After reviewing my analysis on a conversation I had with a financial professional in 2013, I decided to take another close look at my finances. To my surprise, I uncovered a huge gap between my perceived risk tolerance and the reality of my portfolio.

Since leaving work in 2012, I’ve generally seen myself as a moderate-to-conservative investor. Without a steady paycheck, along with having a stay-at-home spouse and two young kids, I thought it prudent to be more conservative.

But after a thorough review of my largest tax-advantaged retirement account—my rollover IRA—I’ve come to realize I’ve been deluding myself for close to a decade. I am, in fact, an aggressive risk-taker, maybe even a risk addict!

I suspect your true investment risk profile is not what you think either. You’re either more conservative or more aggressive an investor than you realize.

A More Aggressive Investment Risk Profile Than I Thought

Here’s the breakdown of my rollover IRA. After leaving work in 2012, I wanted to invest in individual stocks in my 401(k), especially tech stocks, given my faith in the tech sector’s growth while living in San Francisco.

If you consider yourself a moderate-to-conservative investor, would you allocate 99.88% of your retirement portfolio to stocks? Probably not. 100% of the 36.55% I hold in ETFs is invested in equity-focused funds like VTI, QQQ, and IWM. At age 47, even with a steady paycheck, a more typical allocation might lean toward a balanced 60/40 split between stocks and bonds.

Likewise, a moderate-to-conservative investor probably wouldn’t put 63.33% of their portfolio into individual stocks. But I’ve concentrated a substantial portion in large tech names like Apple, Google, and Netflix, with additional weightings in Tesla, Microsoft, Amazon, and Meta.

It’s widely recognized that most active investors underperform compared to passive index strategies, yet my portfolio leans heavily into these individual positions out of faith and stubbornness.

Stomaching Higher Volatility

No moderate-to-conservative investor would likely allocate 68% of their retirement portfolio to tech stocks, with the remainder in the S&P 500. The volatility of such a portfolio is intense. But I’ve been a proponent of growth stocks over dividend stocks since the beginning of Financial Samurai, and I like to do what I say.

If I were a financial advisor managing this portfolio for a client in my demographic, I might have been fired long ago—this allocation could easily have given my client a series of mini-heart attacks over the years.

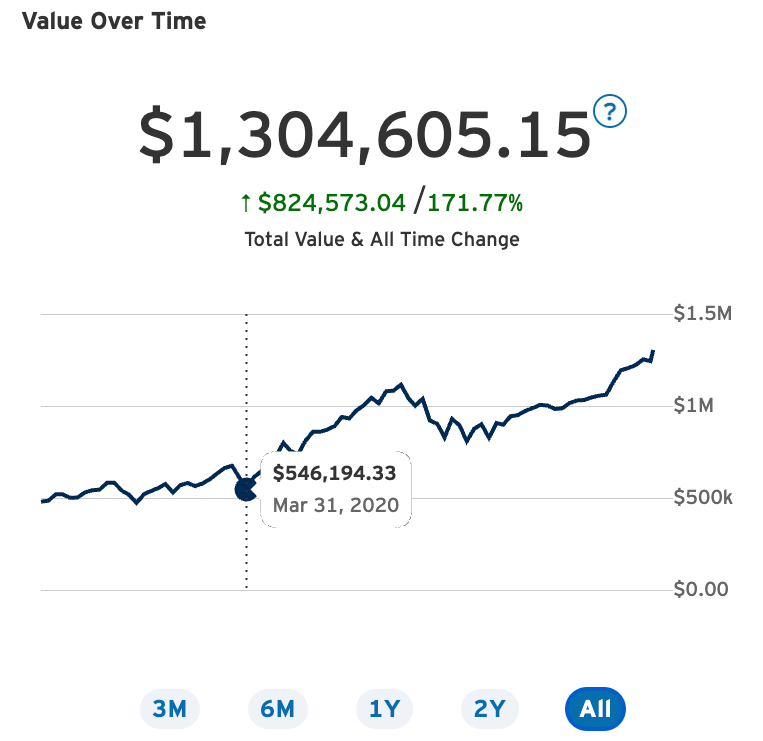

Take the start of 2020, for example. From January 31 to March 31, the portfolio fell from $675,000 to $546,000, an almost 20% decline. Around mid-March 2020, amidst the fear, I published a post titled How To Predict The Stock Market Like Nostradamus, urging readers to hold steady and buy more. However, since this is a rollover IRA, I couldn’t add more funds to capitalize on the downturn, so money went into my taxable portfolios.

