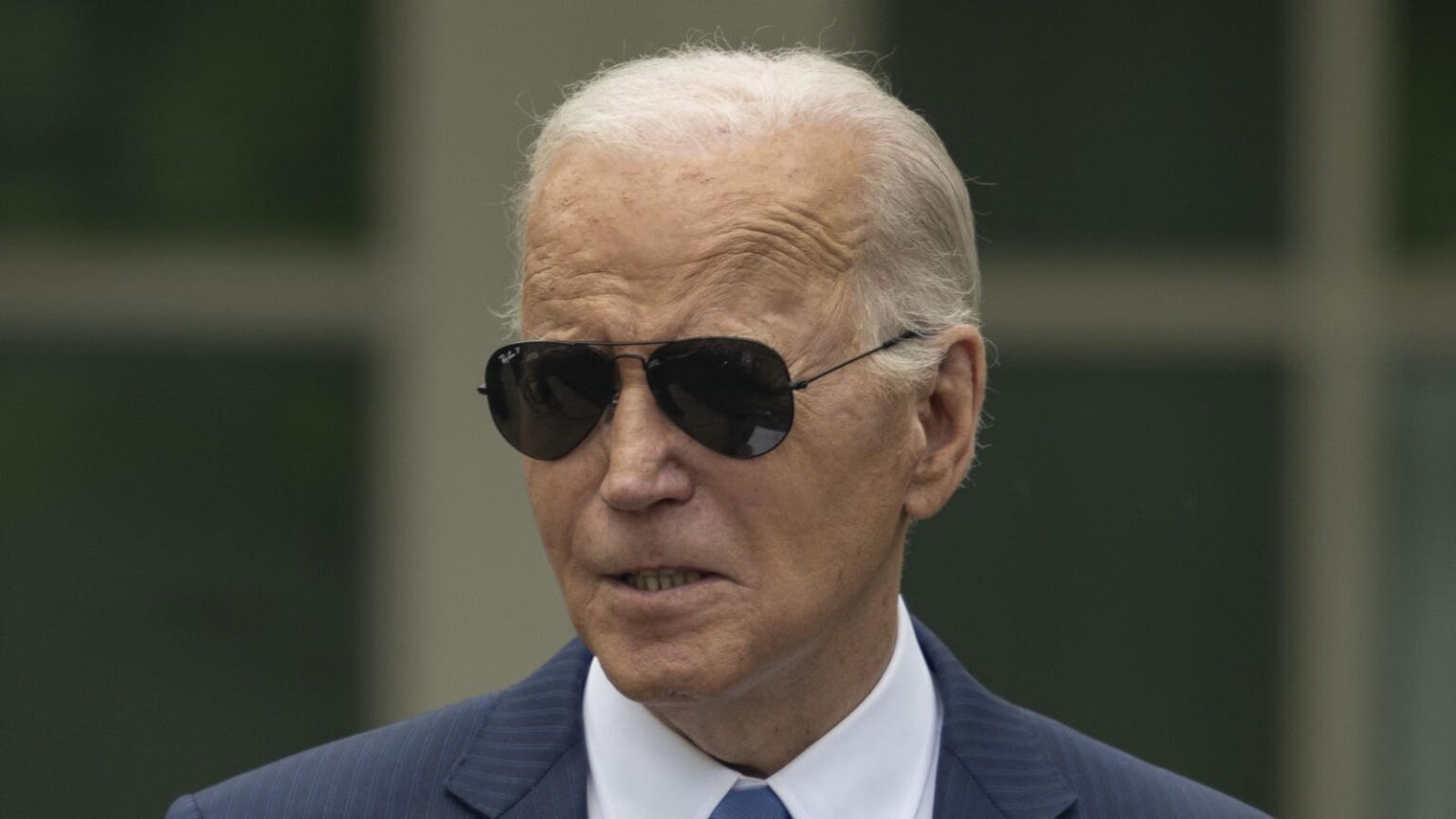

Earlier this week, President Joe Biden formally announced a significant new student loan forgiveness plan that could provide relief to millions of borrowers. The initiative, which has been in the works for months, represents Biden’s second attempt to cancel student debt on a mass scale.

