Investing.com– Most Asian stocks fell on Thursday as technology shares tracked weakness in their U.S. peers following underwhelming guidance from chipmaking major Micron.

Chinese stocks saw extended losses as weak industrial profits data further soured sentiment towards the country, while traders awaited more developments in a potential trade war with the West.

Regional markets took middling cues from Wall Street, which ended a smidge higher in choppy trade. But U.S. stock index futures sank on Thursday as middling revenue guidance from the Micron Technology Inc (NASDAQ:) saw investors dump chipmaking stocks.

Anticipation of key U.S. cues- from data and the Presidential debate- also kept sentiment skittish.

Asian tech, chipmakers sink as Micron underwhelms

Tech-heavy Asian bourses were among the worst regional performers on Thursday. Japan’s shed 1.2%, while South Korea’s lost 0.5%.

A mix of tech weakness and China jitters saw Hong Kong’s index slide 1.7%.

While Micron’s quarterly earnings beat expectations, its revenue guidance for the current quarter disappointed investors hoping for more, especially given that the stock was sitting on an over 100% valuation spike since last year. Micron sank nearly 8% in after-hours trade.

The underwhelming guidance sparked some doubts over an artificial intelligence-driven boom in demand, and also drove investors into collecting some recent profits in tech stocks.

Chinese stocks dip on weak industrial profit data

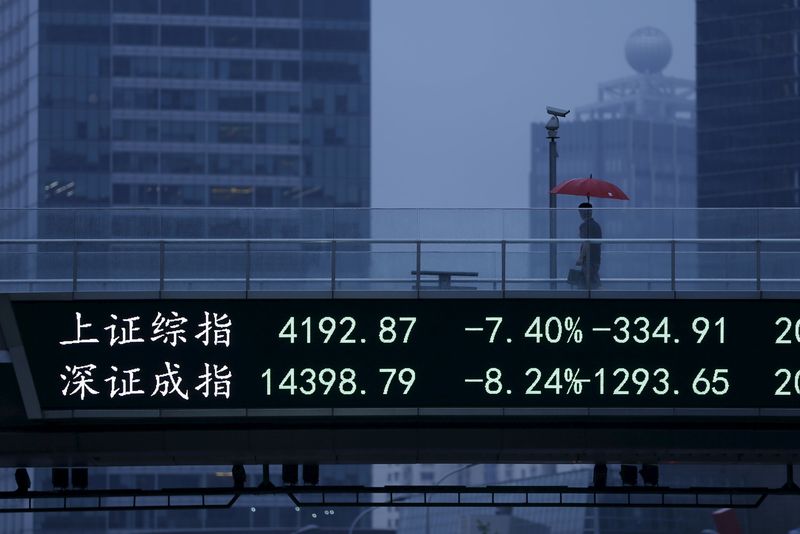

China’s and indexes fell 0.7% and 0.9%, respectively, as data showed growth in the country’s narrowed in May.

The reading ramped up concerns that economic growth in Asia’s biggest economy was slowing, and that Beijing will have to roll out more stimulus measures in the coming months to bolster growth.

The Chinese Communist Party is set to hold its Third Plenum- a key meeting of high-level officials- in July, where it is likely to unveil more economic support.

But sentiment towards China already remained weak in the face of a potential trade war with the West, after the European Union joined the U.S. in imposing import duties on Chinese electric vehicles.

Broader Asian markets were largely negative. Australia’s slid 1%, extending steep losses from the prior session after a hotter-than-expected inflation reading ramped up concerns over a potential interest rate hike by the Reserve Bank.

Futures for India’s index pointed to a muted open, with the index expected to pause for some breath after clocking a series of record highs this week.

Read the full article here