- Goldman Sachs reported a 46% annual increase in debt-capital-markets revenue last quarter.

- The return of DCM activity signals that borrowers are gearing up for corporate dealmaking to return.

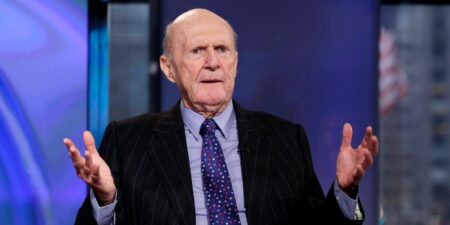

- Goldman’s global head of financing broke down the trends in an interview with BI.

On Wall Street, corporate borrowing is on a roll.

As the industry rides the postelection wave of a win by Donald Trump and barrels toward a 2025 that appears poised for more deal flow, that trend is only expected to continue. Corporate borrowers raised over $50 billion in debt capital since Trump’s presidential victory last week, per LSEG — marking the busiest week since September and up from just $2 billion raised the week leading up to the election.

On the front lines of this surge at one of Wall Street’s most renowned institutions is Vivek Bantwal, a 25-year veteran of Goldman Sachs who leads the bank’s debt-capital-markets division as global head of the financing group. He led the DCM team to a 46% revenue increase for the 12 months that ended in September.

“Our strategy of staying close to clients paid off because, as clients started to get more aggressive, refinancing their maturities, we stayed close to them,” Bantwal told Business Insider in an interview. “We’ve benefited in terms of, we’ve been fortunate to help them with that refinancing activity.”

In the generation he’s spent at the bank, Bantwal has held roles ranging from running the Americas credit finance group and leading the bank’s structured finance business to at one point serving as chief operating officer of the firm’s trading division. Bantwal attended University of Pennsylvania’s Wharton School, graduating in 1999 before his first job as an analyst at Goldman that same year. He was named to the partnership in 2012 and has led the global financing group since 2021.

Bantwal told BI about his team’s approach, what he’s seeing in the debt market, and the factors that buoyed the group to their revenue bump. He explained why he’s confident that a pick-up in the merger market is coming — which whets borrowers’ appetites for “acquisition finance” — and explained how Goldman is positioning itself to grow its market share.

Underwriters steal the show

Though M&A and IPO dealmakers often get the most attention, debt bankers have been the stars of Wall Street this year. As BI previously reported, a top Wall Street compensation consulting firm issued a report last week predicting debt underwriters would see the biggest gains of up to 35% in their bonus compensation for 2024.

The debt-capital-markets group helps Goldman’s clients issue, structure, and manage debt. Many of those clients are large companies or organizations being advised by Goldman’s investment bankers, which means the DCM business is directly reliant on deal flow.

When a banker at Goldman Sachs is advising a client on acquiring a company, for example, the DCM group might come in to help that company obtain the liquidity it needs to do the transaction, including by selling bonds to investors.

DCM is a very important business for Wall Street, representing $3.5 trillion in total US deals this year, compared with $1.3 trillion in M&A and $223 billion in equity raises, according to deals data tracker Dealogic.

Goldman CEO David Solomon ran Goldman’s leveraged finance group before taking over its financing business, including debt and equity capital markets and derivatives.

Goldman projects the return of mergers in 2025

To some extent, Bantwal said, his team’s big upswing has been a rebound in the market since a nadir of activity in 2022 and 2023.

“There’s an element of catch-up volume there, because you had a period where volumes were quiet for two years,” he added, suggesting that the past few months have marked a return to historic levels. “Some of this is catch-up volume.”

Some — but not all. The momentum DCM is experiencing now — a reflection of the 20% bump in dealmaking fees Goldman saw in the third quarter of this year — suggests companies are ready to do deals. The bank is anticipating more going into 2025.

“We are seeing increased client demand for committed acquisition financing, which we expect to continue on the back of increasing M&A activity,” Denis Coleman, Goldman’s chief financial officer, said during the company’s third-quarter earnings call in October.

DCM at Goldman is divided by industry groups, broadly mirroring the coverage groups within the investment bank. The DCM team also works closely with other divisions within the bank to support clients needs — like leveraged buyouts, or “LBOs.” These are deals by financial sponsors mostly funded from debt — not equity or cash — which is repaid later following the acquisition.

“If you look at LBO activity, if you look at acquisition-finance activity, which are big components of the debt capital markets, those have been improving — but still kind of relatively quiet” compared to historical averages, he said. “As M&A dialogue is starting to pick up, we expect to see more acquisition-financing activity” which Bantwal expects to buoy the group even if demand for refinancings dies down.

Bantwal also pointed to the Fed’s efforts to lower interest rates, which has given borrowers more confidence to take out loans.

“Even though there’s some debate about how many rate cuts and where will interest rates end up,” he said, “the fact that there’s no longer talk of rate hikes is a positive catalyst,” he added. “Now that there’s a broad expectation of a soft landing and people weren’t as worried about a recession, that helped,” Bantwal continued.

Cross-training specialists

A strategy that’s augmented Goldman’s coverage, Bantwal said, has been “cross-training” specialists on his team to understand how both investment-grade capital markets (the traditional business of raising money by selling debt for Blue Chip companies) and fixed-income derivatives (contracts to hedge against risk) work.

“Twenty years ago, the equivalent would have just been a derivative specialist who would help clients think through risk management, and would have had a counterpart that would focus on traditional investment-grade capital raising,” explained Bantwal. “Now we’ve trained people who can do both.”

Another helpful strategy, Bantwal said, is that the bank brought its leveraged and structured finance businesses under the same roof in 2016.

“The benefit of having those two businesses under one umbrella,” he said, “is they can serve clients very holistically on a product-agnostic basis.”

Read the full article here