Then, between December 31, 2021, and June 30, 2022, the portfolio saw another steep drop, declining from $1,115,000 to $828,000—a 26% loss. As the dollar amount of losses grew, I began questioning the relentless effort to grind at work.

As I review my investment-related articles written during tough times, I notice many are crafted to provide psychological support—for both my readers and myself—to help us persevere through the lows. These pieces encourage staying the course in the hope of brighter days ahead.

Your Investor Mind is Playing Tricks on You

You are probably not as risky or conservative as you think. This financial blind spot can remain hidden for years, even decades, without an honest conversation with a trusted advisor or financial professional.

My parents and friends don’t have a full picture of how I invest our entire net worth; only my wife does. Even so, she doesn’t know our net worth allocation in precise detail. Like many couples, she leaves the investing to me and focuses on all the other tasks in our family.

Unfortunately, as your net worth grows more complex, so does the work required to manage it. This is why plenty of high net worth individuals offload their investment duties to someone else.

Why Your Investments May Not Align With Your Risk Tolerance

Let’s review five reasons why your investment portfolio may be misaligned with your risk tolerance.

1) Asset Drift Over Time

Without regular financial checkups, your asset allocation is likely to shift over time. But your mind tends to anchor to the initial asset allocation for far too long.

For instance, back in 2012, over 80% of my rollover IRA was in an index fund. Yet, due to tech stocks’ outperformance, that percentage has now dropped to 36.55%. Looking back at a couple of investment posts, I wrote how I have about 70% of my investments in index funds because I didn’t properly estimate the shift.

2) Misremembering What You Own Or What You’ve Done

Unless managing finances is your day job, you might forget what you invested in or sold. Over time, you may even misremember how much you actually made or lost. Revisionist history is a powerful coping mechanism to help deal with bad losses so you can continue investing. How often do you think you have X amount in one position, only to find it’s different? It happens all the time.

3) Becoming More Emotional During Downturns

It’s easy to feel like a winner when markets are strong. But when they dip, emotions can flare, leading you to panic. Instead of seeing downturns as natural, there’s a tendency to extrapolate losses until it feels like you could lose everything.

Only after experiencing significant losses in at least two bear markets will you truly understand your risk tolerance. It’s all too easy to overestimate how much risk you’re comfortable with.

4) Being Overly Optimistic About the Future

If you’re like me, you like to look on the bright side in sub-optimal situations. But this optimism can lead to a more aggressive asset allocation than your financial reality can bear.

You might be tempted to think, “If Sam is willing to go 99.88% in equities in his retirement portfolio, why shouldn’t I?” But here’s the simple reason: you’re not me. I would never take investment advice without on a whim.

I treat my rollover IRA, 401(k), SEP IRA, and Solo 401(k) as “funny money” because they can’t be touched until 60. While I maximize contributions, my focus has been building a sizable after-tax portfolio for financial independence. It is the taxable investments that generates useable passive income to help fund our lifestyle.

More info that may explain why you shouldn’t invest like me:

- Growing Up Surrounded by Poverty: Growing up in Zambia and Malaysia in the late 70s and 80s, and later experiencing poverty in India left a profound impact on me. Seeing what life is like with little, I began to view financial gains as bonuses. With this perspective, I often treat money as if it’s not entirely real, making me more willing to risk it.

- A Tragic Lesson in Mortality: At 13, I lost a 15-year-old friend in a car accident. This loss made me feel as if every year I live beyond 15 is a bonus. With that perspective, I’ve felt compelled to go for it with almost every investment opportunity or otherwise.

