A May ABC News-Ipsos poll found that nearly 9 in 10 Americans said that either the economy generally or “inflation, meaning raising prices” was the most important issue in determining their vote for this November.

Russia’s invasion of Ukraine is Europe’s largest conflict since WWII. Illegal border crossings are at their highest level on record. The Supreme Court’s reversal of Roe triggered a major shift in abortion politics. And yes, a former president, Donald Trump, has been found guilty on felony charges. Despite all of that, political strategist James Carville’s axiom “It’s the economy stupid” may still hold.

In a traditional election, Biden wouldn’t be feeling too much pressure. Unemployment remains low. Inflation has cooled, but prices remain high. Wall Street has hit new records. But voters consistently say they aren’t feeling it. One economist coined the term “vibecession” to describe the disconnect between the solid fundamentals and the downright dour outlook.

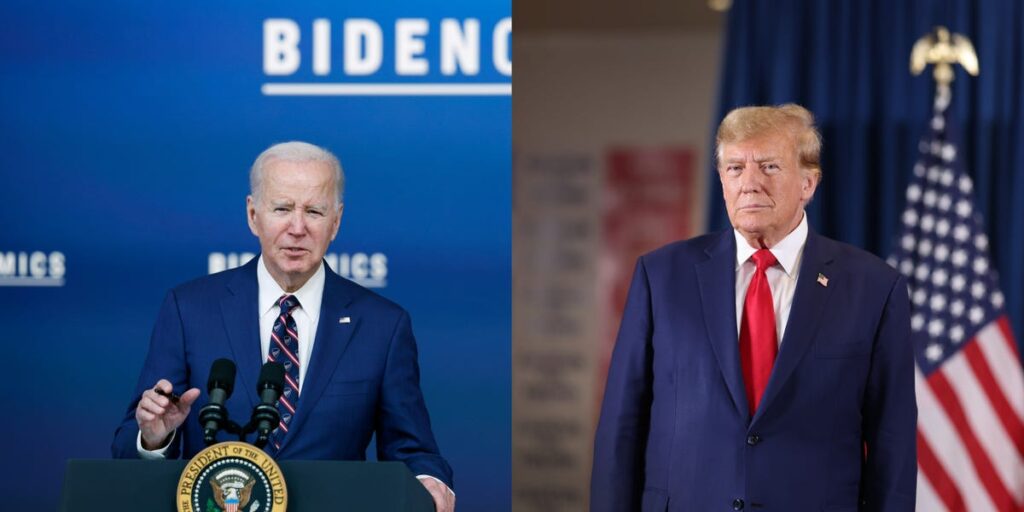

Here’s a look at each candidate’s stance on the issue

Where Joe Biden stands on the economy

Biden is proud of his economic record. Many of the core metrics illustrate there’s reason for him to be. Unemployment has remained under 4% for the longest stretch since the 1960s. More than 15 million jobs have been created since he took office. The US economy is expected to grow at double the rate of its G7 peers, according to the International Monetary Fund. Trump loved touting new Wall Street records; under Biden, the Dow hit over 40,000 for the first time.

Americans aren’t feeling it. Inflation has cooled, but prices on everything from eggs to gas remain high. In 2022, food costs accounted for the highest percentage of household income since the 1990s, according to the Department of Agriculture. Even home repairs are costlier now than ever before.

Biden has pressured companies to cut prices, but the Federal Reserve has far more power to address inflation than presidents. And the central bank typically only cuts rates when faced with the possibility of a recession or the confidence that a rate cut wouldn’t exacerbate inflation. Neither condition exists.

The president has outlined an agenda that could help address some pressures. In his 2023 State of the Union, Biden called on Congress to pass tax credits for middle-class home buyers. He also wants existing homeowners who have held off on buying bigger homes to receive $10,000 if they sell a starter home below the median price in their area.

Biden’s 2025 budget proposal also outlines other potential policies he could pursue if he wins reelection, though he would need Democrats to retake the House. The president proposed hiking the corporate tax rate to 28%; billion-dollar companies would also face a higher corporate minimum tax. Biden also wants a 25% tax on the wealthiest Americans’ unrealized income. Taxing the rich would help cut the deficit by $3 trillion over the next decade, according to the White House’s estimates.

Where Donald Trump stands on the economy

Trump has not yet provided many specifics on what he would do with a second term. Polls show that voters view his presidency much more favorably now. Trump has repeatedly pointed out that inflation was far lower (under 2% on average) during his time in office. Some of the stock market and unemployment records that were set under Trump pre-COVID-19 have been surpassed by Biden.

Economists fear that some of Trump’s ideas could actually make inflation worse.

He wants a crackdown on illegal immigration, which matches the sentiment that the issue has gotten out of control under Biden’s watch. But such actions could worsen labor shortages.

The self-described “Tariff Man” wants to impose a 10% tariff on all imported goods and even higher tariffs on some Chinese products. Trump has falsely argued that foreign countries bear the costs. In actuality, US importers are forced to pay the additional costs, and studies show that sometimes, that is passed on to consumers.

Trump’s allies are also looking at ways to expand on his assault against the Federal Reserve and its chairman Jerome Powell. Trump appointed Powell to lead the central bank, but soured on him. Like all presidents, Trump wanted lower interest rates to juice borrowing. Unlike his recent predecessors, Trump applied significant pressure on the Fed, undermining its prized political independence. The central bank is mandated to keep inflation low, which requires raising the benchmark interest rate. According to The Wall Street Journal, Trump’s allies are considering policies that would give a president greater say over the Fed’s moves.

The former president also wants Congress to renew his signature tax plan that passed without Democrats’ support. Conservatives often argue that tax cuts and deregulation fuel economic growth. At times. of higher inflation, such cuts can actually raise prices. As NPR previously reported, there’s no perfect relationship between cutting taxes and economic growth. Trump has also proposed working with Congress to end the taxation of tips.

Read the full article here