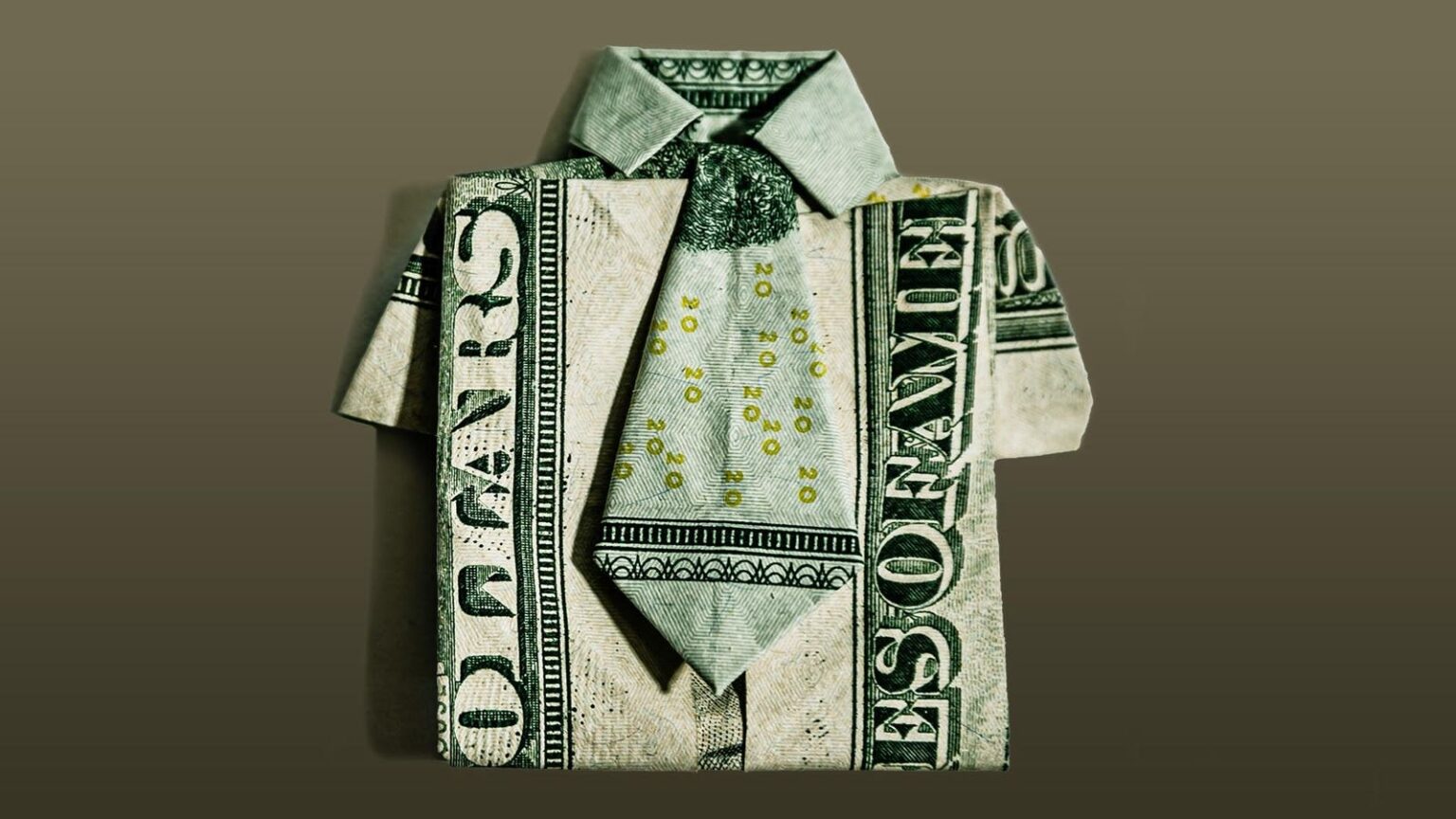

The U.S. was known as the “cleanest dirty shirt” during the financial crisis, the one place you could safely put your money if you had to put it somewhere. Now it is being called exceptional.

A funny thing happened on the way to the U.S. recession of 2024: the irrepressible American economy refused to play along.

At the start of the year, investors around the world were looking for as many as six quarter-point interest rate cuts from the Federal Reserve to protect economic growth and fight inflation. But inflation has stayed stubbornly above the central bank’s 2% target and the economy keeps growing despite an overnight interest rate target range of 5.25-5.5%, the most among the Group of Seven industrial countries.

