Contrary to popular belief, the Federal Reserve does not exert complete control over mortgage rates. Instead, it influences them, with the bond market determining the subsequent course of action. The Federal Reserve oversees the Fed Funds rate, which represents the overnight lending rate for banks and stands at the shortest end of the yield curve.

When the short end of the yield curve experiences an increase, it affects rates for longer durations. For example, if money market funds offer a 5% return and are easily accessible, investors would demand even higher interest rates for longer-dated Treasury bonds to justify locking up their money. It is the bond market that ultimately assesses whether the Federal Reserve’s interest rate decisions are justified, leading to various yield curve scenarios.

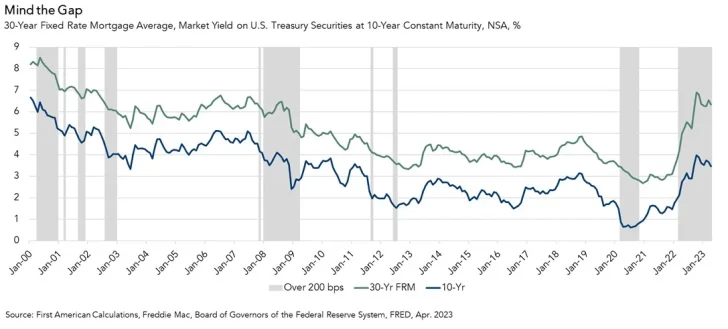

Ultimately, mortgage rates closely follow the 10-year Treasury bond yield rather than the Fed Funds rate.

Amid global anticipation for the Federal Reserve to finally cut rates, let’s dissect the factors influencing mortgage rate fluctuations. Understanding these components will help manage expectations regarding how much a cut in the Fed Funds rate might impact mortgage rates. In turn, this knowledge will help you make better real estate investment decisions.

Components That Affect Mortgage Rates

In the first quarter of 2022, the Federal Reserve commenced a series of interest rate hikes in response to inflation, which reached its peak at 9.1% in mid-2022. Following 11 rate hikes, mortgage rates also experienced a significant uptick.

Below, we analyze the factors contributing to this rise, which saw mortgage rates temporarily spike from 3% to 8%. Out of the 5% increase in mortgage rates:

- 2.5%, or half of the movement, stemmed from adjustments in Federal Reserve policy rates.

- 0.8%, or 16% of the increase, was attributed to the expansion of the Term premium.

- 0.8%, also constituting 16% of the movement, was driven by prepayment risk.

- 0.4%, equivalent to 8%, resulted from changes in the Option-Adjusted-Spread (OAS), measuring the yield difference between a bond with an embedded option (such as an MBS or callables) and Treasury yields.

- 0.3%, representing 6% of the rise, was due to lender fees.

- Another 0.3%, also accounting for 6% of the increase, was influenced by inflation.

The figures provided are estimates by Aziz Sunderji from Home Economics, derived after analyzing data from the Fed, Barclays, and Freddie Mac. While it’s impossible to pinpoint the exact percentage weightings for the factors influencing the mortgage rate movement, these estimates are considered sufficiently accurate.

How Much Will Mortgage Rates Decline Once The Fed Starts Cutting Rates?

The primary aim of this analysis is to forecast the potential decline in mortgage rates if the Federal Reserve begins cutting rates by the end of 2024 or in 2025.

According to the analysis, every 25 basis points (0.25%) cut in the Fed’s rates is anticipated to reduce mortgage rates by approximately 12.5 basis points (0.125%). If the Fed implements four consecutive 25 basis points cuts, resulting in a total 1% reduction in the Fed Funds rate, mortgage rates are likely to decrease by 0.5%.

Furthermore, mortgage rates could potentially decline even further than this 1:1/2 ratio if other contributing factors also decrease. These factors might include lower inflation expectations, heightened competition, and increased confidence in the economy’s resilience.

