After some recent losses, markets turned up during Wednesday’s after-hours trading session. This upturn coincided with Federal Reserve Chair Jay Powell’s announcement confirming that there will be no further rate hikes for the foreseeable future.

The upward turn in the markets highlights the volatility in current conditions – but that’s not a bad thing at all, for at least one market expert.

John Stoltzfus, chief investment strategist at Oppenheimer, gives a clear explanation of where the market stands now: “Some near-term profit-taking in the day to day action of the market, particularly in growth segments that have had exceptional run-ups since last year into this year, continues to appear to us quite normal. Such activity combined with a process of rebalancing and rotation into other segments of the stock market in our view can be healthy and contribute to the broadening of the markets’ progress from last year through this year.”

Stoltzfus goes on to explain why this is good for risk-tolerant investors, adding, “Near-term volatility could in our view continue to present opportunity for investors to ‘catch babies that get thrown out with the bath water’ in periods of market down drafts as the market digests levels of uncertainty that are not uncommon to times of transition like these and in periods of rising geopolitical risk.”

The stock analysts at Oppenheimer are taking this view forward and are predicting strong rallies – over 100% – for two healthcare stocks in particular. We ran them through the TipRanks database to see what makes them stand out. Let’s take a closer look.

Avalo Therapeutics (AVTX)

We’ll start in the world of biopharmaceuticals, with Avalo Therapeutics. This firm’s work is focused on treating immune system diseases, specifically those caused by immune system dysregulation. The company has a pipeline of active research projects, targeting a variety of autoimmune and/or inflammatory diseases. This is a rich field for a biotech, as these conditions frequently are difficult to treat effectively and have consequent high levels of unmet medical needs.

The company’s leading drug candidate, AVTX-009, was acquired by Avalo in March of this year, through an acquisition of AlmataBio. The drug candidate is an anti-IL-1β mAb, considered ready for Phase 2 testing. A Phase 2 trial is planned for the drug candidate in the treatment of hidradenitis suppurativa with topline data expected for readout in 2026. The company sees high potential in AVTX-009 and has plans to develop the drug candidate in at least one more, to-be-determined, chronic inflammatory indication.

Advancing clinical research into late-stage trials does not come cheap, but Avalo is in a sound position to pay for its research programs. In March of this year, the company conducted a private placement financing move that was expected to yield approximately $185 million in gross proceeds and netted $105 million in up-front net proceeds. The company estimates its cash runway as sufficient to fund operations into 2027.

Looking into this stock for Oppenheimer, analyst Leland Gershell takes the measure of the company’s potential earnings, assuming success with AVTX-009. Gershell writes, “We view AVTX-009 as a promising drug candidate with the potential to address large unmet needs in inflammatory disease. We rate shares Outperform as we look forward to a Phase 2 topline reveal in 2026 in HS and additional updates in another important autoimmune condition… We are optimistic the Phase 2 will pave the way to registrational development, to incorporate a pen autoinjector for the commercial market. We project peak penetration of 15% and assume $75,000 launch pricing in 2029, in line with approved biologics… We see ~$400M peak US sales in HS alone.”

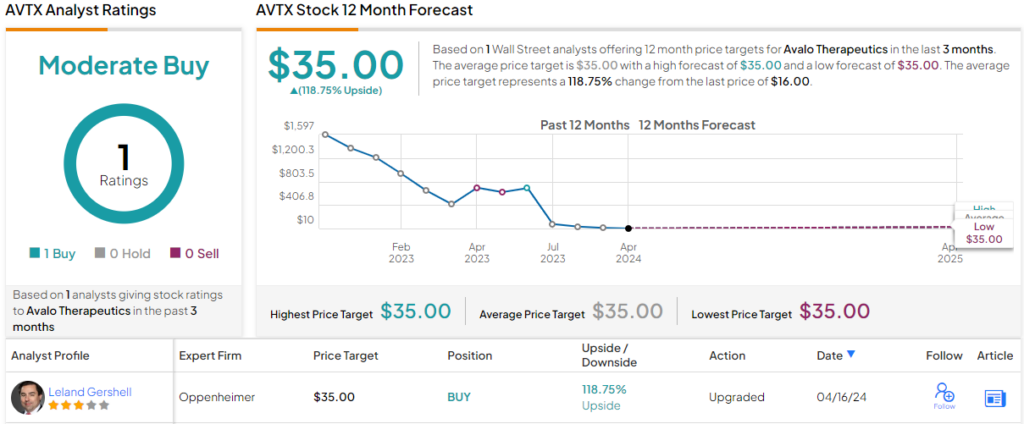

The analyst’s Outperform (i.e. Buy) rating is complemented by a $35 price target that implies a robust 119% upside for the coming year. (To watch Gershell’s track record, click here)

Micro-cap biopharmas don’t always get a lot of analyst attention, and currently Gershell’s is the sole AVTX review on record.