- Constant Lottery Winnings: As a Gen Xer, I clearly remember life before the Internet. Never in my wildest dreams did I imagine being able to earn online income. As a result, almost all online income feels like house’s money, which mostly gets reinvested.

5) Being Overly Pessimistic About the Future

On the flip side, some people have a permanently pessimistic outlook on the future. Instead of evaluating situations objectively, they perceive a crisis around every corner—often rooted in past experiences or even childhood traumas.

With this deep-seated pessimism, they may hold onto too much cash for too long for security reasons. Even when road traffic levels signal strong economic activity, they’ll consider it a fleeting illusion and shy away from purchasing a home. And even if the S&P 500 is up 25%, they’ll believe a bear market is imminent.

While the pessimists will occasionally be right, over time, cash holders and short sellers are likely to underperform those who continue dollar-cost averaging through market cycles.

Know Your True Investing Risk Tolerance

Looking over my portfolio, it’s clear I’m an aggressive investor. I accept higher risks with the understanding that downturns will hit me like a boulder rolling down hill. But over time, I’ve come to accept these larger losses as part of the price of investing. Besides, I suffer from investing FOMO, the hardest type of FOMO to come if you have a finance background.

It’s not just about aggressive equity allocations; my approach to real estate investing may be even more aggressive. From taking out a $1.2 million mortgage at 28 in late 2004 (on top of a $464,000 mortgage in 2003) to a $1.6 million mortgage in mid-2020 amidst the pandemic, I’ve aggressively invested in almost every real estate opportunity that looked attract.

Selling some equities in 2023 to buy a new home in cash was my way of rebalancing risk. In hindsight, though, I should have leveraged even more, given how stocks continued to rise!

If you haven’t reviewed your investments thoroughly in the past year, chances are you’re not investing as conservatively or as aggressively as you believe. Do a deep dive this weekend or get a second opinion. I think you’ll be surprised by what you uncover given the massive move in stocks since 2022.

Taking On More Risk With Private AI Companies

Today, I find myself taking on more risk by investing in artificial intelligence companies. I’m optimistic about AI’s potential to boost work productivity. For example, I no longer need to expend my father or wife’s time to review my posts several times a week.

Yet, I’m also concerned about the impact AI will have on job opportunities for our children. In every neighborhood I move to, I see 20- and 30-somethings living with their parents because they struggle to find well-paying jobs. AI will only make securing good employment even harder in the future.

Given my lack of direct involvement in the AI field, investing in AI companies through an open-ended venture fund is the logical move. Much of my rollover IRA is invested in the same tech companies that passed on me in 2012 when I was applying for jobs to meet my unemployment benefit requirements. Now, I’m taking the same approach with AI.

If I can’t get hired by an AI company, then I’ll invest in them and let their employees work for me! Here’s to buying the next dip—for our financial futures and our children’s.

Investors, how well does your current portfolio reflect your risk tolerance? Do you think there’s a disconnect between how risk-loving or risk-averse you are and your actual investments? If your investments don’t align with your risk tolerance, what’s behind the inconsistency? And will you course-correct to better match your goals, or let your current strategy ride?

A Way To Invest In Private Growth Companies

Check out the Fundrise venture capital product, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what the product is holding before deciding to invest and how much.

I’ve invested $150,000 in Fundrise Venture so far and Fundrise is a long-time sponsor of Financial Samurai.

Get A Free Financial Consultation & $100 Gift Card

If you have over $250,000 in investable assets, schedule a free consultation with an Empower financial professional here. Complete your two video consultations before November 30, 2024, and you’ll receive a free $100 Visa gift card. There is no obligation to use their services after.

With a new president, it’s a good idea to get a financial checkup to see if you are properly positioned. Small adjustments today can mean significant financial differences in the future.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more. Uncover Your Investment Risk Profile is a Financial Samurai original post. All rights reserved.

Read the full article here