This as-told-to essay is based on a transcribed conversation with Natalie Fischer, 25, from Washington, about her experience in a “DINK” — double income, no kids — relationship. The following has been edited for length and clarity.

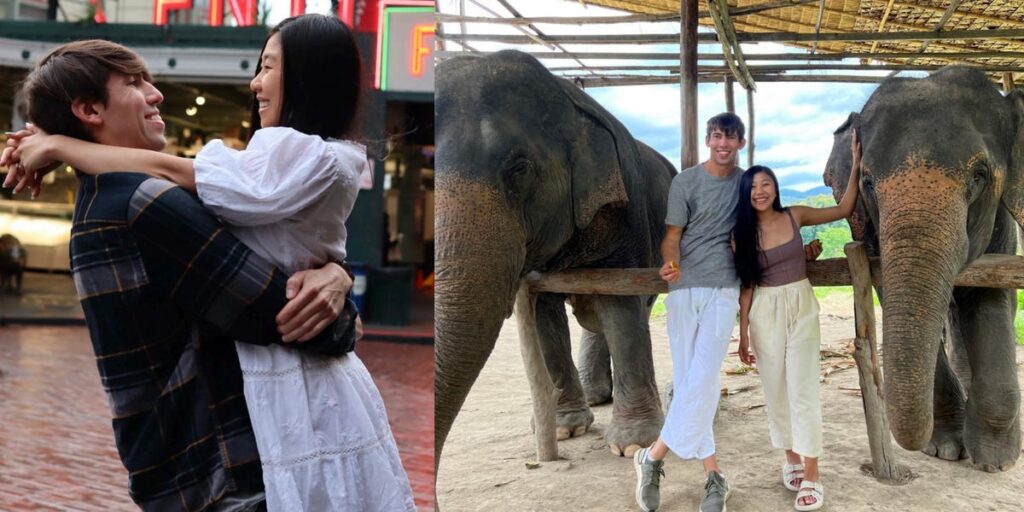

When my husband Keldon and I first got together in January 2018, we knew we weren’t ready to have kids.

I was 20 and he was 25 — we were very young and wanted to experience the world and get our finances together first.

Keldon is now a software engineer. After college, I went into marketing roles, but in 2020, I became a data analyst for a Washington-based energy company. In 2021, I started earning over $100,000 a year. We were tech DINKs, which stands for double income, no kids.

We do want kids later in life, but we both agree that now’s not the right time for us. With two incomes and no children, we’ve been able to buy a house, pay for a wedding, build up our savings, and travel. I even quit my 9-to-5 to pursue my passion for content creation.

There’s also been a spate of tech layoffs. These factors make me feel like we’ve made the right decision by putting off having kids.

We splurged and traveled a lot during our tech DINK era

As tech DINKs, Keldon and I could splurge on whatever we wanted because we had a lot of discretionary income.

We both worked east of Seattle and would meet up after work to eat out or watch a movie. We saw it as a way to treat ourselves because we worked incredibly hard.

In July 2020, we bought a two-bedroom condo for around $500,000. We combined our finances and got pre-approved for a mortgage. It was easier to afford a home with two incomes because we could split the downpayment equally between us.

We were sharing expenses, so it felt like everything was half off, and we were able to save more. We both built up emergency funds in 2022; I have $31,000 in mine. We stopped putting money into them to prioritize savings for our wedding and honeymoon expenses. We were able to save around $20,000 for our wedding in August 2023.

We have a travel fund with $4,000 in it. We also have a home renovation fund, and we put extra income into maxing out our Roth IRAs and investing in a regular brokerage account. Our savings strategy was pretty disciplined. We could put away a little over half our income after taxes into financial goals like savings and investments.

Our dog, a pomeranian, brings a lot joy into our lives, but he was expensive. He cost around $1,700 when we bought him a month after getting our house, making us DINKWADs (double income, no kids, with a dog). We spoil him with a lot of treats.

Last year, Keldon and I could travel almost every other month, even after I quit my job. We felt we had the financial security to do this because we already had a home and emergency funds.

We went to places like Rome, Mexico, and Finland. Having the time and freedom to experience the world was awesome since we didn’t have kids.

I quit my tech job to become a content creator

I started making TikToks about my personal finance journey in 2022. On TikTok, people told me I was making an impact by teaching them new things about finance. I made $40,000 in revenue from content creation in 2022 and $107,000 in 2023 before expenses.

Most of my income from content creation in 2023 came from UGC, or user-generated content, which I make for fintech companies to use on their social media platforms.

In my data analyst job, I was crunching numbers and it was very difficult to feel I was making any impact. I quit my 9-to-5 in July 2023 to pursue content creation full-time.

I felt last year was the perfect time to take that risk of quitting my job because I’m still young, have a savings fund, and don’t have the scary responsibility of providing for a kid. Being a DINK was a large part of why I had savings and could take that risk.

Before I quit my job, content creation was an additional income on top of my salary. We’ve had to adjust our lifestyle because my income fluctuates more from month to month now.

I’m so grateful to have a supportive partner like Keldon. He contributes more toward expenses than I do during months when I make less from my business. He’s been a stable rock — I certainly couldn’t do this without him.

Since I’m not earning a stable income, we’ve decided to limit our spending more this year.

The glory days are kind of over. We spend less on eating out and aren’t traveling as much. This year, we’ve planned one big trip together in the summer.

I decided to give myself a salary of $35,000 for 2024 from my content creation business. Keldon made over $100,000 last year, so we’re still well off, but I’m still trying to be more frugal and financially conscious.

I’m hoping the risk will pay off. As content creation doesn’t require me to go into an office, I’m hoping to build a flexible career that I can continue around raising a kid.

We want to hit certain financial milestones before becoming parents

I think we’ve made the right decision in waiting to have kids. I’d have a lot of regrets if I were already a parent. Keldon and I are both early in our careers and haven’t made a name for ourselves yet.

We feel things are uncertain with the economy, especially with the layoffs happening in tech. We want to hit certain financial milestones before becoming parents. We want a net worth of $1 million and a fund to cover any medical and day care costs of having kids.

Read the full article here