By early February those six rate cuts had become three, and on Wednesday, Fed Chair Jerome Powell gave the world the idea that there might not be any. In the circumspect language of a central banker, he said, “We do not expect that it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2%. So far this year, the data have not given us that greater confidence.”

The central bank did throw the market a bone in the form of slowing sales of bonds from its own portfolio more sharply than had been expected, and Powell said he did not think inflation was so strong that the Fed is likely to want to raise rates. Treasury bond prices rose, a sign of relief that the interest-rate news was not worse, and stocks and the dollar held firm.

In the normal course of events, you could expect a tight monetary policy to curb economic growth and put a lid on stock gains. But Wall Street keeps rising and the dollar remains strong and investors keep financing Washington’s budget deficits. At the heart of this apparent conundrum is the idea that there is something special about the United States and its economy, an old idea that has been gaining popularity for more than a decade.

“The exceptional performance of the U.S. economy, both in absolute terms and relative to other countries, reflects the powerful combination of existing attributes and steps taken to invest in the engine of tomorrow’s growth,” says Mohamed El-Erian, chief economic advisor to the Munich-based insurer Allianz as well as president of Queens’ College at Cambridge University.

Opening Up A Lead

Five-year dollar-adjusted performances of major stock-market indexes in percent.

In 2010, just off the depths of the Great Financial Crisis, El-Erian was co-chief executive officer of Pacific Investment Management, a subsidiary of Allianz. In a television interview that year he began referring to the U.S. as the “cleanest dirty shirt” among major economies, and the description was echoed by Bill Gross, his co-CIO at Pimco. At the time, America remained insulated from economic turmoil in Greece that was souring the outlook for its partners in the European Union, its financial markets benefiting from a flight to perceived quality.

People still use the phrase to compare the U.S. to its industrialized peers, but as the dollar and Wall Street have soared in recent months, it has been rebranded as American exceptionalism. That idea, which has been kicking around in politics since before the Revolution, is that the United States is unique among nations, based on factors that include its size, history, culture and geography. More recently, it is being used to explain world-leading results for U.S. stocks and the resilience of the American economy in the years since the financial crisis. The concept that America is more than a bolt-hole during times of stress is gaining notice. Consider these recent headlines:

American exceptionalism is real—in the stock market –Fortune, February 3

Why the US economy is doing so much better than the rest of the world –CNN, January 26

Tech-led U.S. ‘exceptionalism’ underlined –Reuters, February 15

Since the trough of the financial crisis, U.S. equities handily surpassed major rivals, rising at an annual rate of 16% over the 14 years through 2023, according to research from Goldman Sachs

Goldman Sachs

With the economy still expanding, the Fed can afford to concentrate on its fight against inflation. Consumer prices are rising at an annual rate of more than 3% and almost 4% when volatile food and energy prices are stripped out. The Fed’s favored inflation metric, based on personal consumption expenditures, is closer to the central bank’s 2% target—2.7% overall and 2.8% on a core basis—but the recent data can be misleading because the index surged by 16.6% from the end of 2019 through 2023.

Many investors seemed to have been looking past those sharp price hikes at the start of this year, when they believed U.S. central bankers would cut their overnight interest rate target to a range of 3.75-4%.

One clear advantage that the United States has is that its workers are more productive than those of any other major economy. At an estimated $85,373 of output per person, according to the International Monetary Fund, the U.S. is only surpassed by five countries: four offshore finance centers and oil-producing Norway. The next member of the Group of Seven industrialized nations on the list is Canada, at $54,866. Additionally, America has by far the largest economy (more than $28 trillion of annual gross domestic product) and stock and bond markets (worth about $90 trillion combined).

Those gargantuan numbers translate to the ability to finance research and development in cutting-edge technologies like artificial intelligence (AI) and an ability to overcome disasters, while extensive natural resources limit reliance on overseas suppliers.

El-Erian counts “the intrinsic agility of the economy, its entrepreneurial underpinning and vast resources” as existing strong points that have been joined by “legislative steps taken to support and unleash innovations being pursued by U.S. companies in key areas such as generative AI, life sciences and green energy.”

Washington’s approach to managing its domestic economy can differ markedly from those of other major industrial countries. In a recent research report, a team of Barclays fixed-income analysts led by Themistoklis Fiotakis in London identified a series of iconoclastic policies that are behind the U.S. outperformance:

• Limiting exposure to international trade and thus avoiding a deceleration of worldwide economic growth. Other countries have counted on globalization to stimulate demand.

• Maintaining high returns on invested capital, in part because of efficiency arising from technological advances enabled by American companies but also via tax policies that encourage reinvestment in the U.S.

