Investing.com– Asian stocks rose on Thursday, tracking overnight gains on Wall Street as a swathe of weak economic readings saw investors ramp up bets that the Federal Reserve will cut interest rates by September.

Japanese stocks were the standout performers in recent sessions, recouping most of their losses seen through the second quarter and coming back in sight of record highs.

Regional markets tracked overnight strength in Wall Street, where the and the hit record highs in holiday-shortened trade, after weak and pushed up bets on a 25 basis point cut in September.

But the of the Fed’s June meeting somewhat tempered this optimism, with U.S. stock index futures moving sideways in Asian trade. Anticipation of key data on Friday also kept sentiment cautious.

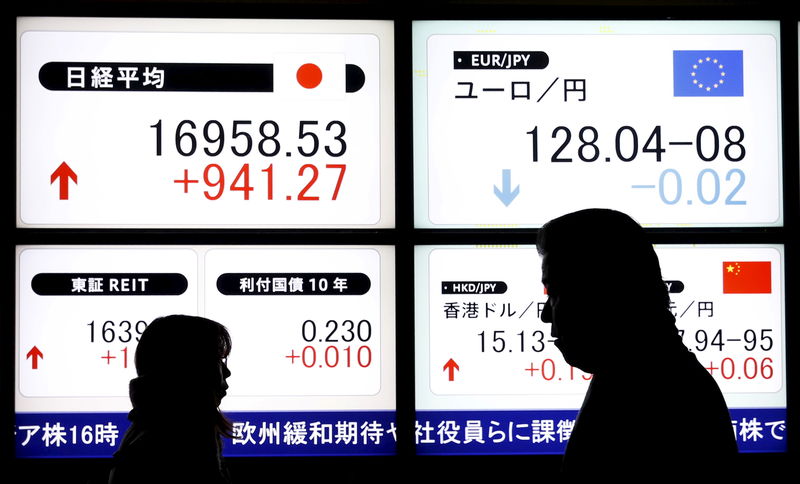

Japan’s Nikkei, TOPIX test record highs

Japan’s and indexes rose 0.2% and 0.5%, respectively, on Thursday.

The Nikkei had breached the 40,000 level for the first time since April earlier this week, and was close to record highs hit during the first quarter.

The broader TOPIX briefly hit a record high of 2,890.47 points.

Japanese markets shot up over the past week as a swathe of weak economic readings weighed on the yen and pushed up bets that the Bank of Japan will have limited headroom to tighten policy.

Investors largely looked past potential headwinds to company earnings from softening Japanese economic growth. Earlier this week, the government downgraded first-quarter gross domestic product data to show a much deeper contraction in growth than initially seen.

Gains in Japanese markets were also driven by technology stocks, which tracked a rally in their U.S. peers on hype over artificial intelligence.

Asian stocks buoyed by Sept rate cut bets

Broader Asian markets advanced amid growing conviction that the Fed will begin cutting interest rates in September. The showed traders pricing in a nearly 66% chance for a 25 basis point cut, up from prior estimations of a 59.5% chance yesterday.

South Korea’s rose 0.7%, while Australia’s surged 1.1%. Data from Australia showed the country’s fell more than expected in May.

Futures for India’s index pointed to a positive open, as the Nifty and the scaled record highs this week.

China lags as economic jitters persist

China’s and indexes lagged their peers, falling slightly as concerns over a slowing economic recovery remained in play. Losses in mainland stocks pulled Hong Kong’s index down slightly.

Sentiment towards China showed little signs of improving, after private purchasing managers index data showed weaker-than-expected growth in the .

A slowdown in stimulus measures from Beijing also sparked doubts over how much more supportive measures the government has in store.

Focus is now on the Third Plenum of the Chinese Communist Party- a meeting of top-level officials that is expected to provide more cues on the Chinese economy.

Read the full article here