Key takeaways

- The Ink Business Preferred® Credit Card’s welcome offer includes 90,000 bonus points after spending $8,000 in the first 3 months.

- The card’s benefits include 3X points on select purchases, redemption for travel through Chase Ultimate Rewards and employee cards at no extra cost.

- Cardholders can maximize the sign-up bonus by utilizing Chase’s transfer partners, such as Virgin Atlantic Flying Club, for flights to Europe.

When it comes to business credit cards with flexible rewards, it’s hard to beat the value proposition offered by the Ink Business Preferred® Credit Card. This is true for almost any business owner, but business owners who can spend a lot in this card’s bonus categories can do even better. After all, cardholders get the chance to earn 90,000 bonus points after spending $8,000 on purchases in the first three months from account opening.

With such a notable welcome offer, new cardholders may be wondering how to make the most of the Ink Business Preferred’s sign-up bonus. I’ll break down maximizing the Ink Business Preferred below.

Features of the Ink Business Preferred card

There are several reasons to love the Ink Business Preferred. For starters, it offers a reasonable $95 annual fee, and new cardholders can earn 3X points on up to $150,000 spent each year on shipping purchases, internet, cable and phone purchases, select social media advertising and travel purchases (then 1X points). The fact you can redeem your rewards for travel through the Chase Travel portal and get 25 percent more value for your points when you do is also a major plus. So is the fact that you can pool your rewards from other business and personal Chase credit cards into one account.

Other card benefits include trip cancellation/trip interruption insurance, an auto rental collision damage waiver, purchase protection against damage or theft up to $10,000 per claim and $50,000 per account and cell phone protection.

Plus, employee cards come at no extra cost, so you don’t have to worry about an additional fee per card.

These are just some of the reasons why the Ink Business Preferred is one of the best business credit cards and why I use it for nearly all my business purchases throughout the year. If you’re looking for an example of how someone can utilize the bonus offer on this Chase business card, read on to learn about my favorite way to use Chase Ultimate Rewards points.

Maximizing the Ink Business Preferred card’s sign-up bonus

Let’s break down how I maximized the Ink Business Preferred. First, I should note that I actually use a combination of cards known as the Chase trifecta for my personal and business spending. My collection includes the Ink Business Preferred Credit Card, as well as the Chase Freedom Unlimited® and Chase Sapphire Reserve®.

Over the course of any given month, I use these cards to earn more bonus points in each one’s best categories. From there, I typically use my Chase rewards for any number of travel redemptions, including for hotels and excursions or activities through the Chase Ultimate Rewards portal.

Here is how I used my Ink Business Preferred Card’s sign-up bonus points:

- I use my Chase points for 1:1 transfers to Chase airline and hotel partners, which is what I did with the 100,000 bonus points I earned with the Ink Business Preferred.*

- After I earned these 100,000 bonus points, I almost immediately transferred them to the Air France/KLM Flying Blue frequent flyer program, which I frequently use to book inexpensive economy flights to Europe.

- The 100,000 bonus points I earned with this card paid for four one-way flights to Italy, although I did pay the expected airline taxes and fees, as well.

*This number reflects the Ink Business Preferred’s previous sign-up bonus amount.

Another great Chase transfer partner is Virgin Atlantic Flying Club. If you search the Virgin Atlantic website today, it’s easy to find similar redemptions to various locations throughout Europe. In addition to the fact you can find redemptions for as low as 12,000 points per person, one way, I also love that this program is worth 2.6 cents per point, according to Bankrate’s valuations. This means your points can go even further than with other airlines.

Consider this example below, which shows economy standard flights starting at 12,000 miles one-way (plus $185.20) from Chicago (ORD) to Paris (CDG) during the summer of 2025:

EXPAND

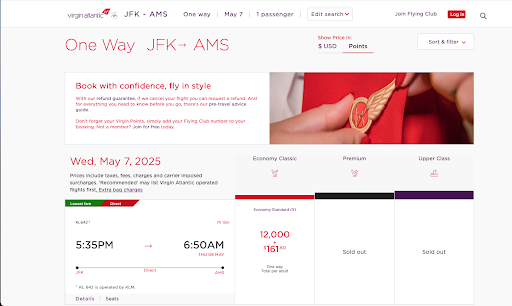

Or, consider a similar redemption from New York City (JFK) to Amsterdam (AMS) next summer for 12,000 miles per person (plus $161.60):

EXPAND

Note that, with these two example flights, the actual cost of these one-way tickets works out to $668 and $817, respectively, if you book with USD instead of points. This represents a redemption value of well over 5 cents per mile.

If you take the time to search for flights at Virgin Atlantic or Air France, you can easily find numerous redemption opportunities just like these, which is why I almost always transfer my Chase points for flights to Europe. However, I also use other transfer partners like United MileagePlus and Southwest Rapid Rewards.

Does Chase’s 5/24 rule apply to the Ink Business Preferred?

One interesting detail to note about the Ink Business Preferred is how Chase treats this card in relation to its infamous 5/24 rule. While personal credit cards all count toward the rule, many business credit cards from Chase don’t count against you when you apply for a new Chase credit card.

You do have to be compliant with the Chase 5/24 rule to be eligible for the Ink Business Preferred, meaning you have to have less than five new cards in the last 24 months to be considered. However, your Ink Business Preferred application won’t count against you when you apply for other Chase credit cards.

The bottom line

If you’re on the hunt for a business credit card for travel that offers a huge sign-up bonus, the Ink Business Preferred should be at the top of your list. Not only is the card’s welcome bonus worth $1,125 in travel booked through Chase Travel, but you can also transfer your points to popular airline and hotel partners at a 1:1 ratio and get an outsized value that way, too.

Other reasons to get this business credit card include its reasonable $95 annual fee, the fact you get free employee cards, the lack of foreign transaction fees and various Ink Business Preferred benefits. Those benefits include trip cancellation and interruption insurance, cellphone protection, primary auto rental coverage when you rent a car for business purposes and extended warranty coverage.

With a huge sign-up bonus, flexible rewards and numerous cardholder perks and features, the Ink Business Preferred Card is certainly worth it.

Read the full article here