Digging deeper into the data, we find that these regulatory developments are focused on dozens of different aspects of sustainability compliance, from mandatory reporting requirements to new standards for determining responsible investment to new rules focused on employee wellbeing, gender equality, human rights in supply chains, non-discrimination and a wide range of ESG topics.

Way More Than Environmental Risk

The widespread collection of incredibly specialized and detailed requirements addressing all aspects of corporate sustainability is important to note here. There is a tendency in a lot of discussions relating to sustainability, to focus on environmental and specifically climate change issues, but areas such as human rights and worker safety also play a big part in the current regulatory mix, both in companies’ own operations, but more problematically, across global supply chains. To get a handle on all of these ESG areas, sustainability teams are going to need to involve multidisciplinary experts with the domain knowledge and the jurisdictional knowledge, to drill down into the details of all aspects of a very wide set of regulatory changes.

This is an important perspective for investors to consider when reading about new laws being passed or new regulatory proposals being introduced. Every individual action by a local jurisdiction to introduce a new impactful reporting requirement or implement a new supply chain due diligence process, is part of a global collection of constantly changing mandates for which businesses must interpret, adapt and comply accordingly. While there is a great deal of overlap between these regulatory developments, corporate compliance processes will become more mature over time.

However, at this stage, the initial push to get up to speed and put in place the people and systems needed to comply, will introduce significant financial and administrative challenges for most companies. Making the investment in time and resources now will reap dividends in the long run as both regulators and customers will be willing to give them some leeway at this stage. That same understanding just simply won’t be there in a year or two.

Read the full article here