If you want to move forward financially, your current money habits need to line up with your future money goals. But it can be hard to know if you’re on the right track.

That’s why we created custom budget reports inside EveryDollar—to help you stay on top of your spending and make better decisions with your money!

Why You Need Budget Reports

Budgeting is how you go from where you are to where you want to be with your money. And reporting can help you get there faster.

With personal budget reports, you can:

- Spot spending trends

- Know where to cut back

- Track your income over time

- Build better money habits

- Hit your financial goals

So, let’s dive into the budget insights you get with the premium version of EveryDollar and how they take your budgeting to the next level.

Spending Totals

Do you know how much you spent on transportation this past year? Well, now a quick glance at the Spending Totals pie chart will tell you! It shows you a breakdown of your total spending for all your budget categories from the last year.

You’ll see everything from housing and food (probably the biggest slices) to transportation and personal expenses. But what do you do with all these numbers? Well, let’s say you’re a little shocked by your food spending total. You can then dive a little deeper into each category and see how much you’ve spent in each budget line for the year.

Maybe you’re doing okay in the groceries budget line but eating out has gotten out of control. Time to make some adjustments to get that number down. Do you need to start meal planning and making grocery lists? Stop giving in to those drive-thru temptations? This is the time to make changes to your budget so you can get your spending—and your goals—back on track!

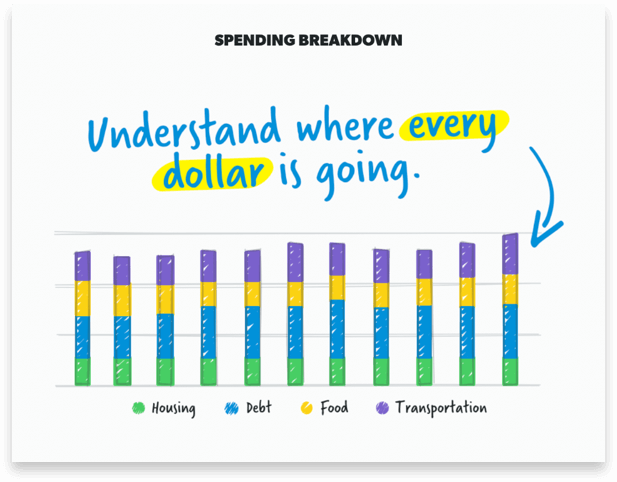

Spending Breakdown

A budgeter favorite, the Spending Breakdown section helps you know where your money is going by giving you a detailed breakdown of your spending from month to month.

Again, this feature shows you where you need to tighten the reins on your spending. You’ll see if you’re consistently overspending in certain budget lines or if your spending spikes in certain months.

Consider yourself a budget archeologist—dig into those categories that seem too high and find ways to spend less so you can save more!

Monthly Income

Maybe you don’t make the same amount of money on every paycheck. If that’s you, you’re not alone! Plenty of people work hourly or have side gigs that change up their income every month.

If you have an irregular income, the best thing you can do is set your budget based on your lowest monthly income, not an average. If you budget for the smallest amount, you can always go up from there!

Figuring out your lowest monthly income usually means searching through bank statements or looking at your past budgets month by month. But once you get a couple of EveryDollar budgets under your belt, the Monthly Income section will start to show you your high and low earning months all in one spot—so you can budget better in the future!

This chart also helps you see how any side hustles you have are stacking up month over month! Plus, the Monthly Income feature works really well with other premium features in EveryDollar—like paycheck planning, which helps you set up your budget around when you get paid and when bills are due.

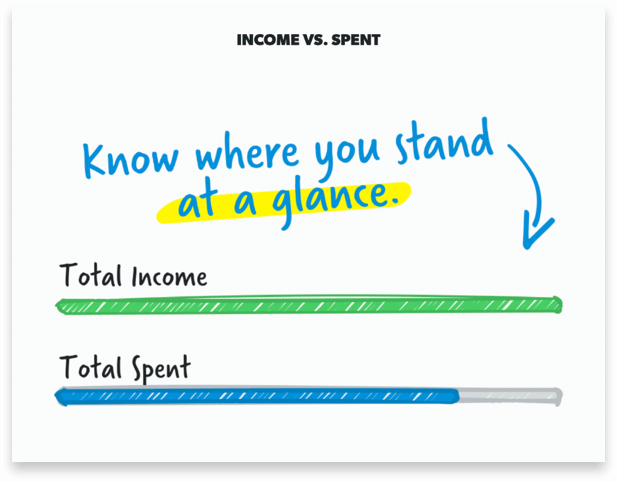

Income vs. Spent

The way to crush any money goal is to live on less than you make. And with the Income vs. Spent section, you can see if you’re spending more or less than you earn each month (the goal is less!).

![]()

Budget every dollar, every month. Get started with EveryDollar!

Now, this chart doesn’t include money you’ve budgeted for savings or sinking funds—it’s only money you’ve actually spent. That means your Spent category will usually be lower than your Income category.

If you’re on Baby Step 2 (paying off all your debt), you’re working the debt snowball, which means you’ve paused saving and you’re throwing everything extra at those debt payments. In that case, your Income category might be equal to your Spent category. And that’s okay!

But if your Spent category is consistently higher than your Income, you may be stuck in a pattern of overspending. If so, it’s time to have a good heart-to-heart with the person in the mirror (and/or your spouse) and figure out some ways to decrease your expenses or increase your income. Sticking to a budget isn’t always easy, but you can do it!

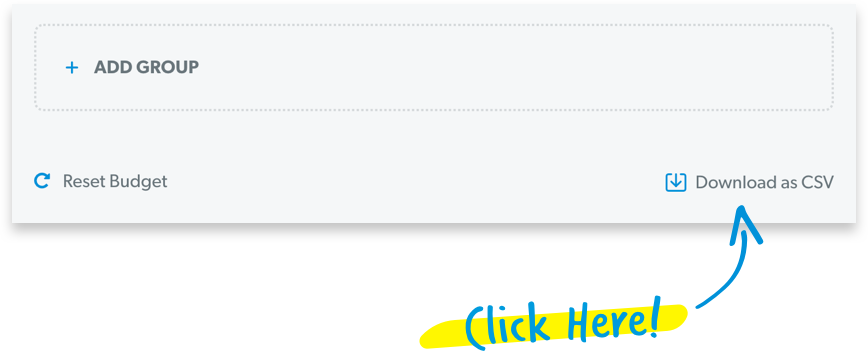

Transaction History

For all you budgeting nerds out there, we’ve got another amazing premium feature that you’ll love! You can actually download your transaction history for the month as a CSV spreadsheet (if you know, you know).

All you have to do is open the desktop version of your budget and scroll to the bottom to find the option to download your transactions. Then, you can dive into those numbers as much as you want!

Get Your Own Custom Budget Reports

All these budget report features we’ve shown you aren’t just a bunch of fancy charts and graphs with pretty colors. They’re so much more!

Budget reports are a chance for you to get real. With yourself. With your spending. You’ll know where to give yourself a high five and where you can improve. That’s how you make progress!

Get your very own custom budget reports (and other awesome budgeting features) with the premium version of EveryDollar. It’s time to crush your money goals faster than ever!

Read the full article here