US stock futures traded mixed on Monday but held near record highs as investors prepared for the next batch of big bank earnings to test that rally and the chances of an economic “soft landing.”

S&P 500 futures (ES=F) moved up roughly 0.2% after ending above 5,800 for the first time, while contracts on the tech-heavy Nasdaq 100 (NQ=F) rose 0.3%. Dow Jones Industrial Average futures (YM=F) slipped 0.2%.

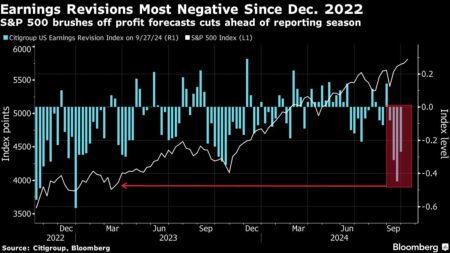

Earnings are taking center stage as the first full week of third quarter results gets underway. How the season plays out is seen as key to the rally in stocks as the bull market turns 2 years old.

The Dow and S&P 500 closed a winning week at new records after JPMorgan Chase (JPM) and Wells Fargo (WFC) earnings largely passed Wall Street’s test. Investor focus is staying on big banks with reports from Goldman Sachs (GS), Citi (C), and Bank of America (BAC) on Tuesday’s docket, and Morgan Stanley (MS) due Wednesday.

At the same time, there’s still uncertainty about whether the Federal Reserve will cut interest rates again. A benign jobs report and data showing “sticky” consumer and wholesale inflation are building a case for no rate cut in November, some analysts argue. Retail sales data later in the week will feed into the debate as to whether the economy has held up in the face of Fed policy — the preferred soft landing.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

Elsewhere, Chinese stocks initially seesawed as investors picked over Beijing’s latest promise of stimulus, but managed to rise and resuscitate their recent historic rally.

On the corporate front, Boeing (BA) shares slipped in premarket amid questions about the crisis-hit plane maker’s future. The company, which faces a record $5 billion in third quarter losses, has slashed 17,000 jobs as a month-long strike hits manufacturing.

Read the full article here