Related: 30-Year Fixed versus An Adjustable Rate Mortgage

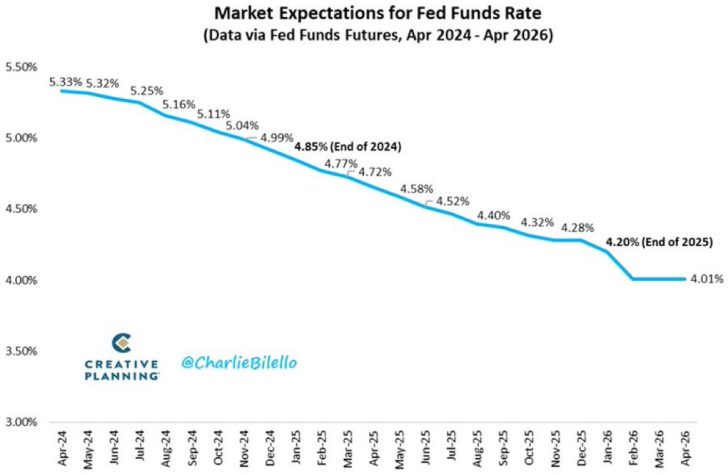

Latest Expectations For The Fed Funds Rate

The latest market expectations for Fed Funds Rates through April 2026 indicate a delay in anticipated rate cuts following higher-than-expected inflation data in the first quarter of 2024.

However, if the Fed adjusts rates based on this revised outlook, it’s projected that mortgage rates could decrease by 25 basis points (0.25%) by the end of 2024 and by 65 basis points (0.65%) by the end of 2025.

Despite these reductions being somewhat modest compared to previous expectations, the robust state of the economy suggests that mortgage rates may remain elevated for an extended period.

The Mortgage-Treasury Spread Could Narrow

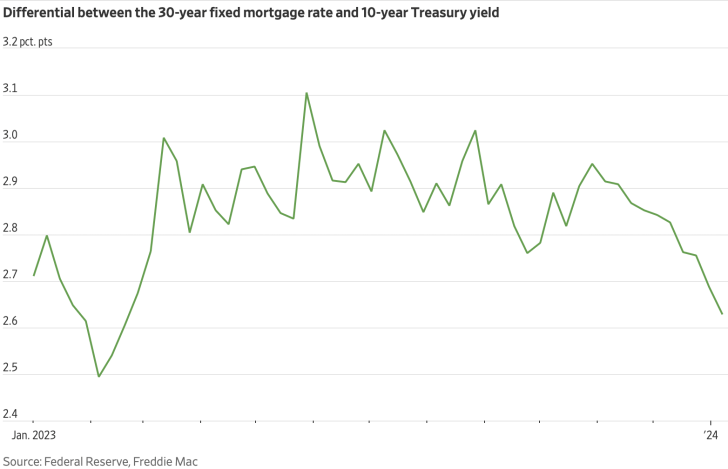

Another factor that could potentially drive mortgage rates lower is the mean reversion of the spread between the average 30-year mortgage rate and the 10-year Treasury rate. This is referred to as the Mortgage-Treasury Spread as shown in the yellow components of the first chart above.

Since the conclusion of the Great Recession, the 30-year fixed mortgage rate has typically remained 1.7 percentage points (170 basis points) higher than the 10-year Treasury bond yield, on average.

However, the Mortgage-Treasury Spread widened to over 3 percentage points (300 basis points) in 2023. Part of the reason is due to more volatility and economic uncertainty, which requires banks to earn a higher return.

In 2024, we’ve seen a decline in the Mortgage-Treasury Spread to around 270 basis points as banks are lowering their lending fees and offering more competitive mortgage rates given a lower chance of a hard landing. That said, the spread is still about 1% higher than its historical average.

Why Mortgage Rates Likely Can’t Go Much Higher

Considering the robustness of the U.S. economy, there is a possibility for both the Fed Funds rate and mortgage rates to rise. However, this scenario appears unlikely given the current stage of the economic cycle.

Several factors contribute to this assessment: inflation has already peaked, the S&P 500 is trading at more than 20 times forward earnings, the risk-free rate exceeds inflation by at least 1%, and the level of U.S. government debt is becoming increasingly burdensome.

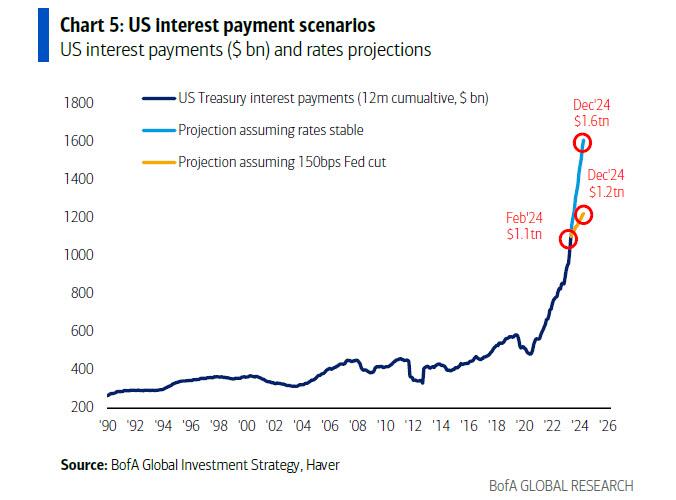

An examination of the U.S. interest payment scenario reveals a significant burden. Without any rate cuts by the end of 2024, the annual interest payment on U.S. Treasury debt could soar to $1.6 trillion. This staggering figure underscores the importance of carefully managing interest rates to mitigate the impact on government finances.

