On Wednesday, the Education Department announced it was taking another step toward implementing its plan to cancel student debt using the Higher Education Act of 1965. This process began after the Supreme Court struck down President Joe Biden’s first attempt at relief last summer.

The plan, expected to benefit over 30 million borrowers, is required to undergo negotiated rulemaking. During this process, the department negotiates with stakeholders and holds a period of public comment before finalizing the rule.

The department’s latest announcement brings borrowers closer to final implementation. All borrowers with at least one federal outstanding student loan will receive an email from the Education Department to provide updates on the relief, including the notification of an August 30 deadline for borrowers to contact their servicer if they wish to opt out of the relief.

Borrowers might choose to opt-out for a number of reasons, including concerns about state tax liabilities should they receive loan forgiveness. The department said that borrowers who opt-out will not be able to opt back in at a later date.

A copy of the email reviewed by Business Insider told borrowers that “if you WANT to be included in potential student debt relief, you don’t need to take any action.”

Additionally, since the rules are not yet finalized, borrowers who receive an email are not automatically guaranteed relief — the department will provide additional details to eligible borrowers upon finalization.

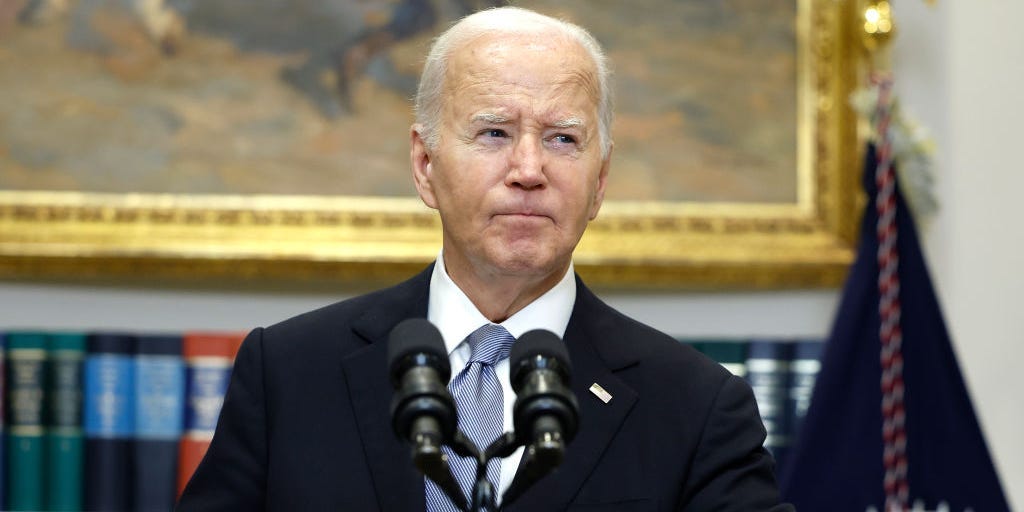

“Today, my Administration took another major step to cancel student debt for approximately 30 million Americans,” Biden said in a statement.

“By providing more information to borrowers on how they can take advantage of our upcoming debt relief programs, borrowers will be prepared to benefit swiftly once the rules are final,” he continued. “Despite attempts led by Republican elected officials to block our efforts, we won’t stop fighting to provide relief to student loan borrowers, fix the broken student loan system, and help borrowers get out from under the burden of student debt.”

The Education Department released its draft rules for debt relief in April. They included full or partial debt relief for borrowers who have been in repayment for at least 20 years, borrowers who owe more than they did when they entered repayment, borrowers who are eligible for loan forgiveness but have not yet applied for the relevant program, and borrowers who enrolled in schools that left them with too much debt compared to post-graduation earnings.

“The Department expects that all four of these proposed forms of relief would be provided to eligible borrowers without requiring any action from borrowers; no application would be needed,” the press release said.

The department plans to finalize the rules by October, meaning relief could reach borrowers before the election. However, the plan is likely to face lawsuits similar to the ones that struck down Biden’s first plan, meaning there could be delays to the relief depending on court rulings.

“The Biden-Harris Administration made a commitment to deliver student debt relief to as many borrowers as possible as quickly as possible, and today, as we near the end of a lengthy rulemaking process, we’re one step closer to keeping that promise,” Education Sec. Miguel Cardona said in a statement.

Read the full article here