(Bloomberg) — The Bank of Korea cut its benchmark interest rate after local property markets showed signs of cooling and inflationary pressure eased sharply, allowing authorities to finally shift their focus to supporting economic activity.

Most Read from Bloomberg

The central bank lowered its seven-day repurchase rate by a quarter-percentage-point to 3.25% in a decision predicted by 20 of 22 economists surveyed by Bloomberg. The other two expected the bank to maintain the rate at 3.5% to help rein in home prices that risk spurring more household debt.

The bank cited a “clear trend of stabilization” in inflation, a slowing in the growth of household debt and an easing of currency risks as factors behind its decision, according to a statement. While the BOK said it was slightly moderating its restrictive stance it removed a reference to keeping policy restrictive in its concluding remarks. The bank said it would judge the pace of further rate cuts by assessing prices, economic growth and financial stability.

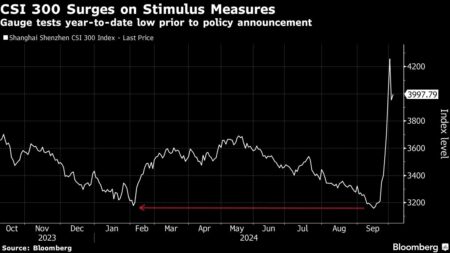

With its policy pivot the BOK joins a growing wave of central banks changing course to embark on easing cycles in a bid to revive economic momentum now that inflationary pressure has cooled. The Federal Reserve last month cut its key rate by a half-percentage point as ensuring a soft landing for the economy took precedence over its inflation battle.

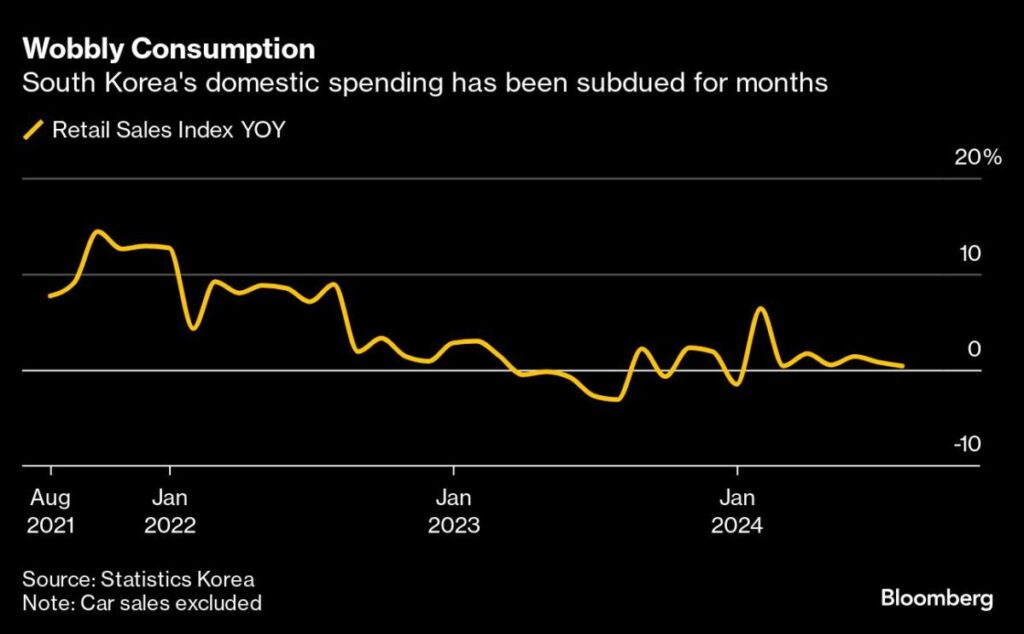

“The rate cut not only responds to the consumption that’s been lackluster, but also shows the BOK can afford to loosen a bit given the pressure pushing the inflation rate back above 2% appears limited,” said Ahn Yea-ha, analyst at Kiwoom Securities Co. Ahn still forecasts a gradual easing with the BOK holding the rate in November.

Until Friday, the BOK had held the rate at a restrictive 3.5% for more than a year and a half. Policymakers extended the holding pattern in recent months on concerns that any early signals of a pivot might further fuel a rebound in the housing market and threaten financial stability.

The rate cut reflects concerns over stagnant private spending and credit risks related to the construction industry. With most borrowers on floating rates, interest expenses have exerted a drag on consumption, prompting some lawmakers to call for the central bank to cut rates.

“Given the prevailing negative sentiment and the Fed’s sizable cut, the market expects faster rate cuts by the BOK to support economic growth and momentum,” Standard Chartered Bank economists Chong Hoon Park and Nicholas Chia said in a note before the decision. “Still, we think negative sentiment on Korea’s economy is overblown, and the BOK is likely to stay cautious on cutting the base rate aggressively as it weighs the risks to financial stability.”

What Bloomberg Economics Says…

“With rising home prices in Seoul and growing debt remaining a key concern, we expect this easing cycle to proceed only gradually. Our baseline view is the BOK will hold rates at its November meeting, then resume cuts in the first quarter of 2025.”

— Hyosung Kwon, economist

For the full report, click here

The government has sought to rein in housing markets with a pledge to increase home supplies and by rolling out stronger regulations on mortgage loans, moves that may have reassured the central bank that the market would cool. One BOK board member cited those measures in the lead-up to Friday’s decision.

“Monetary easing on a measured pace could also help engineer a soft landing of property markets in a close coordination with financial regulators,” Goldman Sachs analysts Goohoon Kwon and Andrew Tilton said in a note. With moderating export growth and other potential headwinds to the economy, the BOK will likely conduct a quarter-point cut each quarter until the rate reaches 2.5% by the third quarter of next year, they projected.

Governor Rhee Chang-yong will hold a press conference later Friday to address questions over the future trajectory of rate policy. In addition to disclosing how many board members dissented from the latest decision, the governor is likely to outline expectations among board members for rates over the next three months.

Factors that will help strengthen speculation over another cut include lukewarm spending by consumers, credit risks that undermined investment in the construction industry and geopolitical uncertainties such as US-China trade tensions and the ongoing conflict in the Middle East.

South Korea’s gross domestic product shrank unexpectedly in the second quarter after a stronger-than-expected expansion at the start of 2024. Declines in investment weighed on economic activity with elevated borrowing costs and uncertain consumption outlooks hurting sentiment. Still, policymakers have downplayed the slip in growth largely as temporary.

The South Korean won’s rally against the dollar since mid-August may have given authorities confidence that the currency can withstand the impact of a rate cut. Even with the gains, the won remains among Asia’s worst-performing currencies this year.

(Adds details from statement)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here