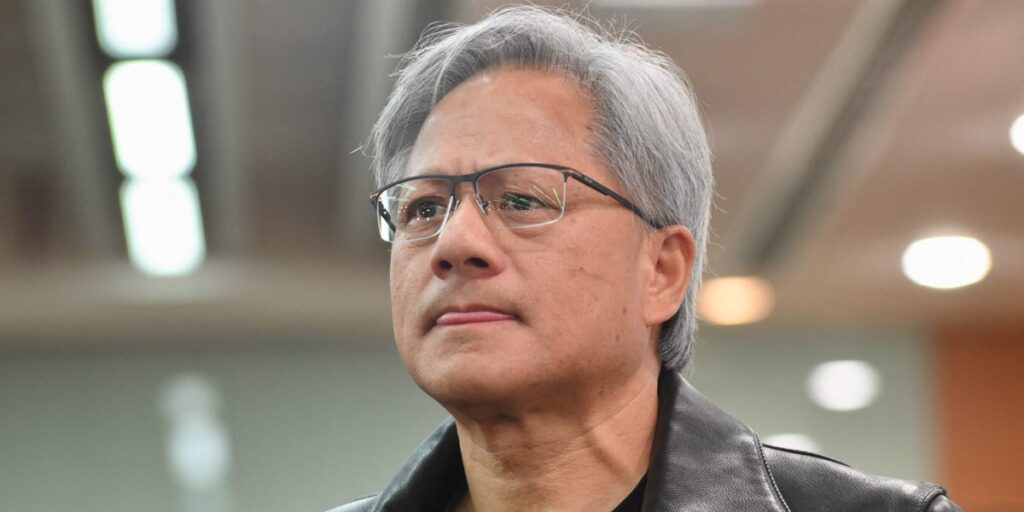

Nvidia’s meteoric rise on the back of the AI boom has made it one of the world’s most valuable companies and boosted the fortune of CEO Jensen Huang.

Now, key supplier Taiwan Semiconductor Manufacturing Company, or TSMC, appears to want in on the hype.

“I did complain to Nvidia’s CEO Jensen Huang — the ‘three trillion guy’ — that his products are so expensive,” CC Wei, TSMC’s CEO, said last week, per Nikkei.

Wei was referring to Nvidia’s market value, which surpassed $3 trillion last week. The AI chipmaker submitted another blowout earnings report last month, with first-quarter revenue and earnings both beating Wall Street estimates.

Wei added that Nvidia’s products are “really valuable for sure, but I am thinking about showing our value as well.”

Wei’s comments sparked speculation that TSMC — the world’s largest contract chipmaker — is considering a price hike. TSMC produces, by some estimates, 90% of the world’s most advanced processor chips.

TSMC sought to tamp down market speculation last week, telling local media that the company’s pricing has always been “strategy-oriented rather than opportunity-oriented.”

In April, an analyst asked if TSMC was reaping the benefits of the AI boom and how the CEO thinks about pricing.

“We are happy that our customers are doing well. And if customers do well, TSMC does well,” Wei answered.

Nvidia’s Huang doesn’t appear to mind a price hike from TSMC.

He told reporters in Taiwan last week that TSMC’s contribution to the industry is “really great.”

“Raising prices is consistent with the value they deliver. I’m very happy to see them succeed,” Huang said.

Morgan Stanley analysts wrote last week that Nvidia’s management probably recognizes TSMC’s reliability.

“We believe that if NVIDIA accepted price hikes, other key AI semi customers may follow,” the analysts wrote in a note.

They estimated Nvidia will account for 10% of TSMC’s 2024 revenue.

TSMC has already indicated price hikes for production outside of Taiwan

It isn’t the first time this year that TSMC has signaled a price hike.

In April, Wei said the company plans to charge customers more if they want their chips made outside Taiwan.

“If my customer requests to be in some certain area, then definitely, TSMC and the customer had to share the incremental cost,” the CEO said on TSMC’s first-quarter earnings call. “In today’s fragmented globalization environment, costs will be higher for everyone, including TSMC, our customers, our competitors, and the entire semiconductor industry.”

Taiwan also hiked electricity rates for large industrial users in April, which would pressure TSMC’s bottom line. Wei said inflation and electricity were leading to higher costs.

“We expect our customers to share some of the higher cost with us, and we already started our discussion with our customers,” he said, declining to talk specifics about pricing strategies on the earnings call.

Used in everything from data centers to smartphones, chip production is now a geopolitical concern, since the world’s chip production is concentrated in independently governed Taiwan — which China claims as its own territory.

There are fears that a Chinese invasion of Taiwan could adversely impact the global economy and allow Beijing to seize TSMC’s facilities.

TSMC is diversifying production with new facilities in Arizona, Japan, and Germany.

Wei said last week that TSMC has discussed moving some chip plants outside Taiwan, but that it was impossible to move all production out of the island.

TSMC’s shares in Taiwan closed 1.7% lower at 879 New Taiwan dollars apiece on Friday and are up 48% year-to-date. The Taiwanese market is closed on Monday for a public holiday.

Nvidia shares closed 0.1% lower at $1,208.88 apiece on Friday after gaining over 140% year-to-date — ahead of a 10-for-1 stock split after the closing bell.

TSMC did not immediately respond to a request for comment from Business Insider.

Read the full article here