AngioDynamics (ANGO)

Next on our list of Oppenheimer picks is AngioDynamics, another tech-oriented company in the medical field, but one focused on medical devices rather than therapeutic drugs.

AngioDynamics got its start in 1988, and its innovative products are aimed at several medical specialties, including interventional radiologists, interventional cardiologists, and surgeons. The company’s devices are used in the diagnosis of cancer and peripheral vascular disease, with a minimally invasive mode of operation.

AngioDynamics has an extensive product list, used in a wide range of applications. Some of the notable devices are the AlphaVac, used in endovascular therapies; the NanoKnife, used in localized oncological treatments; and the Auryon, used in endovascular treatments for peripheral atherectomy technology. The company makes these devices, and many others, available in over 50 markets worldwide – in the US, in Europe, in Asia, and in Latin America. AngioDynamics works through a network of direct sales and distributors, and continually works to improve and adapt its product lines.

Earlier this month, the company released its financial results for its fiscal 3Q24. At the top line, the company reported a total of $66 million in revenues, a result that was up 8% year-over-year, while the bottom line figure came to a net loss of 16 cents per share by non-GAAP measures.

Of the company’s revenue total, $25.7 million was attributed to MedTech, while $40.3 million was attributed to Medical Devices. During the quarter, AngioDynamics successfully conducted a divestment of several product portfolios, particularly its PICC and Midline products.

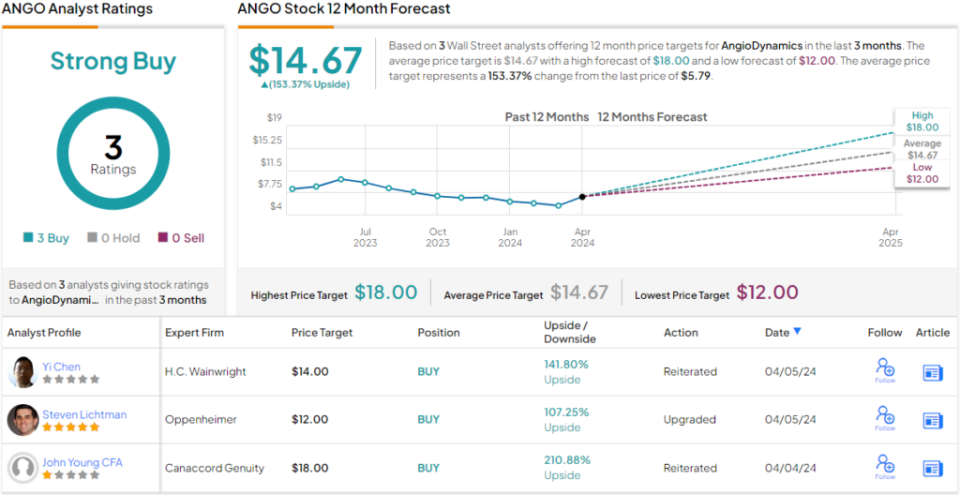

Despite a 26% decline in ANGO shares this year, Oppenheimer analyst Steven Lichtman, who holds a 5-star rating from TipRanks, remains bullish on the company’s growth prospects

“ANGO is focused on accelerating growth by focusing its investments on its higher-margin Med Tech product lines— Auryon, AngioVac/AlphaVac, and NanoKnife. The company has several pipeline opportunities ahead including AlphaVac expansion into PE, Auryon into DVT, and NanoKnife indication expansion. While competition in ANGO’s core market remains stiff, new pipeline products are close to contributing, the company has strengthened its balance sheet, and the shares trade at less than 1x FY25E EV/sales,” Lichtman opined.

Quantifying his stance on ANGO, Lichtman gives the stock an Outperform (i.e. Buy) rating, with a $12 price target that points toward a 107% gain in the next 12 months. (To watch Lichtman’s track record, click here)

While there are only 3 recent analyst reviews on file for this stock, they are all in agreement that these are shares to buy – making for a unanimous Strong Buy consensus rating. The stock is priced at $5.79 and its $14.67 average price target implies an upside of a robust 153% for the year ahead. (See ANGO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Read the full article here