Investing.com– Most Asian stocks traded in a flat-to-low range on Wednesday as a rebound in Chinese markets paused for breath, while comments from some Federal Reserve officials sparked questions over the timing of potential U.S. interest rate cuts.

Regional markets took middling cues from a largely flat overnight close on Wall Street, after Minneapolis Fed President Neel Kashkari said that the central bank could potentially keep interest rates unchanged for the rest of the year, undermining expectations of rate cuts.

U.S. stock index futures moved little in Asian trade.

Asian markets had marked a strong start to the week after weaker-than-expected nonfarm payrolls data fueled expectations of a September rate cut. But these bets were tempered by cautious statements from Fed officials over the past two days.

Chinese markets pause after rallying to over 6-mth highs

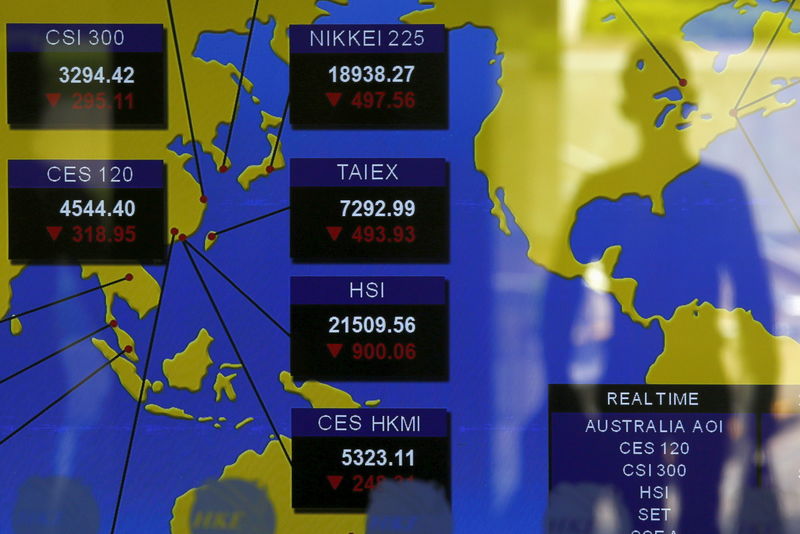

China’s and indexes fell 0.4% and 0.3%, respectively, retreating slightly from six-month highs after a stellar rebound rally over the past few months.

Optimism over improving economic conditions in China- amid persistent stimulus measures and easing restrictions on investment- had driven the recent stock rally. Bargain buying also factored into these gains, after Chinese stock benchmarks hit over five-year lows in late-January.

Focus remained on more economic signals from Asia’s biggest economy, with for April due on Thursday.

Hong Kong’s was an outlier, rising 0.5% to an eight-month high on gains in technology and real estate stocks.

Japan’s Nikkei 225 sinks amid yen uncertainty; Toyota awaited

The index was among the worst performers in Asia, falling 1.3% from a recent three-week high as recent volatility in the , stemming from government intervention, spurred caution towards Japanese markets.

The government had seemingly intervened in currency markets last week to pull the yen up from 34-year lows. But the yen was then seen moving back towards these lows in recent sessions.

This kept traders on guard over any more intervention, especially as Japanese officials also offered up verbal warnings on speculating against the currency.

A stronger yen weighs on Japanese exporters, and also dissuades foreign capital flows into local markets.

Japan’s broader fell 1.1%. Focus was also on annual earnings from automaking giant Toyota Motor (NYSE:) Corp (TYO:), whose shares fell 1.6%.

Broader Asian markets moved in a flat-to-low range. Australia’s steadied near a one-month high after less hawkish signals from the Reserve Bank sparked a strong rally on Tuesday.

South Korea’s was flat, while futures for India’s index pointed to a muted open after the index fell steadily from record highs in recent sessions.

Read the full article here