• Stimulating growth by increasing government spending in times of economic weakness, a counter-cyclical approach not taken by other developed countries.

• Energy policies that encouraged fracking and other methods to expand production, allowing the country to become a petroleum exporter. Besides supporting the trade balance, there is a secondary benefit: oil and gas are priced in dollars, adding to relative strength in the greenback instead of sapping it when energy prices rise.

These trends are not guaranteed to last forever, and the United States is not without its problems. The country has lost triple-A ratings at Standard & Poor’s and Fitch and is being considered for a downgrade at Moody’s because of issues like polarized politics and the national debt load, which reflects years of deficit spending.

“There may be a time when the U.S. overstimulates its economy,” the Barclays analysts wrote, broadening the country’s trade deficit to a harmful degree. Europe could begin to adopt some U.S. policies and close a gap that economists polled by Bloomberg expect to keep American output growing significantly faster than that of the Eurozone through at least 2026. In addition, China may recover from what the Barclays analysts consider a cyclical low.

“But for now,” they added, “there is a sense that reinvesting in the U.S. domestic market has been a winning strategy–to the degree that it has benefited the dollar and U.S. asset returns.”

The resilient American economy lends strength to the dollar, which in turn allows the United States to borrow in its own currency even as it has been racking up debt. While this may be one reason why the perceived inflation hedges gold and bitcoin have touched record highs this year, it has not dented the greenback against other currencies. The Intercontinental Exchange’s ICE U.S. Dollar Index is at about 106, a smidgen above the level at which it opened the century, data from YCharts shows.

The strengthening U.S. economic outlook has, by contrast, put special pressure on the yen. Japan uses borrowed money to invest in stocks and foreign bonds and its currency has fallen to a three-decade low against the greenback as the outlook for Fed interest-rate cuts recedes.

LEADER OF THE PACK

Despite a wall of domestic and political worries the U.S. economy still reigns supreme among large developed nations.

“The exceptionalism story protects the dollar from the downside,” says Kit Juckes, chief foreign-exchange strategist at Societe Generale. That helps keep it in favor with central banks of other countries for use in international transactions and also is why many commodities are priced in dollars.

“One of the things about being the world’s reserve currency is you have more room to maneuver,” says Juckes. “The U.S. has privileges granted to it.”

In practical terms this means that investors will finance American budget deficits for the foreseeable future, with little to fear from depreciation in the foreign-exchange market. The U.S. pays more to borrow money than other industrialized nations, but the premium is not outrageous: 10-year Treasuries yield about 4.6%, above the German level of 2.6% but similar to Britain’s 4.4%.

The U.S. debt burden has grown in the last decade, to more than $34 trillion from less than $18 trillion 10 years ago, but so has the economy. The International Monetary Fund estimates the ratio of gross U.S. debt to gross domestic product will be 127% this year. That’s third-highest in the Group of Seven industrial countries, behind Japan at 255% and Italy at 139%, while Canada, France and the U.K. all have gross debt loads that are about equal to their annual economic output. Germany is substantially less profligate at 64%. Still, the U.S. ratio is not entirely unreasonable, and the expenditures that are boosting the debt have had positive ramifications, especially since the Covid-19 outbreak.

“There is economic growth being achieved through this spending,” says Juckes. “The U.S. has succeeded in getting genuine growth during this period, whereas the rest of us haven’t.”

The phrase “cleanest dirty shirt “ echoes the lyrics of the song “Sunday Mornin’ Comin’ Down,” a 1970 hit for Johnny Cash that recounts a protagonist’s hangover:

Well, I woke up Sunday morning

With no way to hold my head that didn’t hurt

And the beer I had for breakfast wasn’t bad

So I had one more for dessert

Then I fumbled through my closet for my clothes

And found my cleanest dirty shirt

And I shaved my face and combed my hair

And stumbled down the stairs to meet the day

When El-Erian rolled it out in reference to the United States during a Bloomberg television interview in April 2010, he credited the saying to his colleague Paul McCulley, then Pimco’s chief economist. McCulley tells Forbes by email that he devised it “in response to Bill Gross’ constant questioning (badgering) about whether America’s putative fiscal irresponsibility threatened the dollar’s reserve currency status.

“And yes, I was fully aware that I was ‘borrowing’ the phrase from Kris Kristofferson, who penned that Johnny Cash hit,” says McCulley. “I’m a huge fan of Kristofferson, as well as Jackson Browne, two of the finest poets of our generation. “

MORE FROM FORBES

Read the full article here