The new loan forgiveness program, which hasn’t been officially finalized or made available quite yet, will target specific groups of borrowers for relief. But when it’s officially launched — which could happen by this fall — many borrowers may not need to submit an application. Millions could receive student loan forgiveness automatically.

Here’s what we know.

Automatic Student Loan Forgiveness Without An Application For Some Borrowers

Biden’s new student loan forgiveness plan has gone through several rounds of negotiated rulemaking, a process where key non-federal stakeholders convene and try to reach consensus on regulatory text governing the program. During these rulemaking sessions, which were held over the course of the last six months, advocates and the Education Department largely agreed on the need to automate student loan forgiveness wherever possible.

Of the five categories of borrowers who could qualify for student loan forgiveness under the new Biden plan, several may not require applications. This could streamline the program and expedite debt relief for millions, since officials would not have to manually review individualized requests for relief.

One such group comprises those that are eligible for loan forgiveness under existing programs, but haven’t yet applied or enrolled. The plan would “automatically cancel debt for borrowers who would otherwise be eligible for loan forgiveness under income-driven repayment (IDR) plans, like the SAVE Plan, or Public Service Loan Forgiveness but are not enrolled in those programs,” says new department guidance.

Biden’s plan also calls for the cancellation of student debt for those who entered repayment many years ago. Undergraduate borrowers would be eligible for student loan forgiveness if they first entered repayment at least 20 years ago, while borrowers with graduate school debt could get student loan forgiveness if they first entered repayment at least 25 years ago. The Education Department already has the data needed to make these determinations, so an application may not be required.

Similarly, Biden’s plan also calls for forgiveness of accrued and capitalized interest. This is geared towards borrowers who have experienced negative amortization — balance increases associated with compounding interest accrual even while payments were made. The Education Department has not specified in its limited published guidance how it would determine the amount of interest eligible for forgiveness, but the department would be in a much better position to make these determinations than a borrower, and (in theory, at least), no application should be required.

Borrowers who attended “low-financial-value programs” could also be eligible for automatic student loan forgiveness under Biden’s plan. The Education Department should already have data on schools that “lost their eligibility to participate in the federal student aid program or were denied recertification,” which could allow for automated relief.

Student Loan Forgiveness Application May Be Required For Some Borrowers

But for some borrowers seeking student loan forgiveness under Biden’s new plan, an application may be required.

The most likely category that will require an application is financial hardship. Some borrowers who are “predicted to fall in to default” could receive student loan forgiveness automatically based on existing data. But borrowers “experiencing other cost burdens” would need to request loan forgiveness “through an application process,” says the Education Department.

The negotiated rulemaking committee reached consensus on over a dozen possible “hardship” indicators earlier this year. These include a borrower’s income and expenses, other debts, age, disability status, and eligibility for other means-tested public benefits. Since the Education Department would not have this data readily available, borrowers would almost certainly need to submit a formal application for consideration. This could mean lengthy delays for borrowers seeking relief under this prong of the program.

What To Know About Biden’s Student Loan Forgiveness Application Process And Next Steps For The Plan

The new student loan forgiveness plan is not active yet, and still must undergo several additional steps before the program will be available to borrowers. These include the publication of the final version of the governing regulations, followed by a period in which the public can submit comments on those rules. The program is not expected to be officially live until closer to the fall.

“Once we have final rules, we will work to implement them as quickly as possible,” says department guidance. The department will likely update its guidance to reflect any application requirements. Biden’s first student loan forgiveness plan had an online application, providing an easy mechanism for borrowers to request relief.

But just like Biden’s first plan, the latest student loan forgiveness program will almost certainly face legal challenges, which could block relief. The Biden administration has been careful with its guidance, using qualifying phrases like “if implemented” to describe the potential benefits of the program, suggesting that officials are keenly aware that courts could intervene.

Read the full article here