In the last presidential election, Wall Street donors turned out for Joe Biden, contributing more than $74 million to his 2020 campaign, per the Center for Responsive Politics data.

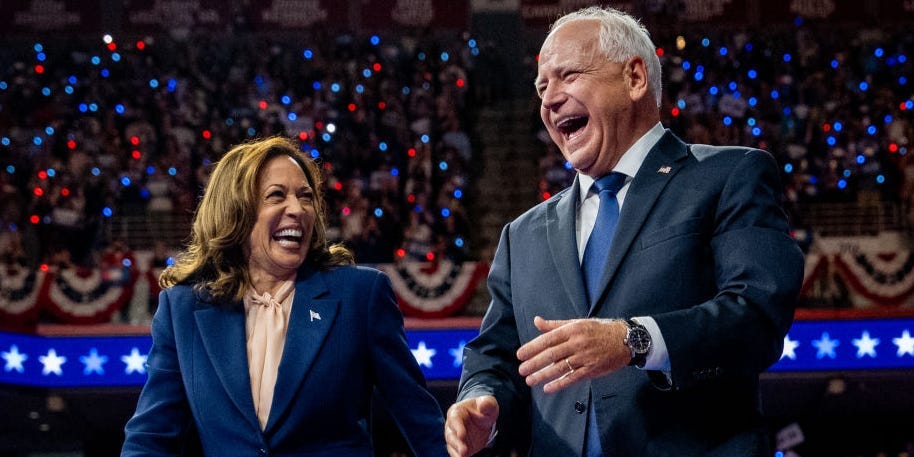

This time around, Democrat-leaning bankers have their hands tied due to Vice President Kamala Harris’ choice of running mate, Minnesota Gov. Tim Walz. Financial services firms risk the wrath of the Securities and Exchange Commission if their employees make campaign contributions to state or local officials such as Walz. Donating to the campaign would violate the regulator’s “pay-to-play” rule, which keeps firms from trying to sway politicians for favors such as managing their state’s pension fund.

To heed this rule, Citigroup told US employees on August 6 that they must seek pre-approval to donate to the Harris-Walz campaign, according to a memo seen by Business Insider. These restrictions apply to employees who belong to all but one of its five business units, including investment banking and wealth management. The US consumer banking division is exempt.

Citi employees are not required to get pre-approval to donate to former President Donald Trump’s campaign unless they are designated as a “Municipal Finance Professional” or “Covered Associate” or are part of a “public-sector facing business.” Those employees are also required to get permission to donate to the Harris-Walz campaign.

The SEC’s “pay to play” rule, adopted in 2010, also applies to Citi’s peers, such as JPMorgan, Wells Fargo, and Bank of America, which did not respond to a request for comment in time for publication. It is unclear whether those banks are asking employees for pre-approvals or banning contributions.

Citi implemented a similar policy in 2016 when Trump selected then-governor of Indiana Mike Pence as his running mate.

The policies may seem harsh, but even small donations can incur steep penalties. In 2017, Pershing Square paid a $75,000 fine four years after a then-analyst donated $500 to a candidate for governor of Massachusetts. The state’s pension plan was an investor in Pershing Square at the time. Pershing was unaware of the donation, a spokesperson said at the time, and the analyst was able to get his money back.

The SEC bars banks from getting paid for government advisory services for two years after donations to a state or local official. This applies to donations over $350 made by employees before they joined the bank. JPMorgan agreed to advise a Tallahassee, Florida pension fund for two years for free after hiring an employee who had previously donated to a mayoral campaign.

“To sort of single out one campaign over the other, whatever the reason is — and there’s regulation in place there — it looks very political,” Professor Patricia Crouse told Business Insider.

Crouse, who teaches political science at the University of New Haven, said these policies inevitably discourage employees.

“You want to be able to support your candidates,” she said. “And if you can’t do that, I think it makes you feel left out.”

It is possible to sidestep the “pay to play” rule by donating to PACs or Super PACs that aren’t directly tied to the relevant candidate.

In 2022, then-SEC Commissioner Hester Peirce criticized the pay-to-play rule after the SEC fined four investment advisors for one-time, small donations, calling it an “exceedingly blunt instrument.”

“The Pay-to-Play Rule, although well-intentioned, imposes unique, unquantifiable costs on individuals by impeding their ability to participate in the political process.” she wrote in a statement. “A government agency’s probe into the motives of a person exercising her right to participate in the political process is not comfortable for anyone involved and can itself become political.”

Read the full article here