Bing Guan / Bloomberg via Getty Images

Key Takeaways

-

U.S. equities were mixed at midday following a report showing weekly jobless claims were more than anticipated ahead of tomorrow’s release of the September employment report.

-

Sinking wine and spirits sales slowed revenue growth at Constellation Brands.

-

Another jump in crude prices because of Middle East turmoil again lifted shares of companies in the oil patch.

U.S. equities were mixed at midday as a report on initial jobless claims came in higher than expected one day ahead of the release of the September employment report. The Dow Jones Industrial Average was lower, the Nasdaq was higher, and the S&P 500 little changed.

Constellation Brands (STZ) shares dropped as the alcoholic beverage maker reported a drop in wine and spirits sales and cut its guidance on lower demand for those drinks.

Shares of Tesla (TSLA) declined following news the electric vehicle (EV) maker had recalled more than 27,000 of its Cybertrucks because of a problem with the rearview camera.

Stellantis (STLA) shares sank as the carmaker’s U.S. unit saw a big decline in sales, and the stock was downgraded by Barclays.

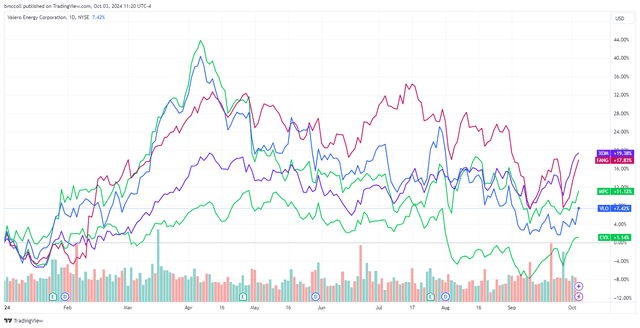

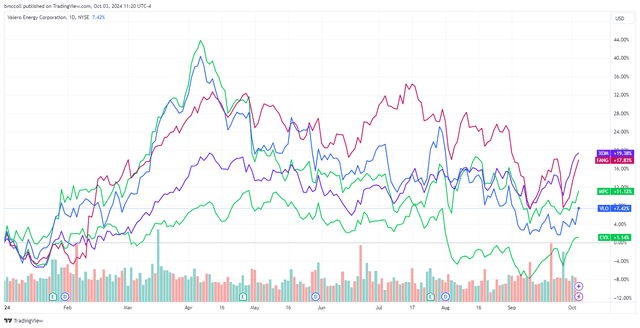

Shares of Valero (VLO), Diamondback Energy (FANG), and others in the oil industry gained as crude prices continued to rise on concerns about a possible escalation of fighting in the Middle East.

EVgo (EVGO) shares soared as the EV charging station provider received a $1 billion government loan guarantee.

Southwest Airlines (LUV) shares advanced when billionaire board member Rakesh Gangwal bought more than $100 million worth of the carrier’s stock.

Gold prices were little changed. The yield on the 10-year Treasury was up. The U.S. dollar gained on the euro, pound, and yen. Most major cryptocurrencies traded down.

Read the original article on Investopedia.

Read the full article here