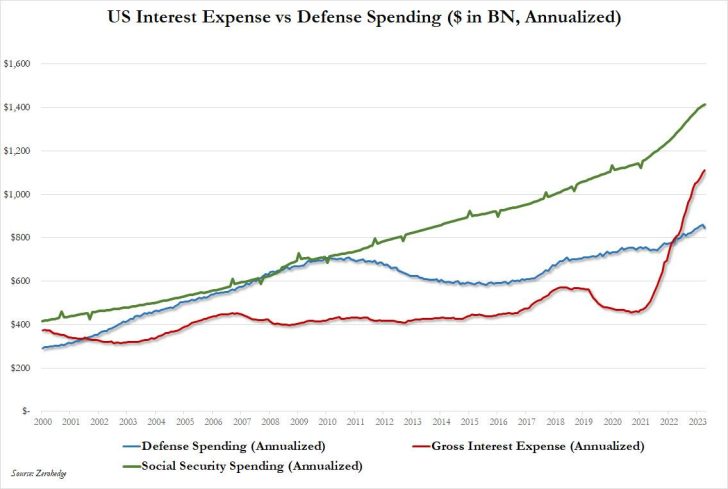

How does $1.6 trillion compare to other U.S. government liabilities?

Let’s consider one measure: U.S. interest expense versus defense spending and Social Security spending. Gross interest expense has already exceeded defense spending and is on track to surpass Social Security spending.

This situation highlights a challenging dilemma for the government. The Federal Reserve cannot afford to raise interest rates further without risking the economic collapse of our country.

Tame Your Expectations About Mortgage Rate Declines

If you’re eagerly anticipating a decline in mortgage rates due to imminent Fed rate cuts, temper your expectations. Not only will the Fed’s influence on mortgage rates be limited to about 50%, but it’s also likely to take a couple of years or even longer for the Fed to reduce rates to levels that feel more accommodating for borrowers.

Given the significant pent-up demand for real estate resulting from high mortgage rates since 2022, the Fed cannot enact rapid cuts. Doing so could trigger a surge in demand, further driving up home prices.

Consequently, you must consider how long you’re willing to delay your plans before purchasing your dream home. The longer mortgage rates stay high, the bigger the pent-up demand given life goes on, e.g. marriage, children, job relocation, divorce, etc.

Personally, as a middle-aged individual, I was unwilling to put my life on hold. With my children aged three and six at the time of my home purchase in October 2023, I wanted to move forward with life as soon as possible. I recognized that once they reach adulthood, I won’t have as much time to spend with them.

Now that you better understand the components that affect mortgage rates, hopefully, you’ll make a more rational home purchasing decision. In terms of where interest rates will go long term, I believe interest rates will eventually revert to its 40-year trend of down.

Reader Questions And Suggestions

Were you aware that the Fed is only partially responsible for the rise and fall of mortgage rates? Do you think the Mortgage-Treasury Spread will revert to its long-term mean of 1.7 percentage points? What other components affect mortgage rates?

If you’re looking for a mortgage, check online at Credible. Credible has a network of lenders who will compete for your business. Get no-obligation personalized prequalified rates in one place.

To invest in real estate without all the hassle, check out Fundrise. Fundrise offers funds that mainly invest in residential and industrial properties in the Sunbelt, where valuations are lower and yields are higher. The firm manages over $3.5 billion in assets for over 500,000 investors looking to diversify and earn more passive income.

I’ve personally invested $954,000 in private real estate since late 2016 to diversify my holdings, take advantage of demographic shifts toward lower-cost areas of the country, and earn more passive income. We’re in a multi-decade trend of relocating to the Sunbelt region thanks to technology.

Fundrise is a sponsor of Financial Samurai and Financial Samurai is an investor in Fundrise.

Read the full article here