Almost every client meeting I’ve had this year has mentioned the forthcoming US election. It’s partly a reflection of the role that we at Man Group increasingly play for our clients: they know that we meet top strategists and thought leaders, that we debate and analyze and run scenarios. They come to us to understand how we are thinking, but also for how we synthesize the broader opinions of the street and political analysts.

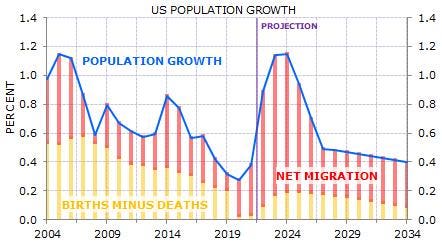

There were an interesting couple of charts in Gerard Minack’s Downunder Daily (if you’re not a subscriber, you should be). Firstly, Minack looked at what a crucial role immigration played in cooling down some of the excess heat in the US markets, keeping wage inflation under control while also making a meaningful contribution to growth.

He went on to show that the vast majority of this migration was illegal/awaiting proceedings.

I found myself thinking about this analysis in the light of a number of conversations we’ve had with strategists over the past few weeks, specifically about Biden’s route to a second term and what it would mean for the markets and the US economy. It feels like Biden is caught in the jaws of an extraordinary dilemma. It is broadly accepted that immigration policy will be one of the key factors in deciding the outcome of the 2024 election. Biden clearly needs to be seen to be dealing with illegal immigration in order to win. But the spike in illegal immigration has been one of the factors keeping a lid on inflation. If Biden acts now, there’s a risk that he adds fuel to the fires of inflation, thereby negatively impacting the one thing that voters – particularly independents and undecideds – care about more than migrants crossing the border.

The broad narrative currently seems to be that Trump would represent a more positive force for the markets and the economy come November than Biden. Certainly he has consistently positioned himself as a champion of deregulation and low taxes. Now I’m not here to pick sides, but I do wonder whether the persistently elevated inflation numbers we’ve seen so far in 2024 might offer a different interpretation of a Trump presidency. We’ve already written about how cracking down on immigration could stoke inflation – Trump has (again) promised to take drastic action on the US/Mexican border should he win. Other Trump policies, from onshoring to trade wars to tax cuts are also likely to continue stoking inflation.

It all leaves us with an incumbent and a challenger who are both struggling with an economic message that still plays in a period where we are suddenly focused once more on rising prices, and when interest rate cuts are being pushed out ever further – potentially to the other side of the election.

As markets digest Jerome Powell’s Q&A with Tiff Macklem, his opposite number at the Bank of Canada, in which he gave the clearest statement yet that the Fed will keep rates high as long as inflation persists, it’s clear that we should not be discounting inflation as a significant factor in deciding the outcome of an election that is on a knife edge, as the betting markets below illustrate.

A final, related thought: Henry Neville, CFA pointed out to me that, should Biden lose this, he’ll be the first incumbent since 1860 to fail to hold onto the presidency without (so far at least) having a recession on his watch.

Read the full article here