Hundreds of people thronged the Guangzhou office of the e-commerce platform Temu in rallies this month, protesting fines and refund policies they said are destroying small merchants’ profits.

About 80 merchants gathered on Monday on the 30th floor of the Guangzhou office building, with some eventually gaining entry to the company premises, Chinese outlet Yicai reported. Temu is run by PDD Holdings, which also operates the local online retail platform Pinduoduo.

Many of the protesters run small businesses on Temu, a platform that sells Chinese products and has surged in popularity in the West due to lower prices.

Yicai reported that employees were told to stop working after the protesters entered the office but that the merchants left after the police arrived. According to the outlet, they had sought to confront the company’s top executives but couldn’t secure a meeting.

Multiple local outlets reported that a total of about 300 people had arrived in protest, though many were unable to enter the building or get past the lobby.

Videos posted on social media showed crowds gathered outside the building and chanting slogans. One clip showed protesters sitting on the floor of the PDD Holdings office as security blocked a nearby corridor.

Yicai reported that about 100 people staged a similar rally on July 22 with banners and demonstrations outside the headquarters building.

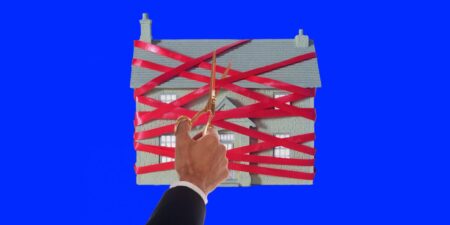

The anger was largely directed at Temu policies that fine merchants if they receive refund requests or complaints.

One merchant told The South China Morning Post that he lost almost all of his profits when he was fined about $410,000 for customer refunds and complaints.

Others have complained to local media that the platform often refunds its customers even if they don’t send back the product — essentially allowing them to keep it for free.

Temu’s policy contains a guide for returning items and says refunds without return are limited.

The China Securities Journal, a Beijing-based outlet run by state agency Xinhua, wrote that merchants had approached the Guangzhou office about 10 times in July over their complaints.

It reported a claim from an anonymous Temu employee, who said many of the protest attendees were not merchants but employees or other people asked to support their cause.

The platform told The China Securities Journal in a statement on Tuesday that it does not make money from fining its merchants.

“If fines are imposed, the proceeds will be given to consumers,” Temu said.

In a statement to Business Insider, Temu acknowledged the protests and said it is “actively working” with the merchants on a solution.

“Recently, a group of merchants gathered at the office of a Temu logistics affiliate in Guangzhou,” the statement said, adding that the group “included about a dozen sellers.”

“They were unhappy with how Temu handled after-sales issues related to the quality and compliance of their products, disputing an amount worth several million yuan,” the statement continued. “These merchants have declined to resolve the disputes through the normal arbitration and legal channels stated in the seller agreements.”

On China’s social media, anger is mounting toward what is being seen as Western shoppers taking advantage of Chinese merchants.

“Foreigners can buy products from Chinese merchants, receive the goods, and not spend any money,” wrote one blogger based in Hebei. “It has essentially moved the zero-dollar purchase practice from the US to here, making Chinese companies provide goods to foreigners for free.”

“Even though we are socialist, with strict supervision for enterprises, there are still many companies that do more capitalistic things than companies in capitalist countries!” another blogger wrote.

The international rise of Temu has been a driving force for PDD Holdings’ success after the pandemic, with Pinduoduo shares rising from lows of $31 in May 2022 to up to $159 in May this year.

The company’s strong postings contrast with those of competing local e-commerce apps, such as Alibaba and JD.com, which have struggled to recover as China exited its zero-COVID posture with a lagging economy.

Read the full article here