I am in the middle of what I’m calling Stay Home September.

It’s something I made up — a catchy phrase to distract me from the fact that I have to stay home for the month to save money.

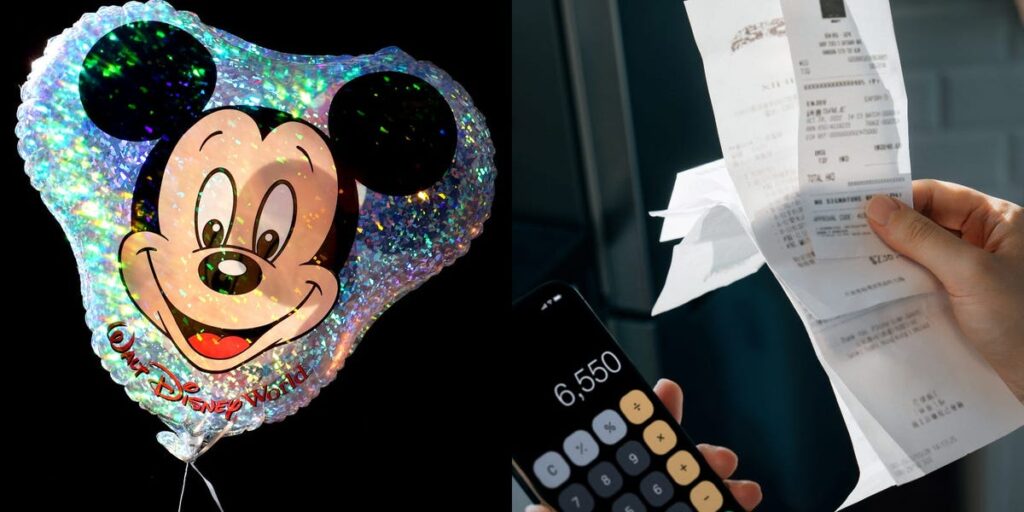

I recently returned from a trip to Disney World, where the cost of lodging, park admissions, food, and transportation reached shocking numbers. After my trip, I calculated I spent nearly $3,000 for six days and five nights at the parks — far more than I could afford.

To earn some of that money back, I’ve vowed to stay home for most of September and spend as little money as possible.

Food is my biggest expense and my biggest obstacle

Every month, my biggest expense (beyond my New York City rent) is food. I often order takeout, go out to eat with friends, and order expensive groceries using InstaCart.

On average, I spend close to $1,000 on food a month. But during Stay Home September, I have to curb that expense significantly.

I have deleted my DoorDash app, so there will be no last-minute McDonald’s orders. I also deleted InstaCart, so I won’t be getting my fancy Wegman’s hummus this month.

Instead, I will go to my local grocery store, buy food for the week, and cook every meal. I’m a terrible cook, so I am not looking forward to this change, but I hope this measure will cut my biggest expense in half.

My social life will most likely take a hit

My second biggest expense comes from going out with friends — whether that’s attending shows, eating out at restaurants, exploring museums, or going to the movies.

This month, I will abstain from all of those activities. I have told my friends not to entice me with invitations, and I’ve already had to say no to two comedy shows I really wanted to attend.

I also told my friends that if they want to hang out this month, we must do it at my or their house. Some prefer to go out and explore the city, and I don’t blame them, so I know that my social life will take a hit during Stay Home September.

I’m worried about my mental health this month

It seems that every time I leave my house in New York City, I spend at least $50. To avoid that, I will spend a lot of time alone in my one-bedroom apartment.

As an introverted extrovert, I get a lot of my energy from being with people and hanging out with friends. I’m worried that staying home for most of a month will make me feel isolated and left out.

A small part of me fears my friends will forget about me this month because I can’t do everything they want to do. But I keep reminding myself that my friendships aren’t based on the amount of money we spend to hang out. My friends will still hang out with me, and we will find free things to do together around the city.

When I do feel that inevitable loneliness this month, I have a support system to fall back on, including a therapist. I also have crafts set up to keep my mind busy while at home.

All this is a sacrifice I’m willing to make for travel

Since travel is so important to me, most of my annual savings go toward travel expenses.

I went to Costa Rica last summer, explored cities in Italy the summer before that, and spent a week in Orlando at three Disney parks last month. In between those big trips, I’ve taken smaller ones throughout the year to cities around the US.

Between flights, hotels, Airbnbs, and excursions, vacationing isn’t cheap. Each of these trips took a large chunk out of my savings.

As the cost of travel continues to rise and my savings account continues to dwindle, I am aware that I will probably be having a lot more stay-home months in the future.

Sure, I could have avoided a lot of budgeting pain this month if I had just not taken that costly Disney trip to begin with, but travel is important to me. I’d rather spend money, have adventurous experiences, and explore new cultures than stay home and count my dollars.

If budgeting for a few weeks so that I could see the world — yes, even Disney World — is the price I have to pay, then so be it.

Read the full article here