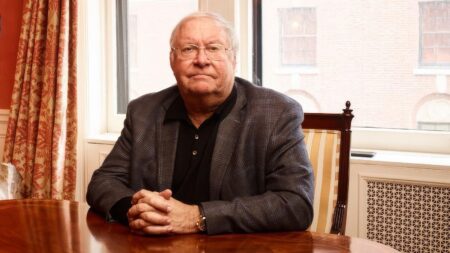

The industry took note last month when Barakett’s Tremblant launched an exchange traded fund, Tremblant Global ETF (TOGA), a concentrated long-only equity portfolio with about 40 positions. According to SEC filings, the ETF is a conversion of Tremblant’s tax efficient private LP fund. The long-only equity fund, which funded in August 2022, posted a gross return of 36.2 percent last year.

Some of the best active money managers in the world run money primarily in the hedge fund format. “Best” means attractive returns that can scale, with persistent outperformance over time (plus superior risk-adjusted profiles for any funds being run in a long/short format.) These top tier hedge fund managers must be superior to charge the premier fees they do for extended time periods, with business and client sustainability over decades.

Starting the past few years, the bulk of fresh money seeking alternatives has shifted from institutional to retail and HNW investors. Yet most individuals have had no economical way to invest in vehicles run by alternatives firms. Platforms developed at banks and RIA platforms to pool individual investments into hedge funds and other alternative investments typically charge 2 percent loads with full management and incentive fees.

So why does TOGA matter? Now any individual with access to a brokerage account can directly buy the NYSE-listed TOGA ETF shares at the current day’s NAV (or about $25 a share on June 12th). Instead of participating in much-higher-cost-with-less-liquidity vehicles based upon qualified purchaser rules (value of investments) or accredited investor rules (minimum annual income and net worth), an individual or entity can simply purchase the ETF shares on the NYSE.

The fees and liquidity are compelling. For example, in TOGA, investors will benefit from the lower total 0.69% management fee and daily liquidity, compared to hedge fund higher fees and longer lock-ups. Taxable investors also receive tax efficiency as they have the ability to defer capital gains. Barakett said, “The ETF wrapper allows for compounding wealth long term and in a tax efficient way, which we believe will be attractive to U.S. taxpayers. I am personally investing significant capital into TOGA, and I am paying the same fees as everyone else.”

Industry sources say there is early investing interest for TOGA from ultra HNW/family offices and the RIA platforms.

Where could this potentially sit in an investment portfolio? I believe in indexing the majority of one’s equity allocation into passive ETF indexes, with a preference for mid-large caps, for low-cost beta equity exposure. Then one can invest a portion of the remaining equity allocation in active equity solutions, such as TOGA—for differentiated higher expected equity returns over time.

According to the Tremblant website, the TOGA ETF was just over $100 million on June 12th, with largest holdings of Grab, TKO, and Spotify. The US and non-US regions currently share an equal split of the regional exposure.

Tremblant Capital, founded by Brett Barakett in 2001, has about $1 billion in assets.

The Financial Times reports other hedge fund managers have launched ETFs over recent years, including Gotham Asset Management, Ionic Capital Management, Chesapeake Capital and Man’s AHL.

Count me in.

Read the full article here