Managing your bills, budgeting, investments, and taxes is a constant practice. Hopefully by the time you reach middle age, you have your money systems in place and stay financially secure throughout your lifetime.

Most people handle their own bills and budgeting but may get professional help with their investments and taxes. Others enjoy doing it all and don’t hire any help. All financial management styles work if you know what you are doing. But most importantly, you need to know when to get help.

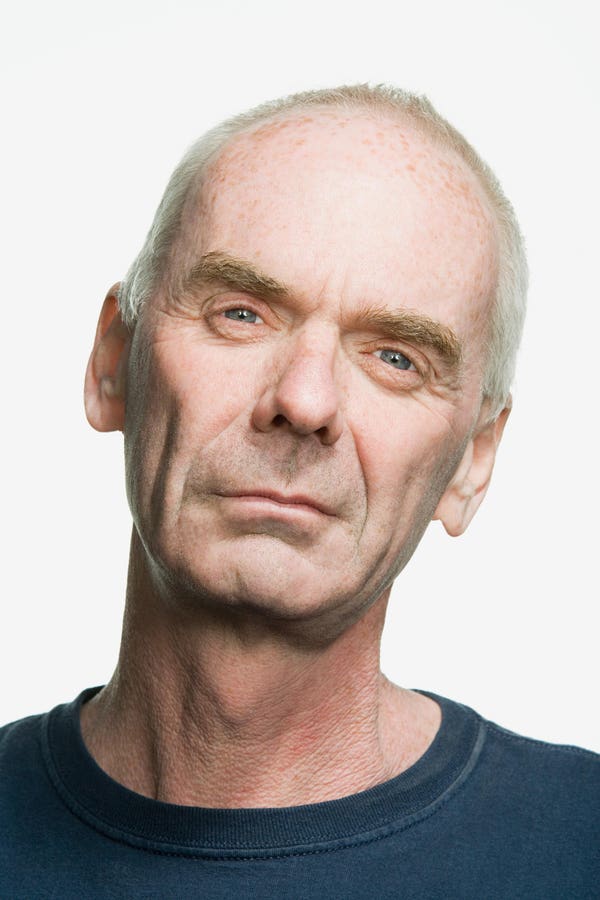

As a financial planner and physician, I’ve seen several disasters in people who don’t plan for the loss of their capacity to manage their finances. How can you prepare for this and maintain your financial autonomy as long as possible?

There are three main categories of how people approach their finances as they age:

· Those who let someone else handle the finances

· Those who manage most aspects of their finances but seek help for more complicated matters

· Those who do everything and don’t rely on anyone for help or advice

Each personality has benefits and pitfalls. Where do you fall in these categories and what steps should you take to mitigate the chance of financial mismanagement as you age?

Those who let someone else handle the finances

This situation occurs most often in marriages. One spouse enjoys handling the money and the other spouse is perfectly happy with that arrangement. The benefit is easy – the non-financial spouse doesn’t have to spend any precious time managing the finances.

The pitfalls are potentially huge. If the financial spouse is unhappy in the marriage, they may siphon off assets before they announce their intention of leaving. Also, the non-financial spouse won’t have the skillset to take over if they are divorced or if the spouse dies.

It isn’t right or wrong to let someone else take over the finances. However, the non-financial spouse should always understand the family’s financial situation and have a contingency plan in the event of their spouse leaves or dies. They should understand the big picture of the budget, how to log into accounts and pay the bills, and how their money is invested. I recommend a “financial audit” twice a year where the couple sits down and reviews finances together.

It is also smart to have a financial planner in the background ready to step in and help. This is easy if the financial spouse is willing to do that, but some do-it-yourselfers don’t like sharing any information or paying anyone else for advice.

Those who manage most aspects of their finances but seek help for more complicated matters

This is much of the population. People are fine handling their bills and understanding their budget. Most people learn to save money to their retirement plans and they may get basic help to determine how to invest their savings. Once taxes become a bit too complicated, they may turn to an accountant for help.

The challenge comes in the later years nearing retirement. People tend to accumulate savings plans from different jobs and have no idea if their investments are appropriate for their goals. Also, they must figure out how they are going to live on their money when the retire. Do they have enough and are they being tax efficient in how they withdraw their money? This can get complicated.

There are many benefits of hiring professional help once complications occur. To name a few, professionals can point out less obvious tax savings, such as the importance of taking money out of your IRA in early retirement and making certain a portfolio is tax efficient. They can help plan cash flow and help determine if money will last a retiree’s lifetime. And they can be there as a sanity check when the market is topsy-turvy so that investment losses aren’t taken out of fear.

Most importantly, family and professionals can take over more of the financial management duties in the event aging is making it difficult to manage finances confidently.

If you hire professionals, it is important to understand what those professionals are doing for you and how they are paid. The best professionals do the work and explain it to you in a way you can understand.

If you are using family members, make certain they are being transparent with the rest of the family and hired professionals about how money is being managed. Checks and balances keep people honest. To blindly trust anyone creates the perfect setup for fraud and abuse.

Those who do everything and don’t rely on anyone for help or advice

This group is the bread and butter of disaster. Doctors, engineers, and other very smart people tend to feel they can do it themselves much better than professionals. In some cases, they are correct, especially since pretty much anyone can call themselves a financial advisor.

This group tends to manage all aspects of their finances quite well when they are young and don’t yet have significant assets. As assets grow, they develop blind spots to issues such as present and future tax efficiency, effective estate transfer, and concentrated asset positions.

The big challenge happens when they age and develop cognitive challenges. Even normal aging processes can affect a person’s ability to make complex financial decisions. These very smart people can be very adept at hiding their difficulties.

I had a client who was going to be the power of attorney for his very sharp 92-year-old engineer father. His father had significant assets but the son had no idea what he had or how to locate it. His father was very secretive, was a buy and hold stock picker, and did his tax return by hand. The son convinced his father to talk to me so he could at least understand what needed to be done if the father became incapacitated.

The father’s investments totaled $6 million including a $2 million IRA, about 40 stocks held in certificate form, and a few actively managed mutual funds. He had a living trust that left a significant amount to charity and the rest of his assets to his sons. Nothing was titled to the trust. The sons were the beneficiary of his IRA.

I pointed out the tax savings of leaving the IRA to charity and leaving the trust only to his sons. We had the trust amended and moved all the individual stocks and mutual funds into a brokerage account owned by his revocable trust. This saved the family an estimated $600,000 in income taxes and probate fees.

What should you do if you are in this do-it-yourself group? Find a fee only fiduciary who can give you a second opinion on what you are currently doing. Thankfully, there are more fee only advisors now who act only in your interest.

Develop transparency with your family so they understand what you are doing and why. Create agreements and the appropriate legal documents to ease financial care taking transitions. Make your goal to be a do-it-yourselfer who ends up with a good story to tell instead of a financial disaster.

Read the full article here